- Over $17M in SUI has moved off exchanges up to now week, signaling regular accumulation by longer-term holders.

- Merchants are leaning closely lengthy, with leveraged bullish positions far outweighing shorts close to key ranges.

- A each day shut above $1.75 might unlock a transfer towards $2.20, supported by sturdy development momentum.

Recent derivatives knowledge is beginning to inform a narrative that the SUI worth chart alone doesn’t absolutely seize. In line with CoinGlass, greater than $17.17 million value of SUI has been pulled off exchanges over the previous week. That form of outflow often isn’t random. It tends to point out accumulation, particularly when it occurs throughout uneven market circumstances like these.

In easy phrases, a rising variety of holders seem like shifting SUI into wallets as an alternative of leaving it on exchanges. That habits typically strains up with traders positioning early, not chasing momentum later.

The place Merchants Are Targeted Proper Now

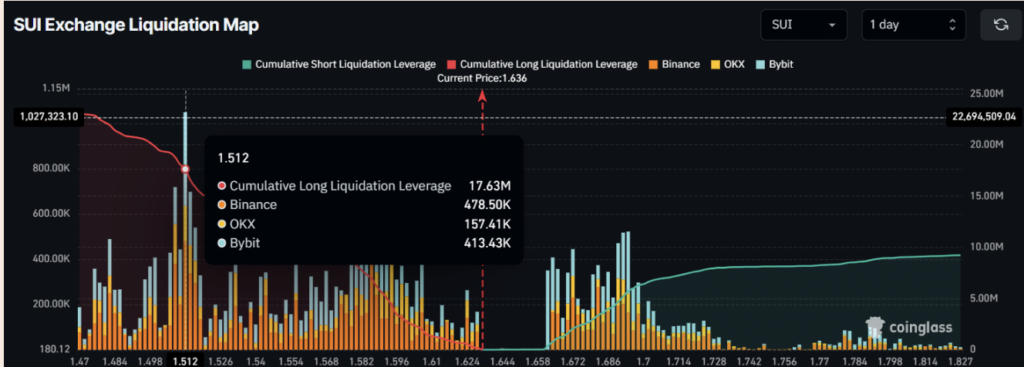

Zooming into derivatives, the liquidation map highlights two key zones that matter most within the quick time period. On the draw back, $1.512 stands out as the primary stage the place lengthy liquidations would cluster. On the upside, $1.694 marks the zone the place quick strain might kick in.

Bullish sentiment round SUI has been heating up, and never quietly both. The token has benefited from regular accumulation, rising lengthy bets, and a broader restoration throughout the crypto market. At press time, SUI trades close to $1.64, up 6.35% on the day.

That stated, participation has cooled barely. CoinMarketCap knowledge reveals 24-hour buying and selling quantity dropped 22%, falling to round $831 million. Even with worth pushing larger, decrease quantity suggests merchants are staying cautious, seemingly ready for clearer course.

ETF Inclusion Provides a New Supply of Demand

One of many greatest catalysts behind SUI’s current power is its addition to the Bitwise 10 Crypto Index ETF (BITW). The fund started buying and selling on NYSE Arca on December 10, 2025, and its newest allocation reveals 0.24% publicity to SUI, roughly $2.4 million at launch.

Which may sound small, however ETF flows are usually sticky. As soon as included, belongings profit from ongoing rebalancing and passive inflows, which may quietly assist demand over time.

Merchants Lean Lengthy as Accumulation Continues

Derivatives positioning provides one other layer. CoinGlass knowledge reveals a transparent skew towards lengthy positions, with the market trying barely over-leveraged within the quick time period. Across the $1.512 to $1.694 vary, merchants have constructed roughly $17.63 million in leveraged longs, in comparison with simply $5.72 million in shorts.

That imbalance factors to sturdy intraday bullish conviction. It additionally explains why worth has remained comparatively agency regardless of decrease spot quantity.

On the similar time, longer-term holders seem assured. The $17.17 million weekly change outflow reinforces the concept that consumers aren’t simply buying and selling — they’re holding.

Value Construction and What Comes Subsequent

From a technical perspective, SUI’s current push has introduced it again above a key assist zone close to $1.60. So long as that stage holds, the construction stays constructive.

Based mostly on historic habits, a clear each day shut above $1.75 might open the door to a different leg larger. If that breakout sticks, a transfer towards $2.20 — roughly a 26% upside — comes into view.

Momentum indicators assist that concept. The ADX sits at 26.68, above the important thing 25 stage, signaling that the present development has power behind it.

For now, SUI sits in an fascinating spot. Accumulation is rising, merchants are leaning bullish, and institutional publicity has arrived through ETFs. Quantity has cooled, sure — however that hesitation could also be precisely what permits the subsequent transfer to construct quietly earlier than it reveals up on everybody’s chart.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.