Amid a gentle worth rebound within the Bitcoin (BTC) market, standard market analyst with the X username KillaXBT is predicting one other important correction within the forthcoming days.

Bitcoin Historic Knowledge Reveals Recurring Month-to-month 8% Worth Decline

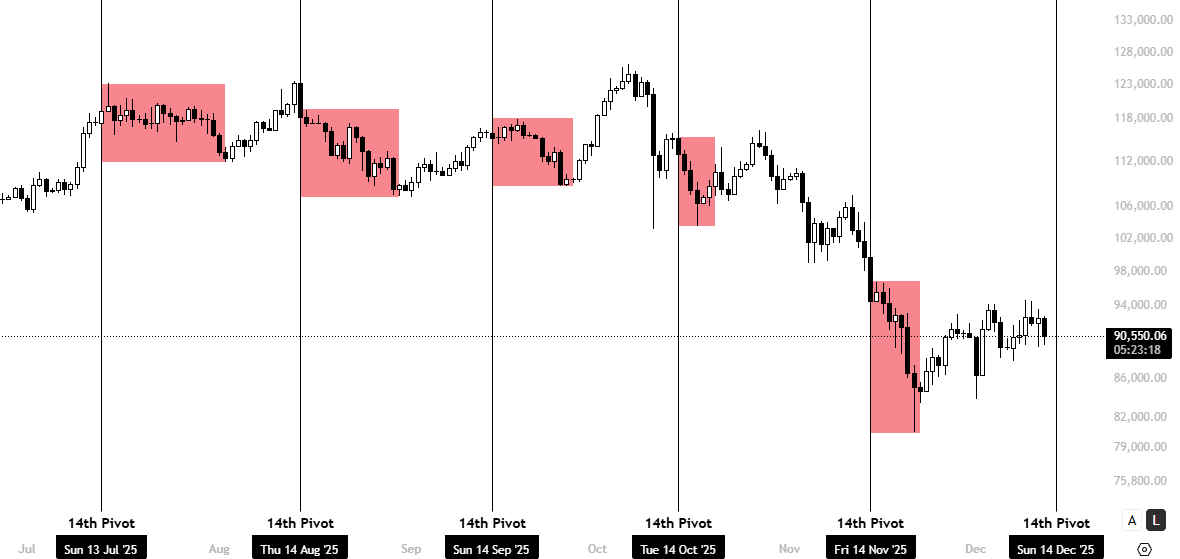

In an X put up on December 12, KillaXBT outlines a cautious market perception that means Bitcoin is headed for a worth pullback. Based on the famend analyst, the premier cryptocurrency has persistently recorded an 8% worth decline after the 14th day of the final 5 months. KillaXBT describes this statement because the 14th Pivot, which now holds essential implications for Bitcoin within the brief time period. Since hitting a worth backside of $80,000 in late November, BTC has shaped an ascending channel, recording a gentle sequence of upper lows and better highs.

Nonetheless, KillaXBT’s projection is anticipated to interrupt this channel, doubtlessly halting the nascent uptrend. Going by the recurring worth sample, the analyst states Bitcoin buyers ought to anticipate a minimal 5% worth decline after the 14th of December, hinting at a possible retest of the 85,000-$86,000 worth zone.

Given the asset’s broader bullish market construction, such a transfer could symbolize nothing greater than a short-term pullback. Nonetheless, the extended correction seen earlier in This fall has already set a precedent, leaving room for one more part of deeper draw back ought to momentum weaken.

BTC To Backside Beneath $50,000?

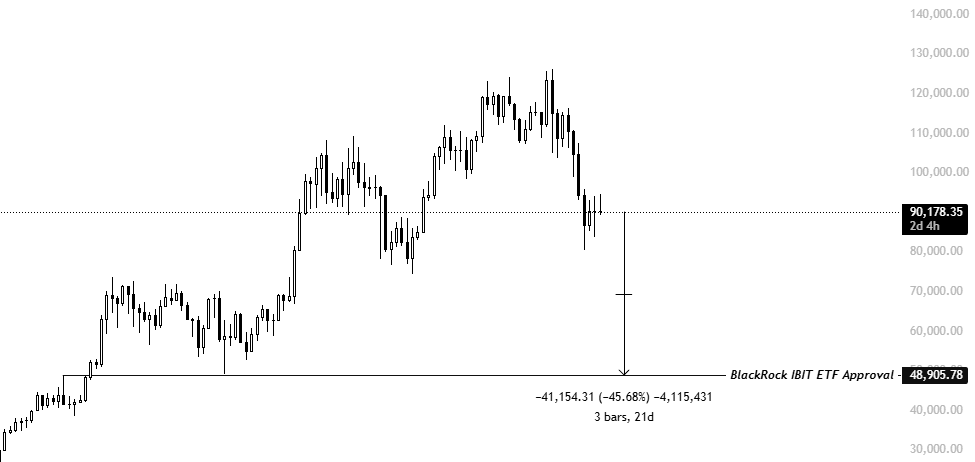

In one other X put up, KillaXBT shares extra bearish projections of the Bitcoin market. This time, the seasoned analyst predicts the crypto market chief will hit a worth backside of $48,905 regardless of latest worth good points. KillaXBT’s backside goal represents Bitcoin’s worth as of the approval of the BlackRock IBIT ETF, alongside 11 different Bitcoin Spot ETFs in January 2024. This projection is probably going because of the frequent rationale that the current bullish run has been closely supported by institutional inflows.

Notably, the Bitcoin Spot ETFs have been central to those institutional inflows, boasting complete web belongings of $119.18 billion. The BlackRock IBIT holds over half of this traction because the undisputed market chief with $71.03 billion in web belongings and $62.68 billion in cumulative web inflows.

If Bitcoin have been to return to its pre-ETF approval worth ranges, it could indicate an estimated 46% decline from present market costs. Such a transfer would possible sign a pointy reversal in institutional positioning, suggesting that sustained ETF outflows, somewhat than retail capitulation, may emerge as the first catalyst for a renewed crypto winter.

At press time, Bitcoin continues to commerce at $90,348, reflecting a 2.18% decline.

Featured picture from Pexels, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.