- Peter Brandt criticized XRP supporters, calling them overly optimistic regardless of lengthy drawdowns

- XRP neighborhood members pushed again, citing adoption, regulation, and shifting sentiment

- The controversy displays a deeper conflict between technical buying and selling fashions and utility-driven theses

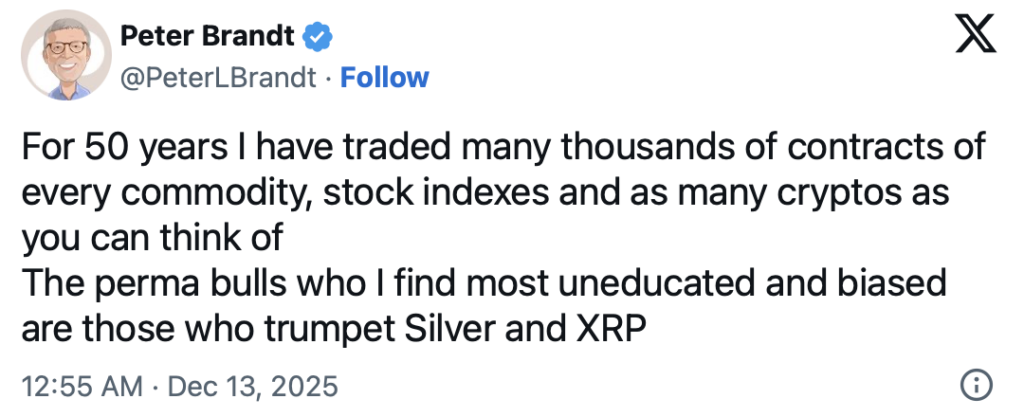

Veteran dealer Peter Brandt has as soon as once more stirred dialogue throughout the crypto house, this time by taking goal at XRP supporters. With greater than 5 many years of expertise throughout commodities, equities, futures, and digital belongings, Brandt argued that XRP backers present a stage of conviction he sometimes associates with what he calls poorly knowledgeable “perma bulls.” The remark landed exhausting and quick, reopening a long-running divide between classical technical merchants and XRP’s adoption-focused neighborhood.

Brandt framed his critique as behavioral fairly than private. From his perspective, some investor teams keep relentlessly optimistic no matter prolonged drawdowns, shifting macro circumstances, or repeated technical breakdowns. He positioned XRP supporters in the identical class as long-term silver traders, suggesting each teams have a tendency to carry agency even throughout lengthy stretches of underperformance, virtually on precept.

Pushback From the XRP Group

The response from the XRP neighborhood was instant. Analyst Zach Rector pointed to indicators that sentiment round XRP is evolving, even amongst former skeptics. He highlighted a current remark from YoungHoon Kim, a widely known Bitcoin maximalist, who revealed on December 12 that he had begun accumulating XRP. Given Kim’s traditionally hardline stance in opposition to altcoins, that transfer raised eyebrows.

Others took a extra measured method. Market commentator X Finance Bull acknowledged Brandt’s lengthy buying and selling profession however questioned whether or not conventional chart-based evaluation totally captures XRP’s present setup. In his view, XRP’s valuation could more and more hinge on regulatory readability, institutional involvement, and its position in cross-border cost methods, not simply near-term value buildings.

Altcoin Buzz echoed an identical sentiment, arguing that many XRP holders aren’t overly involved with short-term volatility. As a substitute, they’re centered on long-range utility and infrastructure progress. From that angle, Brandt’s criticism displays a distinction in funding philosophy fairly than a definitive verdict on XRP’s future.

A Acquainted Dispute With Deep Roots

Brandt’s skepticism towards XRP isn’t new. Over time, he has repeatedly questioned its valuation and, at instances, projected continued weak spot in opposition to Bitcoin. XRP supporters usually counter by stating moments when these forecasts didn’t play out as anticipated, which retains the back-and-forth alive.

It’s additionally value noting that Brandt hasn’t been persistently bearish. Earlier this yr, he flagged a bullish technical sample on XRP that did result in a value advance earlier than broader market strain reversed the transfer. That combined report suggests his criticism is aimed extra at investor habits than at dismissing XRP outright as a tradable asset.

At its core, this change highlights a broader divide in crypto. Conventional merchants like Brandt lean closely on historic value motion and classical technical frameworks. XRP traders, in contrast, usually emphasize authorized progress, institutional adoption, and evolving monetary infrastructure. That pressure continues to form how XRP is mentioned, and it’s unlikely to fade anytime quickly.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.