Dogecoin misplaced a essential technical degree after a pointy, high-volume selloff, signaling a change in short-term market construction and forcing merchants to reassess near-term danger.

Information background

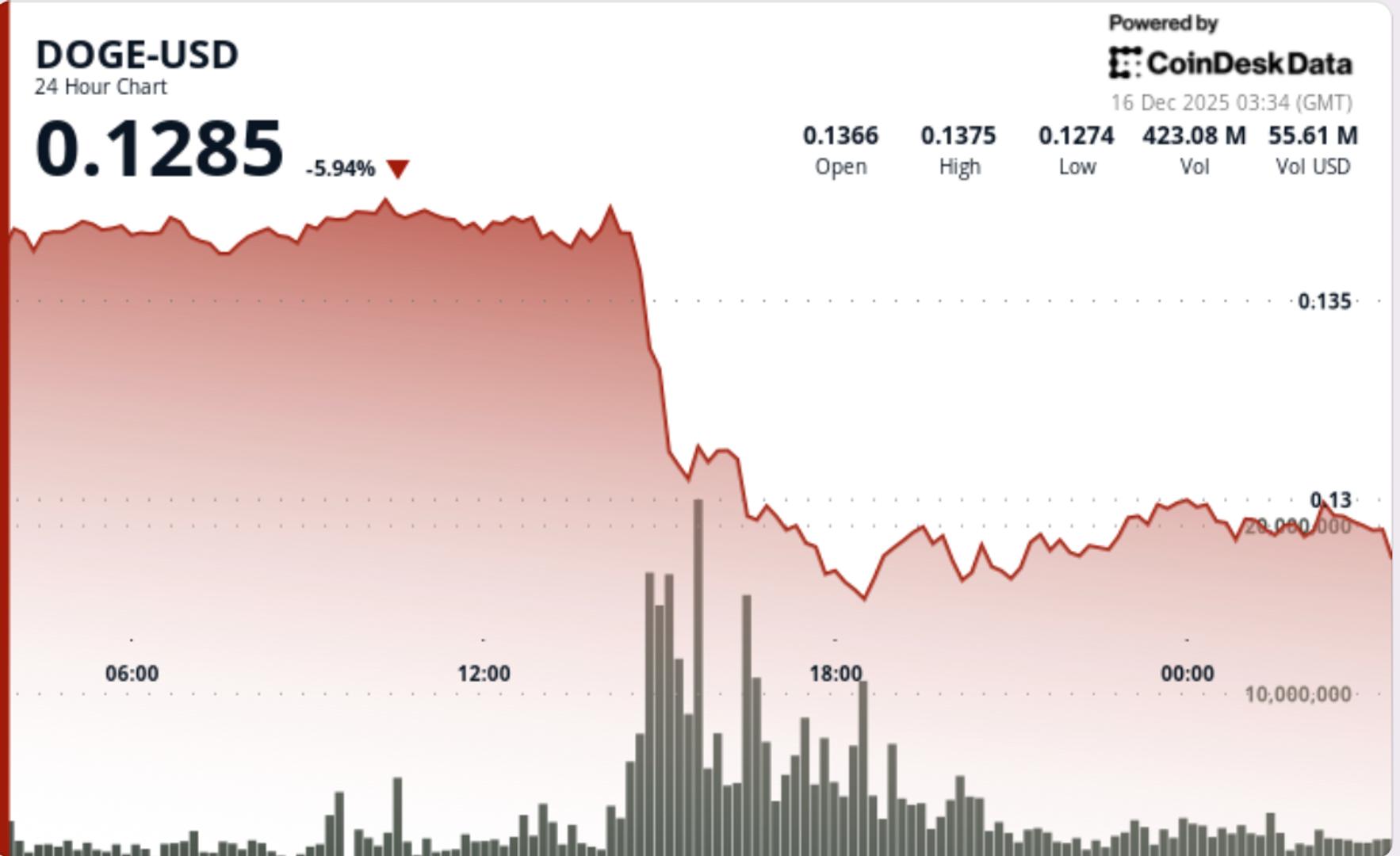

- Dogecoin declined 5.5% over the previous 24 hours, falling from $0.1367 to $0.1291 as promoting stress intensified throughout the broader crypto market.

- The transfer got here amid weaker danger sentiment and declining participation in higher-beta belongings, with meme tokens absorbing outsized draw back relative to majors.

- Whereas no single catalyst drove the selloff, the transfer coincided with continued rotation out of speculative exposures and thinner liquidity circumstances.

- DOGE stays range-bound on the next timeframe, however the newest drop represents a transparent failure to defend ranges that had held via current consolidation.

Technical evaluation

- The breakdown beneath $0.1370 marked a decisive lack of short-term development help. Quantity surged to 1.63 billion tokens throughout the selloff, roughly 267% above common, confirming that the transfer was pushed by massive flows fairly than passive drift.

- Worth pushed cleanly via intermediate helps with out significant pauses, indicating restricted bid depth as soon as $0.1320 gave approach. The failure to reclaim $0.1300 on the primary rebound try retains near-term construction tilted to the draw back, at the same time as momentum indicators start to stabilize.

- From a construction standpoint, DOGE has shifted from vary compression to draw back enlargement. Till value reclaims former help, rallies stay corrective fairly than trend-changing.

Worth motion abstract

- After reaching session lows close to $0.1290, DOGE started to stabilize as promoting stress tapered. Subsequent candles confirmed diminished quantity and shorter draw back extensions, suggesting liquidation stress could also be fading.

- Intraday value motion has began to type larger lows from the $0.1290 base, however upside follow-through stays restricted. Sellers proceed to seem close to $0.1300, maintaining value capped and confirming this degree as fast resistance.

What merchants ought to know

- Quick-term route now hinges on whether or not DOGE can maintain above the $0.1290–$0.1280 zone.

- Sustained acceptance beneath this space would expose the following help band close to $0.1250, whereas a profitable reclaim of $0.1300 could be the primary sign that draw back momentum is easing.

- Quantity conduct is essential. Continued normalization would help a consolidation section, whereas renewed spikes on draw back strikes would counsel additional distribution. For now, DOGE sits in a fragile stabilization section, the place endurance and affirmation matter greater than anticipation.