- Lengthy-term crypto narratives are gaining consideration as short-term momentum fades

- If Bitcoin follows Saylor’s path, XRP may theoretically see large upside over a long time

- Provide dynamics and market construction stay the largest constraints on excessive XRP valuations

With digital asset markets nonetheless leaning beneath macro stress, investor focus is beginning to stretch additional out. As a substitute of chasing short-term rallies, extra individuals are asking what crypto may appear like years, even a long time, down the road. One concept gaining traction is how main altcoins, particularly XRP, may carry out if Bitcoin ever reaches the formidable long-range imaginative and prescient laid out by Michael Saylor.

Earlier within the cycle, expectations have been centered round quick upside and explosive strikes. That tone has cooled. Tighter monetary circumstances and decreased threat urge for food have pushed the market towards longer-term valuation fashions, the place persistence issues greater than momentum.

Michael Saylor’s Huge Bitcoin Guess

Michael Saylor has by no means been shy about his Bitcoin outlook. By means of Technique, he’s overseen one of the crucial aggressive accumulation efforts in company historical past, constructing a place of greater than 660,000 BTC. That alone makes his long-term thesis arduous to disregard, even for skeptics.

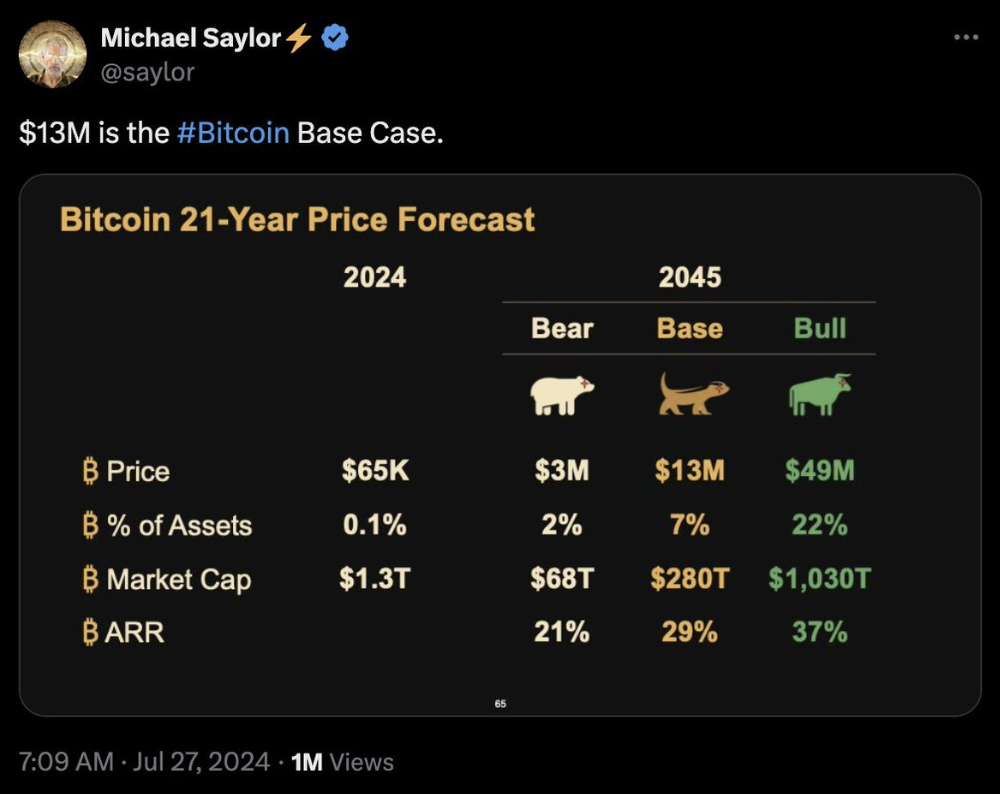

Again in July 2024, with Bitcoin buying and selling close to $65,000, Saylor floated a daring projection: $49 million per Bitcoin by 2045. Since then, BTC climbed to a brand new all-time excessive above $126,000 in October 2025 earlier than pulling again amid macro headwinds. Even at present ranges close to $90,000, Bitcoin would nonetheless must rise greater than 54,000% to succeed in that focus on, which places the dimensions of the forecast into perspective.

The place XRP Matches Into That Situation

Whereas Saylor’s thesis is Bitcoin-only, its ripple results matter for the broader market. Bitcoin’s dominance means long-term appreciation typically drags different massive belongings together with it, particularly throughout enlargement phases. XRP has traditionally moved in the identical normal route as BTC, although with sharper swings on either side.

In latest months, XRP has fallen greater than Bitcoin, underscoring its sensitivity to broader market cycles. If Bitcoin have been to observe something near Saylor’s projected path, proportional fashions recommend XRP may see dramatic long-term positive factors as properly. Below these assumptions, XRP shifting from round $2 immediately to four-digit costs over the approaching a long time isn’t mathematically not possible, even when it feels distant.

Optimism Meets Actuality Checks

Some long-range forecasting platforms lean into that risk. Changelly, for instance, has projected XRP reaching the $1,100 vary by the early 2040s, assuming sustained adoption and increasing use circumstances. These fashions hinge on XRP turning into deeply embedded in world fee and settlement infrastructure.

Critics push again arduous, although. XRP’s massive circulating provide creates critical valuation constraints, and at four-digit costs, its implied market cap would stretch past $100 trillion. For a lot of analysts, that crosses into territory that current world monetary programs merely can’t help, no less than not as they exist immediately.

Ultimately, Saylor’s Bitcoin forecast affords a framework, not a assure. XRP’s future will rely by itself fundamentals, regulatory readability, real-world adoption, and the way markets evolve over time. Excessive-end projections make for attention-grabbing dialogue, however they continue to be speculative and ought to be weighed fastidiously towards financial actuality.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.