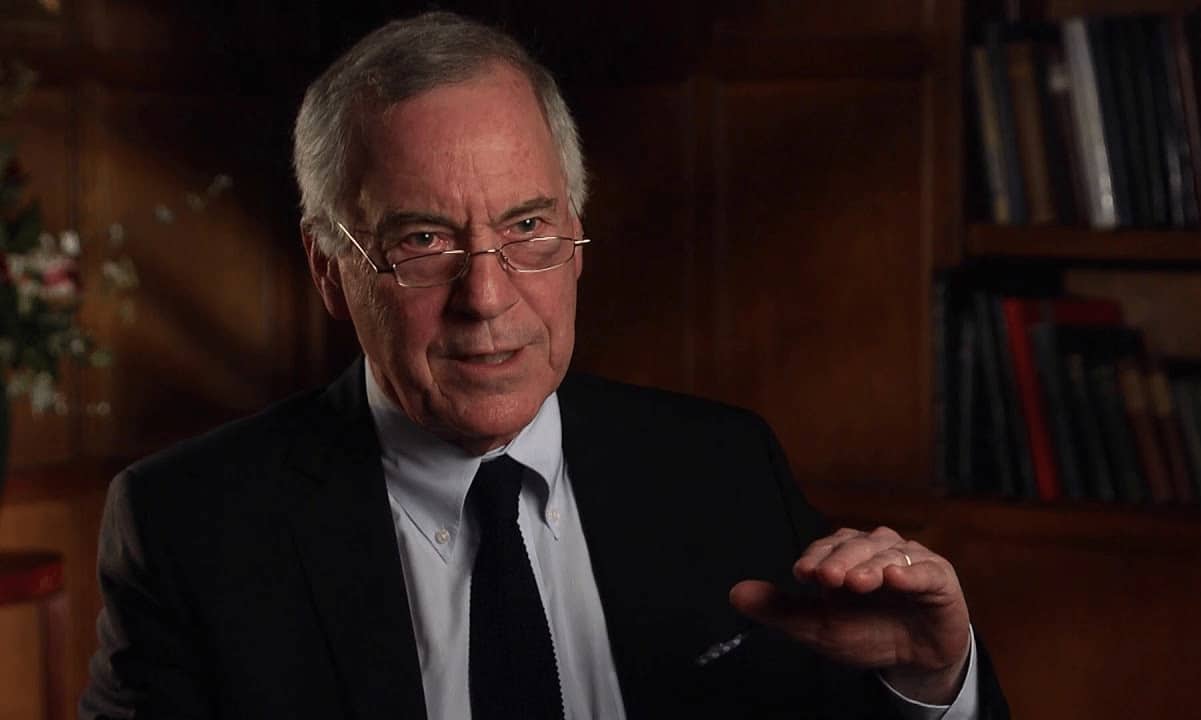

Bitcoin’s newest pullback has reignited a long-running argument over whether or not the asset has any actual worth, after economist Steve Hanke dismissed it as having “zero basic worth” on X earlier in the present day.

The remark landed throughout a risky session that noticed BTC dip towards the mid-$80,000 vary, drawing sharp pushback from analysts and crypto figures who recommended that these judging the OG digital asset based mostly available on the market turmoil have been lacking the larger image.

Analysts Push Again as Bitcoin Slides Under $90K

Hanke, a Johns Hopkins professor, made his feedback throughout a interval of notable pressure for cryptocurrencies. After a number of weeks of weakening from October peaks, Bitcoin’s value briefly hit a two-week low close to $85,100 yesterday, based on market knowledge.

“BITCOIN = A HIGHLY SPECULATIVE ASSET WITH ZERO FUNDAMENTAL VALUE,” the frequent crypto critic posted on X.

On-chain analyst Axel Adler Jr. was fast to react, calling Hanke’s evaluation “completely incorrect” and arguing that Bitcoin is in a correction after years of development and is transitioning into “a key ingredient of the worldwide monetary system.”

Others framed the talk round belief and financial historical past, with dealer Carpe_Diem evaluating the cryptocurrency’s supposed lack of worth to fiat cash, pointing to long-term lack of buying energy within the U.S. greenback.

“Oh. You imply, like that fiat forex we name the US Greenback?” they requested, posting a chart displaying the greenback’s 86% loss in buying energy since 1972.

Concurrently the value drop, community knowledge from December 9-14 confirmed a collection of sharp day by day drops in Bitcoin’s estimated hashrate, totaling drops of as much as 12.8%. Nevertheless, Adler cautioned that community metrics alone can’t affirm explanations for the incidence circulating within the press, together with experiences of mining shutdowns in China.

Market Worth, Macro Stress, and the Larger Debate

Worth motion has added weight to the argument on either side. On the time of writing, Bitcoin was down round 3.4% over the previous 24 hours because it continues to underperform its late-November highs close to $100,000.

Ethereum slipped under $3,000 throughout the identical window, whereas main altcoins similar to XRP, Solana, and Cardano additionally posted short-term losses. The sell-off coincided with $210 million in liquidations inside an hour, as reported by CryptoPotato, highlighting how leveraged positioning amplified the transfer.

Supporters argue that market worth itself challenges the “zero worth” declare. Swan Bitcoin quoted analyst Checkmate on December 15, noting that greater than $1 trillion in capital has flowed into Bitcoin as a retailer of financial savings.

Commentator Daniel Tschinkel added that focusing solely on value ignores Bitcoin’s international fee community and resistance to regulate.

Nonetheless, skeptics have pointed to tightening monetary situations and fragile technical ranges, with some analysts now warning that delayed U.S. price cuts might hold strain on danger belongings into early 2026, and the bearish situations might place BTC far decrease earlier than any sustained restoration.

For now, the conflict between conventional financial concept and Bitcoin’s rising position in markets reveals no signal of fading, particularly when sharp drawdowns give critics contemporary speaking factors.

The publish Analyst Pushes Again on Steve Hanke’s Declare Bitcoin Lacks Worth appeared first on CryptoPotato.