On-chain knowledge exhibits the Bitcoin Inter-exchange Stream Pulse (IFP) has quickly been happening lately, an indication of cooling derivatives curiosity.

Bitcoin IFP Has Witnessed A Plunge Not too long ago

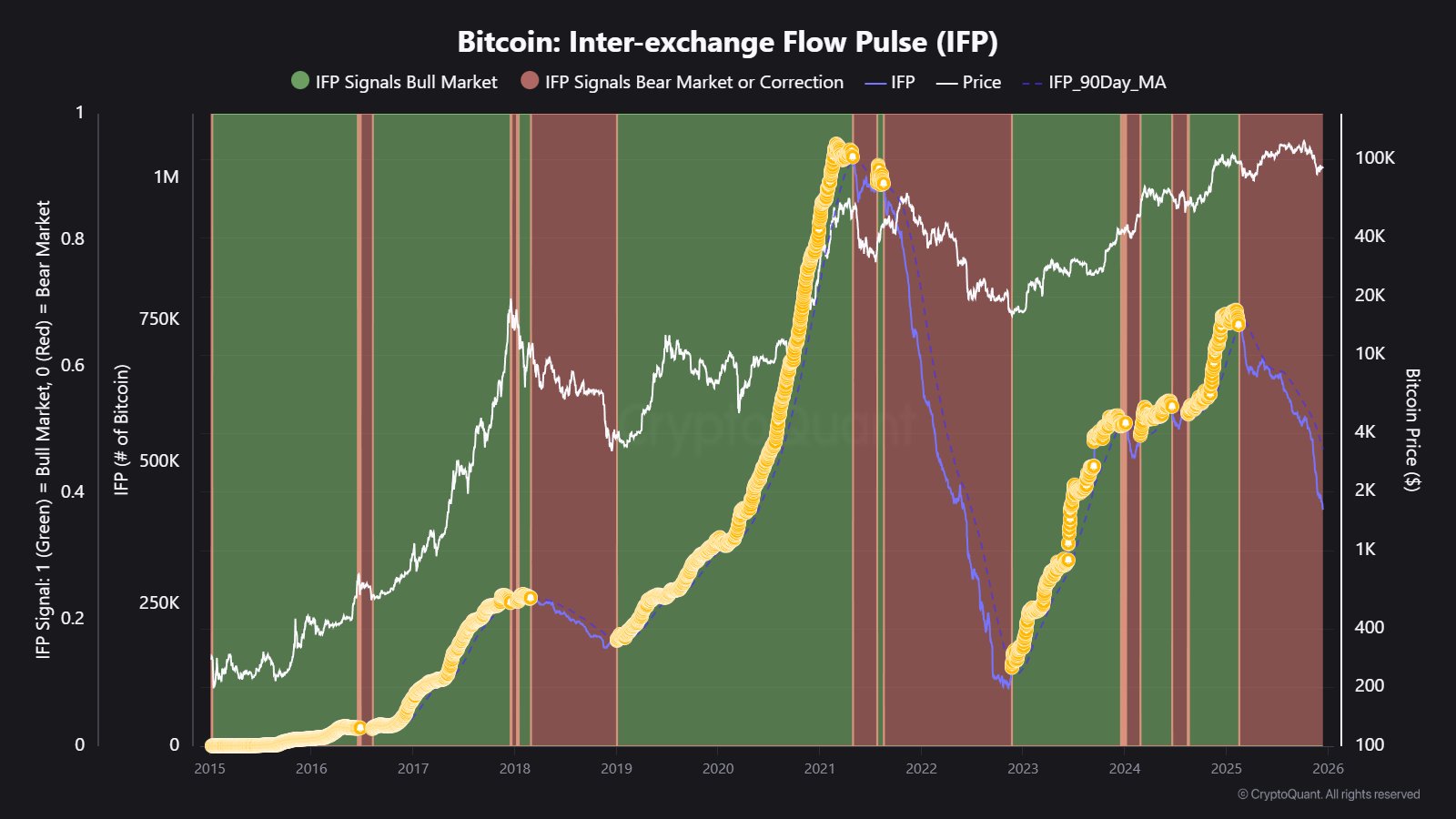

In a brand new put up on X, CryptoQuant neighborhood analyst Maartunn has talked in regards to the trajectory that the Bitcoin IFP has been following lately. The IFP refers to an on-chain indicator that measures the BTC flows going down between spot and derivatives exchanges.

When the worth of this metric goes up, it means traders are ramping up transactions to derivatives platforms. Such a pattern is usually a signal that demand for hypothesis is on the rise.

Then again, the indicator witnessing a decline implies fewer cash are touring from spot exchanges to derivatives ones. This sort of pattern can counsel merchants are decreasing their urge for food for threat.

Now, right here is the chart shared by Maartunn that exhibits the pattern within the Bitcoin IFP and its 90-day transferring common (MA) over the previous decade:

Seems to be like the worth of the indicator has been on the way in which down since some time now | Supply: @JA_Maartun on X

As is seen within the above graph, the Bitcoin IFP was witnessing an uptrend in the previous few months of 2024, however with the beginning of this 12 months, a reversal within the indicator occurred. The swap to a downtrend meant that its worth slipped under the 90-day MA, one thing that has traditionally signaled bearish circumstances.

Over the course of 2025, the IFP has continued its downward trajectory, however these days, the decline has accelerated, indicating that derivatives curiosity is cooling off quick.

Two cycles in the past, the IFP sliding under its 90-day MA led into the 2018 bear market. Within the 2021 bull market, the bear sign on the IFP was initially adopted by the second half of that bull run, however then the 2022 bear market took over because the metric didn’t get well.

The same pattern has been witnessed this 12 months as nicely, with Bitcoin exploring new all-time highs (ATHs) regardless of the IFP suggesting bearish circumstances. The latest acceleration within the indicator’s downtrend, nevertheless, has been accompanied by a bearish interval within the asset’s worth. Solely time will inform whether or not it is a repeat of the sample from the final cycle, or if threat urge for food will make a comeback amongst traders and the IFP will reverse course.

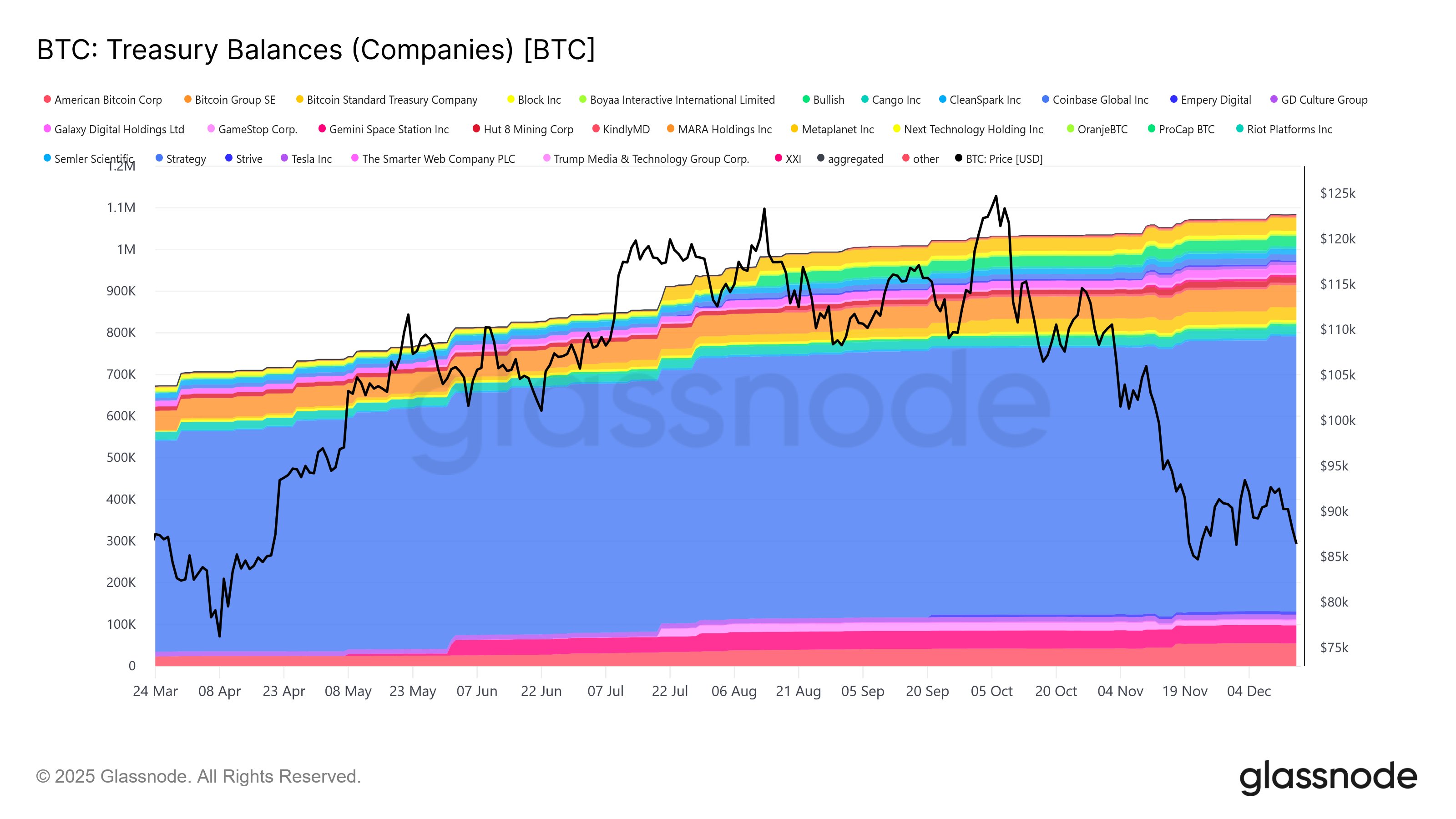

In another information, the Bitcoin treasury corporations have seen their holdings go up lately, regardless of the drawdown that the market has confronted, as identified by Glassnode co-founder Rafael in an X put up.

The pattern within the holdings of the BTC treasury corporations | Supply: @n3ocortex on X

From the chart, it’s obvious that since Bitcoin began declining from its ATH above $126,000, the treasury corporations have nonetheless continued a web upward trajectory. “Not seeing a lot of the alleged pressured promoting right here regardless of some equities buying and selling under mNAV,” famous Rafael.

BTC Value

On the time of writing, Bitcoin is buying and selling round $87,500, down over 7% within the final week.

The value of the coin appears to have been dealing with bearish winds | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, CryptoQuant.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.