- CFTC Performing Chair Caroline Pham plans to affix MoonPay after leaving the company.

- She is going to function chief authorized officer and chief administrative officer.

- Pham’s transfer underscores nearer ties between regulators and the crypto trade.

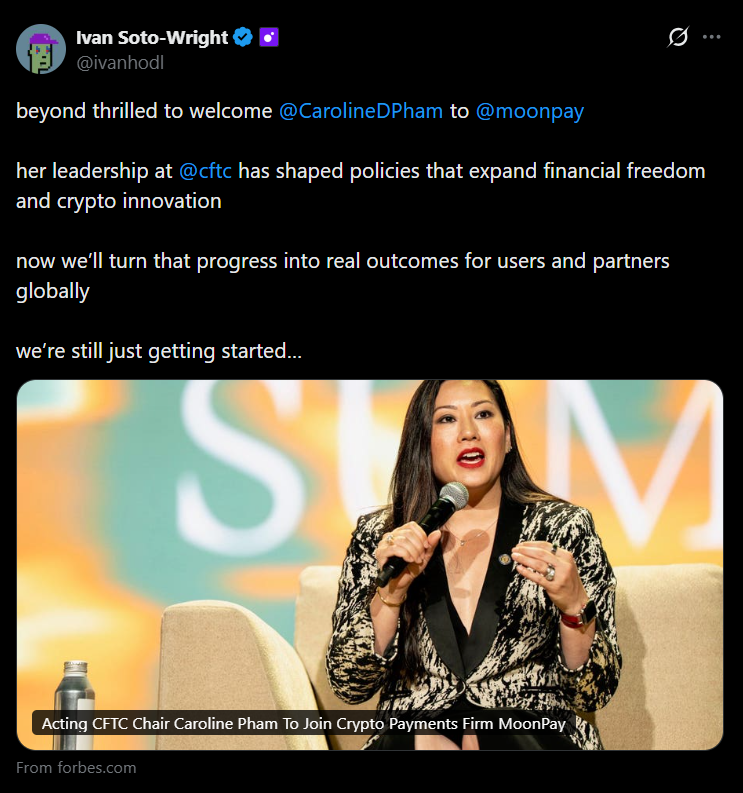

Caroline Pham, the performing chair of the U.S. Commodity Futures Buying and selling Fee, is ready to maneuver into a brand new function at crypto funds agency MoonPay as soon as her time on the company concludes. MoonPay confirmed the transition on Wednesday, noting that Pham has lengthy signaled her intention to step down after a everlasting CFTC chair is confirmed. The transfer locations a senior U.S. regulator immediately right into a management place throughout the crypto trade at a pivotal second for regulatory readability.

From Regulator to Crypto Govt

Pham will be a part of MoonPay as each chief authorized officer and chief administrative officer, in keeping with the corporate. MoonPay CEO Ivan Soto-Wright praised her regulatory tenure, saying her management helped form insurance policies that expanded monetary freedom and inspired crypto innovation. Pham had first indicated plans to affix MoonPay again in August, although the timing of her official begin stays depending on management modifications on the CFTC.

Transition Hinges on New CFTC Management

President Trump’s nominee to steer the CFTC, Mike Selig, is scheduled to face a affirmation listening to this week. Till that course of is full, Pham will stay in her performing function. A MoonPay spokesperson confirmed that no official begin date has been set, underscoring that the transition remains to be tied to developments in Washington.

A Yr of Crypto-Centered Coverage Shifts

Throughout her tenure, Pham pushed the CFTC towards a extra proactive stance on digital property. She led a number of initiatives beneath the company’s “Crypto Dash,” geared toward simplifying and clarifying guidelines for the trade. Simply final week, Pham introduced the withdrawal of steerage associated to the “precise supply” of digital property, calling it outdated and overly advanced. Earlier this month, she additionally revealed that Bitnomial grew to become the primary trade permitted to listing regulator-sanctioned spot crypto merchandise.

Constructing Bridges Between Regulators and Trade

Pham additionally launched a CEO Innovation Council to deepen the company’s engagement with crypto and monetary markets. The council’s first individuals included Polymarket CEO Shayne Coplan, Nasdaq CEO Adena Friedman, and Gemini co-founder Tyler Winklevoss. The trouble mirrored her broader method of working immediately with trade leaders reasonably than regulating from a distance.

What the Transfer Indicators

Pham’s transition to MoonPay highlights a rising development of regulators bringing firsthand coverage expertise into crypto companies. For MoonPay, it strengthens authorized and regulatory management as the corporate scales globally. For the trade, it reinforces the concept that regulatory experience is changing into simply as precious as technical innovation.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.