Bitcoin is struggling to interrupt away from the bearish market construction that has been in place since late October. Regardless of a number of short-lived reduction rallies, value motion continues to replicate weak spot, with bulls failing to reclaim key resistance ranges or generate sustained momentum.

As uncertainty and fatigue unfold throughout the market, many contributors are questioning whether or not Bitcoin’s present conduct matches the standard cycle framework that has outlined earlier bull and bear phases.

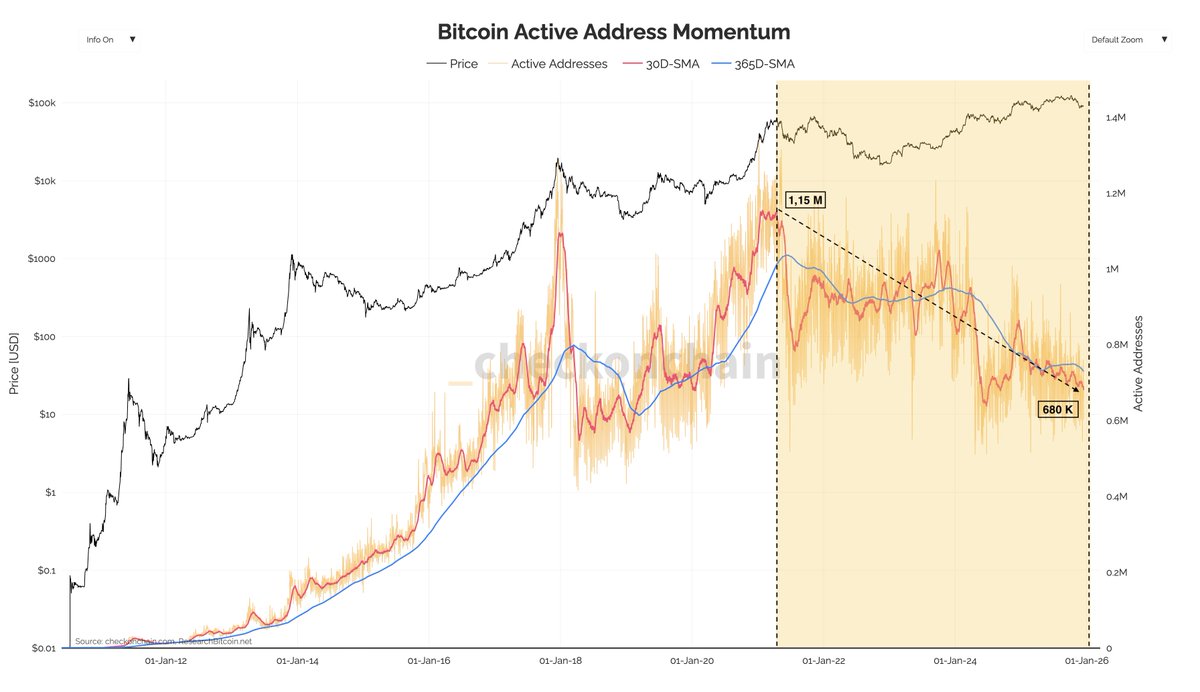

A latest evaluation by Darkfost highlights a structural shift that provides vital context to this debate. In keeping with the information, the variety of lively Bitcoin addresses has been in a persistent decline since April 2021. Traditionally, bullish phases have been characterised by a transparent enlargement in lively addresses, as new buyers entered the market and on-chain exercise surged. This progress sometimes peaked close to cycle tops, adopted by a contraction throughout bear markets as participation dried up.

This cycle, nevertheless, seems markedly completely different. Even in periods of robust value efficiency since 2022, lively addresses have didn’t recuperate meaningfully and proceed trending decrease. This divergence means that Bitcoin’s market construction could also be evolving away from a retail-driven, on-chain participation mannequin towards one thing extra concentrated and institutionally influenced.

As Bitcoin makes an attempt to stabilize after weeks of draw back strain, understanding these structural adjustments is turning into vital. The decline in lively addresses might not merely sign weak spot, however moderately a change in how Bitcoin is held, traded, and valued on this cycle.

Energetic Addresses Sign A Structural Shift In The Market

The evaluation means that regardless of Bitcoin’s robust value efficiency since 2022, on-chain participation continues to deteriorate. Energetic addresses are as soon as once more approaching the bottom ranges noticed throughout this cycle, highlighting a rising disconnect between value motion and community exercise. On the peak in April 2021, Bitcoin recorded roughly 1.15 million lively addresses. At the moment, that determine has almost halved, sitting close to 680,000, a contraction that can’t be ignored.

This decline is tough to attribute to a single trigger. As an alternative, it possible displays a mix of structural adjustments in how Bitcoin is held and accessed. One contributing issue seems to be the rise in inactive addresses. Whereas exact classification standards fluctuate, the broader development factors towards a stronger long-term holding mentality, the place cash stay dormant moderately than actively transacted on-chain. This conduct reduces seen community exercise with out essentially implying bearish conviction.

On the similar time, a portion of market contributors might have shifted away from direct on-chain utilization altogether. Centralized exchanges, custodial platforms, and monetary merchandise equivalent to ETFs supply publicity to Bitcoin with out requiring on-chain interplay. Because of this, demand for block house declines whilst capital allocation to Bitcoin stays vital.

Taken collectively, the sustained drop in lively addresses suggests Bitcoin’s market construction is evolving. The community is turning into much less retail-driven and extra concentrated, reinforcing the concept conventional cycle metrics could also be dropping a few of their explanatory energy on this atmosphere.

Bitcoin Value Assessments Lengthy-Time period Assist as Construction Weakens

Bitcoin continues to commerce beneath strain, with the chart highlighting a transparent deterioration in market construction. After failing to maintain costs above the $100K–$110K zone earlier within the 12 months, BTC has entered a corrective part marked by decrease highs and heavy promoting momentum. The latest transfer towards the $87K space locations value instantly on a vital demand zone, intently aligned with the rising long-term shifting averages.

From a development perspective, the lack of the short- and medium-term shifting averages is important. The blue and inexperienced averages have rolled over, appearing as dynamic resistance moderately than assist, reinforcing the bearish bias.

Value is now hovering simply above the purple long-term shifting common, a degree that has traditionally outlined the boundary between bull market corrections and deeper bearish transitions. A clear breakdown under this zone would materially improve draw back threat towards the low-$80K area.

Quantity conduct provides additional context. Promoting strain expanded notably in the course of the sharp drawdown from the highs, whereas latest bounce makes an attempt have occurred on comparatively weaker quantity. This implies that dip-buying curiosity stays cautious moderately than aggressive. Structurally, the market seems to be consolidating after distribution, not constructing a robust base but.

Within the close to time period, holding the $85K–$88K vary is essential. A failure to defend this space would verify a broader development shift, whereas reclaiming the $95K–$100K area is required to neutralize the present bearish construction.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.