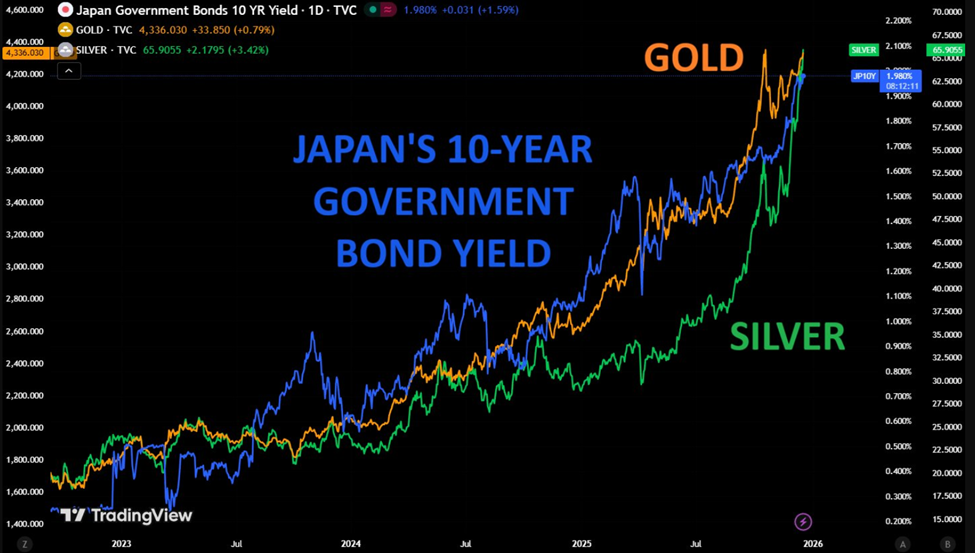

Japan’s 10-year authorities bond yields surged to 1.98% in December 2025, the very best degree for the reason that Nineteen Nineties. It comes as markets braced for the Financial institution of Japan’s (BOJ) coverage assembly on December 19.

The transfer has triggered a worldwide rally in valuable metals, with gold and silver surging 135% and 175%, respectively, since early 2023. In the meantime, Bitcoin is beneath strain as compelled promoting intensifies throughout Asian exchanges, highlighting a divergence in market reactions to Japan’s charge shift.

Sponsored

Sponsored

Japan’s Bond Yields Hit 1.98%

For many years, Japan maintained near-zero rates of interest, anchoring international liquidity via the yen carry commerce.

Traders borrowed yen at a low charge to fund higher-yielding belongings worldwide, successfully exporting ultra-low rates of interest.

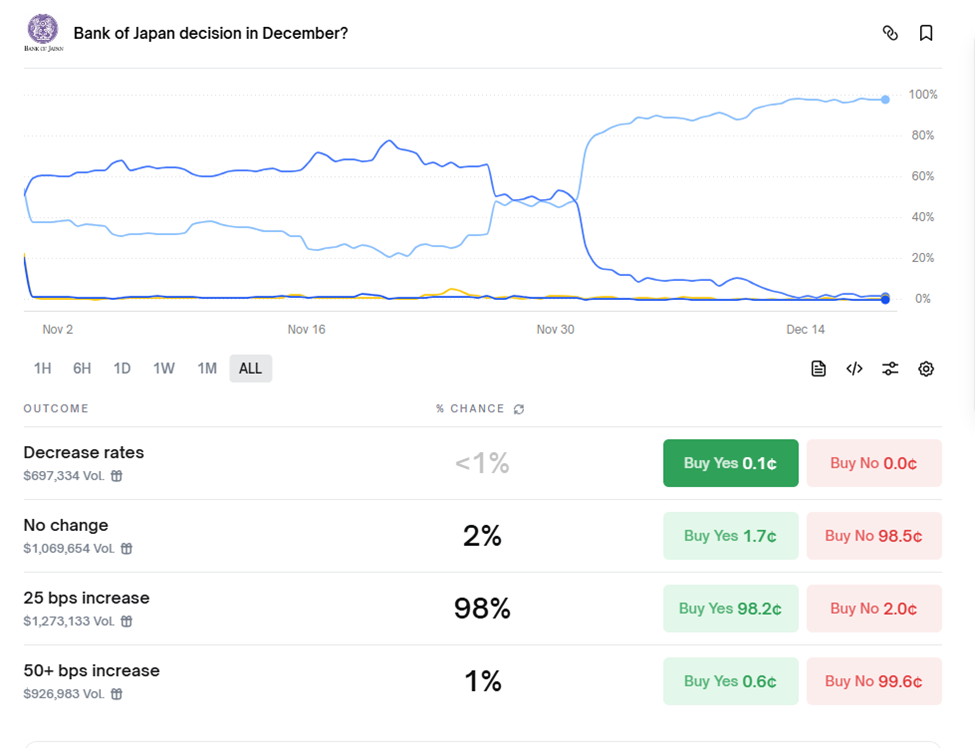

An anticipated 25-basis-point hike, elevating the speed to 0.75%, could seem modest in absolute phrases, however the tempo of change issues greater than the extent.

“Carry commerce in danger: No person is aware of when the actual penalties will materialize, however this continued shift will doubtless drain liquidity from markets, doubtlessly inflicting a ripple impact via margin calls and different compelled deleveraging,” warned Guilherme Tavares, CEO at i3 Make investments.

Analysts see the BOJ transfer as greater than a home adjustment.

“When Japan’s yields transfer, international capital pays consideration. Gold and silver aren’t reacting to inflation headlines. They’re pricing sovereign stability sheet danger. Japan isn’t a sideshow anymore. It’s the fulcrum,” famous Simon Hou-Vangsaae Reseke.

Sponsored

Sponsored

Gold and Silver Costs Surge Amid Rising Sovereign Threat

Valuable metals have been carefully monitoring Japanese yields. In accordance with World Market Investor, gold and silver are shifting nearly completely in keeping with Japanese authorities bond yields. This means that valuable metals are getting used as a major hedge towards the rising value of presidency debt.

“It’s not the yield itself, it’s what the transfer represents — rising sovereign danger, tighter international liquidity, and uncertainty about forex credibility. Gold responds as safety, and silver follows with extra volatility,” commented analyst EndGame Macro.

The silver market is exhibiting indicators of speculative mania. The China Silver Futures Fund lately traded 12% above the bodily steel it tracks, indicating that demand for leveraged publicity is outpacing the underlying asset.

Sponsored

Sponsored

Traders are more and more treating gold and silver as hedges towards broader macro dangers, quite than simply inflation.

Bitcoin Faces Stress as Carry Trades Unwind

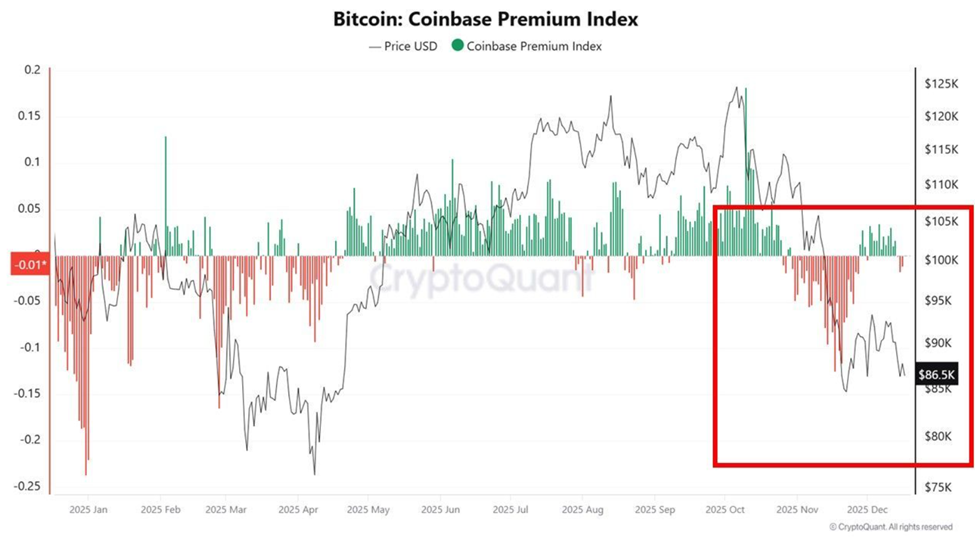

In the meantime, the Bitcoin value is feeling the pressure of tightening yen liquidity.

“Asia-based exchanges have seen persistent spot promoting. Miner reserves are falling — compelled promoting, not selection…Lengthy-term Asian holders look like distributing…Value stays heavy till compelled provide is cleared,” wrote CryptoRus, citing XWIN Analysis Japan.

US establishments proceed shopping for, with the Coinbase Premium optimistic, however compelled liquidations in Asia and an 8% drop in Bitcoin hashrate have added downward strain.

Sponsored

Sponsored

Previous BOJ charge shifts have coincided with vital BTC declines, and merchants are watching carefully for additional draw back towards $70,000.

The contrasting reactions of valuable metals and Bitcoin spotlight variations in danger positioning. Gold and silver are attracting safe-haven flows amid rising sovereign danger, whereas Bitcoin faces liquidation-driven value strain.

Analysts notice that future Fed charge cuts could offset the BOJ’s impacts, however the pace of the coverage change is essential.