- Pi Coin is down over 93% from its February all-time excessive.

- Weak macro situations and fading hype proceed to stress PI.

- A broader Bitcoin rally could also be wanted to revive momentum.

Pi Coin began the 12 months with explosive momentum, surging to an all-time excessive of $2.99 in February and drawing heavy consideration throughout the crypto market. That pleasure didn’t final lengthy. Since its peak, PI has collapsed by greater than 93%, wiping out most early good points and leaving the token struggling to regain relevance. Whereas the value is up a modest 0.7% within the final 24 hours, broader time frames stay firmly adverse, reflecting ongoing weak spot.

A Market That’s Turned Danger-Off

A part of PI’s decline will be traced to worsening macroeconomic situations. Financial progress stays sluggish, and traders have more and more rotated into lower-risk belongings. This shift has triggered sustained outflows from crypto markets, significantly smaller and speculative tokens like PI. On this setting, rallies are usually short-lived and shortly bought into.

PI’s Downtrend Predates the Broader Selloff

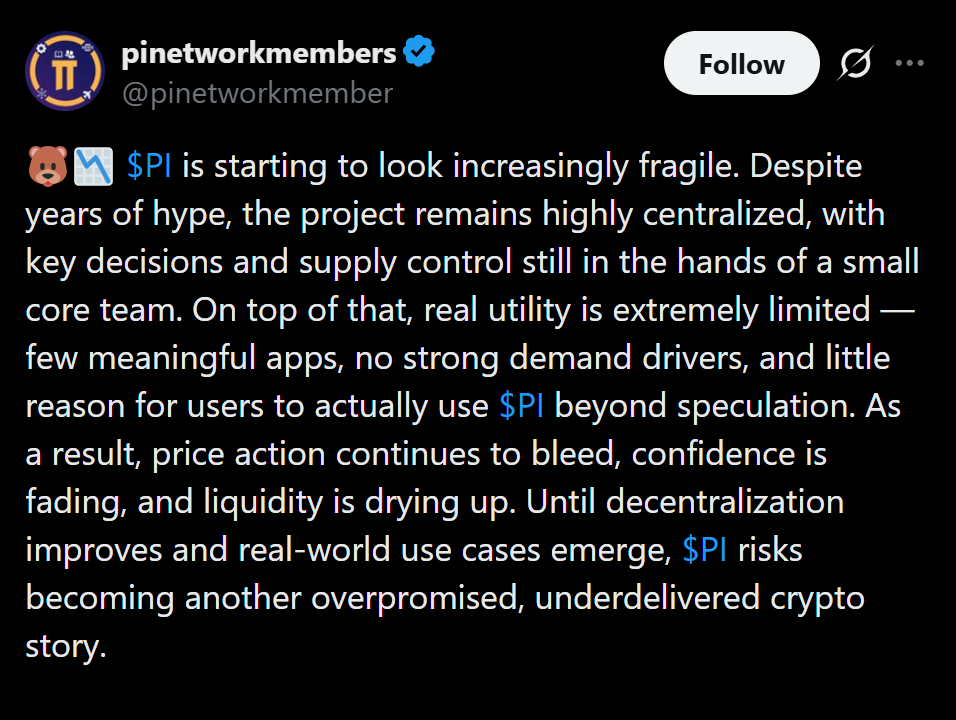

What’s extra regarding for PI holders is that the downtrend started nicely earlier than the most recent market correction. Whereas the broader crypto market took a significant hit in October, PI has been sliding virtually uninterrupted since February, with solely transient and shallow rebounds alongside the best way. Analysts level to fading hype and a scarcity of clear utility as main contributors. As enthusiasm cooled after early 2025, demand for PI weakened noticeably.

Restoration Appears Distant for Now

PI might ultimately rebound, however the timing stays unsure. With the crypto market nonetheless removed from a confirmed restoration and fears of one other crypto winter resurfacing, promoting stress could persist. Excessive employment figures and gradual international progress add to the chance that speculative belongings stay below stress for longer than anticipated.

Bitcoin Might Change the Narrative

One potential catalyst for reduction can be a powerful transfer greater in Bitcoin. Companies like Grayscale and Bernstein have urged BTC might attain new all-time highs in 2026. If that situation performs out, renewed market optimism might spill over into altcoins, together with PI. Till then, PI’s outlook stays tied to broader market restoration fairly than any inner momentum of its personal.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.