Ethereum is dealing with renewed promoting stress because the broader market struggles with worry, uncertainty, and rising bearish expectations. After weeks of weak point, many analysts are actually overtly calling for a protracted bear market stretching into 2026, arguing that Ethereum stays under key structural ranges and lacks sturdy momentum.

Associated Studying

Bulls are trying to defend the $2,800 mark, a stage that has change into crucial for sustaining short-term confidence, however value motion continues to replicate hesitation somewhat than conviction. Volatility stays elevated, and market sentiment is dominated by warning somewhat than optimism.

Towards this fragile backdrop, on-chain knowledge reveals a notable divergence between value motion and habits from skilled market contributors. In keeping with knowledge from Hyperdash, the Bitcoin OG, recognized for shorting the market in the course of the October 10 crash, has as soon as once more elevated his publicity to Ethereum.

This dealer, extensively adopted for his high-conviction and well-timed positioning, simply added one other 12,406 ETH to his lengthy positions, signaling confidence at present value ranges regardless of the prevailing bearish narrative.

Whereas retail sentiment weakens and analysts debate deeper draw back situations, strategic accumulation by seasoned gamers means that Ethereum could also be approaching a decisive part. Whether or not this marks early positioning forward of a restoration or a high-risk guess in a deteriorating market stays the important thing query forward.

A Excessive-Conviction Wager Underneath Strain

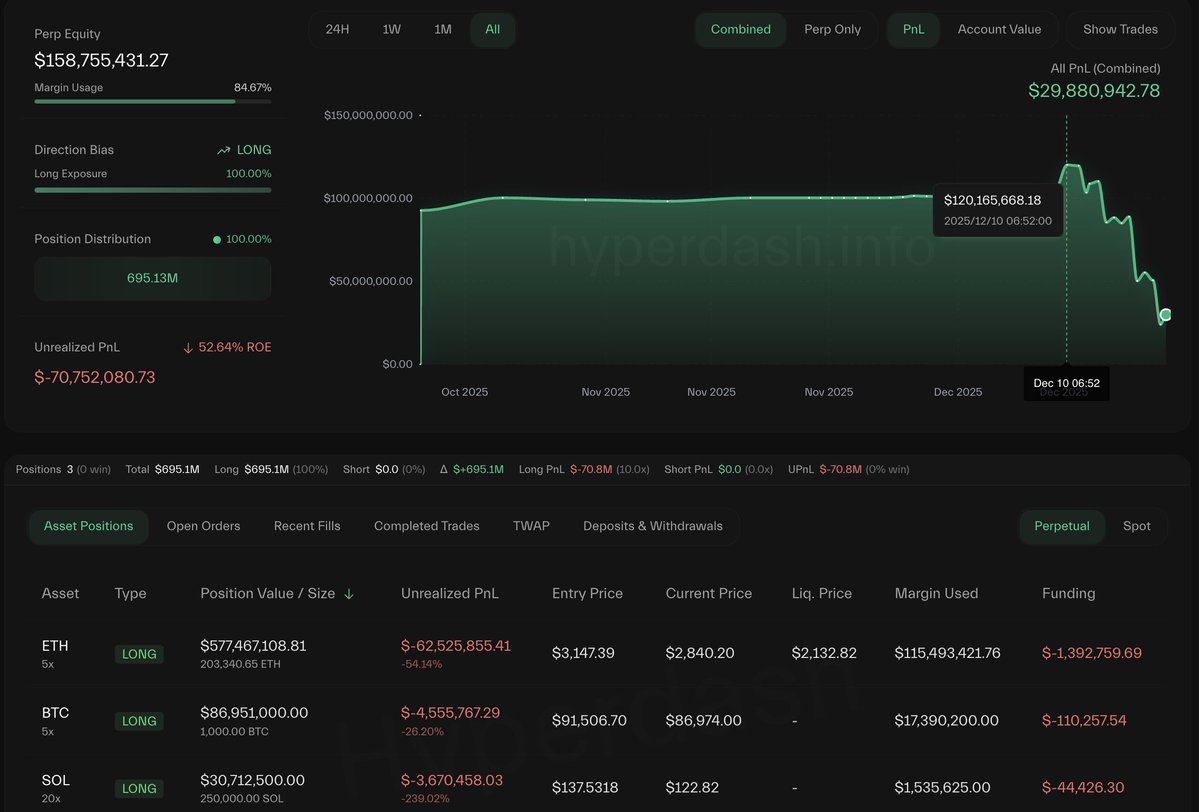

Lookonchain experiences that the Bitcoin OG continues to carry substantial, high-conviction positions throughout a number of property, regardless of the continued market weak point. In keeping with the most recent knowledge, his present publicity contains 203,341 ETH valued at roughly $577.5 million, 1,000 BTC value round $87 million, and 250,000 SOL valued close to $30.7 million. This stage of focus highlights a willingness to endure important volatility somewhat than cut back danger in an more and more unsure surroundings.

That conviction, nevertheless, has include significant drawdowns. The pockets is now down greater than $70 million from its peak. At one level, unrealized income exceeded $120 million, however current value declines have diminished that determine to lower than $30 million. The swing illustrates how rapidly market situations can shift, even for merchants with a robust observe document and well-timed entries previously.

From a broader market perspective, this positioning displays a pointy distinction between sentiment and habits. Whereas many contributors have turned defensive and analysts debate the chance of a protracted bear market, this pockets stays closely uncovered, suggesting a perception that present ranges should still provide uneven upside. On the identical time, the drawdown serves as a transparent reminder that dimension and conviction don’t take away danger in a structurally fragile market.

Associated Studying

Ethereum Exams Structural Assist Amid Rising Strain

Ethereum’s weekly chart highlights a transparent lack of momentum after the rejection close to the $4,800–$5,000 area, adopted by a pointy retracement towards the $2,800–$2,900 zone. Worth is presently buying and selling under the 50-week shifting common and hovering close to the 100-week MA, a stage that traditionally acts as an vital inflection level for medium-term development course. The failure to carry above the short-term averages confirms that sellers have regained management of the construction.

From a development perspective, ETH stays above the rising 200-week shifting common, which continues to outline the long-term bullish framework. Nonetheless, the widening hole between the quicker and slower averages has began to compress, signaling a transition part somewhat than development continuation. Quantity has expanded on down weeks, reinforcing the concept current draw back strikes are pushed by energetic distribution somewhat than passive consolidation.

Associated Studying

The $2,800 space now represents a crucial demand zone. A sustained maintain above this stage would recommend that the correction is a managed pullback inside a broader vary. Conversely, a weekly shut under it will expose ETH to a deeper retracement towards the $2,400–$2,500 area, the place the 200-week MA and prior consolidation converge.

General, the chart displays a market caught between long-term structural assist and short-term bearish momentum. Ethereum wants a decisive reclaim of the 50-week shifting common to neutralize draw back danger and restore confidence in development continuation.

Featured picture from ChatGPT, chart from TradingView.com