Be a part of Our Telegram channel to remain updated on breaking information protection

A surge of crypto ETF (exchange-traded fund) launches in 2026 may result in widespread liquidations later, Bloomberg ETF analyst James Seyffart warned.

Seyffart highlighted in Dec. 17 feedback on X that analysis from crypto asset supervisor Bitwise initiatives greater than 100 crypto ETFs may launch subsequent yr.

He additionally famous that 126 ETF filings are at the moment awaiting SEC approval, including, “Issuers are throwing A LOT of product on the wall.”

The chance is that offer outstrips demand, making it troublesome for a lot of merchandise to attain a sustainable stage of belongings below administration, significantly if the crypto market stays in a funk.

“We’re going to see numerous liquidations in crypto ETP merchandise,’’ he mentioned. ‘’May occur at tail finish of 2026 however doubtless by the tip of 2027.”

I am in 100% settlement with @BitwiseInvest right here. I additionally assume we will see numerous liquidations in crypto ETP merchandise. May occur at tail finish of 2026 however doubtless by the tip of 2027. Issuers are throwing A LOT of product on the wall — there’s a minimum of 126 filings https://t.co/eOmeUIKXFZ pic.twitter.com/UELUKUng7Y

— James Seyffart (@JSeyff) December 17, 2025

SEC Generic Itemizing Requirements Make It Simpler For New Merchandise To Launch

Seyffart’s warning and Bitwise’s 2026 ETF increase prediction comply with a September determination by the US Securities and Change Fee (SEC) to approve generic itemizing requirements for crypto ETFs.

This allows nationwide securities exchanges such because the New York Inventory Change (NYSE), Nasdaq, and Cboe, to checklist sure commodity-based ETPs (exchange-traded merchandise) tied to cryptos.

Earlier than approving the generic itemizing requirements, the SEC had reviewed each crypto ETF utility on a case-by-case foundation. This course of was gradual and unpredictable, and subsequently served as a bottleneck for issuers and managers that wished to launch new merchandise.

Now, the brand new requirements change the method by setting rule-based, goal standards. That is just like what number of conventional commodities ETFs are listed.

On condition that the brand new generic itemizing requirements streamline the method, a number of issuers have filed to launch merchandise for a variety of cryptos with the purpose of repeating the success of the spot BTC and spot ETH funds within the US.

The funds had been anticipated to ignite a crypto market rally earlier within the yr, however the US authorities shutdown had stalled momentum for the market.

Crypto ETFs May Repeat The Development Seen In The TradFi Area

The warning of a crypto ETF increase and subsequent liquidations additionally comes after a number of funds within the conventional finance house did not take off.

Final yr, a complete of 622 ETFs closed down. This included 189 funds within the US, in line with a report from The Each day Upside final month. Morningstar additionally reported in January 2024 that the 244 ETFs that had closed within the US in 2023 solely had a median age of 5.4 years.

A lot of these ETFs had shut down as a result of they failed to draw ample inflows, which in the end led to low belongings below administration.

Indications that the development may make its method to the crypto market have already emerged this yr. In 2025, a number of crypto merchandise have been liquidated. Amongst them is the ARK 21Shares Lively Bitcoin Ethereum Technique ETF (ARKY) and the ARK 21Shares Lively On-Chain Bitcoin Technique ETF (ARKC).

Altcoin ETFs Lag Behind Older Spot Bitcoin Funds

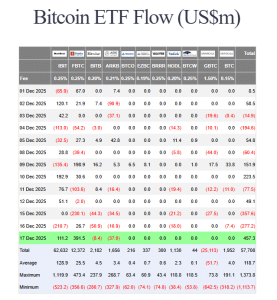

Spot Bitcoin ETFs launched within the US in the direction of the beginning of 2024, and have since seen greater than $57.7 billion of internet inflows. BlackRock’s IBIT has led the cost with its internet cumulative inflows of over $62.6 billion, knowledge from Farside Buyers exhibits.

US spot BTC ETF flows (Supply: Farside Buyers)

Spot ETH ETFs, launched a couple of months after, have seen solely $12.636 billion in cumulative internet inflows.

Earlier this yr, spot SOL ETFs debuted available in the market as nicely, however have solely attracted $725 million in complete inflows.

Spot XRP ETFs are the youngest merchandise available in the market and seem to have bucked the development seen with altcoin merchandise. Following a multi-day inflows streak since their debut, the spot XRP ETFs have already managed to surpass $1.1 billion in complete internet belongings.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection