Bitcoin strengthened because the Japanese yen dropped after the Financial institution of Japan (BOJ) hiked rates of interest as anticipated.

The Japanese central financial institution raised its short-term coverage price by 25 foundation factors to 0.75%, the best stage in roughly three many years, persevering with the gradual shift away from many years of ultra-loose financial coverage.

Within the coverage assertion, BOJ acknowledged that inflation has held above its 2% goal for an prolonged interval because of rising import prices and firmer home worth dynamics. Nevertheless, policymakers emphasised that rates of interest adjusted for inflation stay adverse, implying that financial situations are nonetheless accommodative even after the hike.

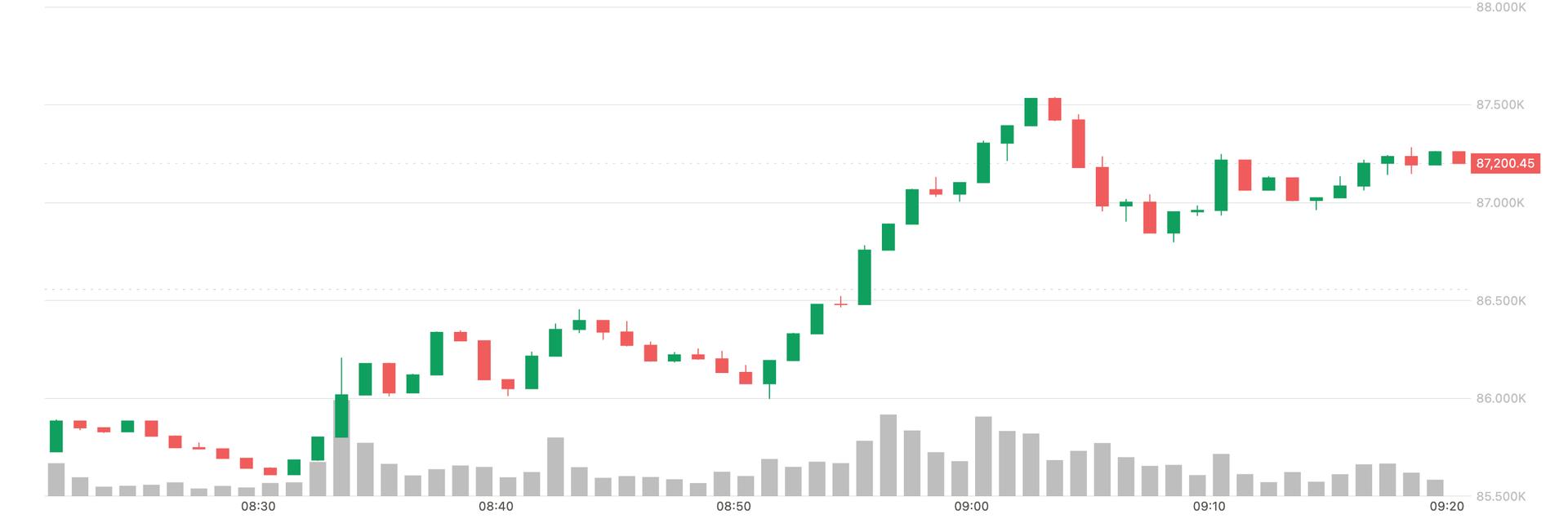

The Japanese yen slipped to 156.03 per U.S. greenback from 155.67 following the speed resolution. Bitcoin, the main cryptocurrency by market worth, rose from $86,000 to $87,500 earlier than pulling again barely to commerce close to $87,000 at press time, CoinDesk knowledge present.

The market response aligns with expectations, as the speed hike had been broadly anticipated. Moreover, speculators had held lengthy positions within the Japanese yen for weeks, stopping any sharp yen-buying response after the announcement.

In current weeks, some observers had expressed considerations that the speed hike might strengthen the yen, triggering an unwinding of yen carry trades and a broad-based risk-off sentiment.

For many years, Japan’s ultra-low and even adverse rates of interest made the yen a most popular funding forex for carry trades. Traders borrowed cheaply in yen to put money into higher-yielding belongings, together with the U.S. tech shares, Treasury notes and rising market bonds, amplifying world liquidity and danger urge for food. This technique thrived so long as Japan’s charges stayed pinned close to zero, successfully turning the yen right into a key enabler of leverage and risk-taking throughout world monetary markets.

So, the prospects of upper charges in Japan scared risk-asset bulls. These fears, nevertheless, had been overblown, as CoinDesk defined, noting that even after the speed hike, Japanese charges would stay notably cheaper than their U.S. counterparts, guaranteeing there isn’t a mass unwinding of carry trades.