An investor who famously nailed the Nice Monetary Disaster of 2008 by shorting mortgage-backed securities is issuing a brand new warning on the US economic system.

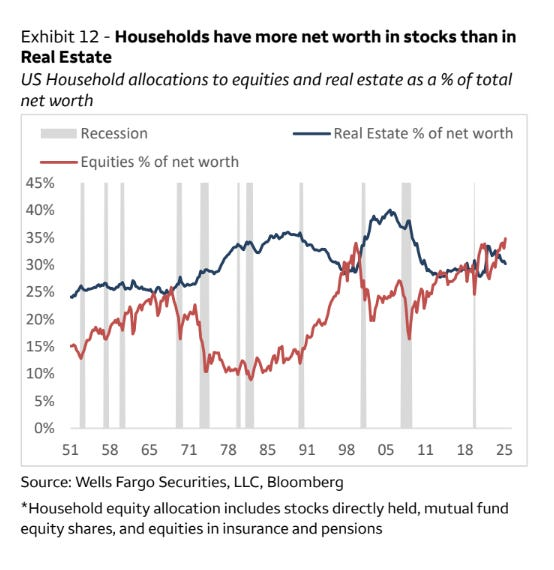

Former Scion Asset Administration head Michael Burry is sharing a chart from Wells Fargo and Bloomberg displaying the proportion of the common US family’s web price allotted to actual property and shares.

The information seems to point out that US households have extra of their web price in shares than actual property, which Burry factors out has typically led to bear markets up to now.

“It is a very attention-grabbing chart, as family inventory wealth being greater than actual property wealth has solely occurred within the late 60s and late 90s, the final two instances the following bear market lasted years.

Beary Burry.”

The investor additional explains,

“On this case I feel the chart explains the scenario right this moment very well. After almost a decade of zero rates of interest, trillions in pandemic helicopter money cash, the best inflation in 50 years, and a brand new paradigm of upper Treasury charges for the primary time in 50 years, shares have emerged victorious even over house costs that rose 50%.

Causes for this are many however actually embody the gamification of inventory buying and selling, the nations playing drawback as a consequence of its personal gamification, and a brand new ‘AI’ paradigm backed by $trillions of ongoing deliberate capital funding backed by our richest firms and the political institution.”

In a current interview on the In opposition to the Guidelines with Michael Lewis podcast, Burry says the inventory market might enter a years-long bearish part because of the development of passive investing.

“Right now it’s all passive cash. And it’s rather a lot. It’s over 50% passive cash. There are index funds… Lower than 10% of cash, some say, is actively managed by managers who’re truly serious about the shares and in any sort of manner that’s long-term.

And so the issue is in america, I feel, when the market goes down, it’s not like in 2000, the place there was this different bunch of shares that had been being ignored, and they’ll come up even when the Nasdaq crashes. Now I feel the entire thing is simply going to come back down. And it could be very onerous to be lengthy shares in america and shield your self.”

Comply with us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Verify Worth Motion

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any losses you could incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please word that The Day by day Hodl participates in online marketing.

Generated Picture: Midjourney