Be a part of Our Telegram channel to remain updated on breaking information protection

The Ethereum worth has surged 4% previously 24 hours to commerce at $2,947 as of 4:00 a.m. EST on a 41% surge in buying and selling quantity to $36 billion.

Ethereum worth enhance comes as weaker US inflation drives constructive market sentiment, even because the Financial institution of Japan (BOJ) raised rates of interest. The US Shopper Worth Index (CPI) rose 2.7% over 12 months to November, down from 3% in September, stunning analysts and signaling a slowdown in worth pressures.

🚨BREAKING: U.S. CPI got here in beneath expectations at 2.7% vs 3.1% anticipated.

This reveals inflation is cooling down.

FED now has extra room for price cuts and financial easing.

That is actually bullish for markets. pic.twitter.com/ZWrzqwNBaA

— Bull Idea (@BullTheoryio) December 18, 2025

Falling prices for accommodations, milk, clothes, and housing, together with vacation reductions, bolstered investor confidence. Which means softer inflation will increase the probability of US Federal Reserve price cuts, which fuels optimism in cryptocurrencies like Ethereum and Bitcoin.

Whereas some dangers stay, from earlier tariffs and tight labor provide in sectors reminiscent of farming, hospitality, and development, the market reacted strongly to the cooling CPI, exhibiting that US financial indicators proceed to have an outsized influence on crypto sentiment.

Don’t struggle the BOJ: -ve actual charges is the express coverage. $JPY to 200, and $BTC to a milly. pic.twitter.com/PdZh87ruVI

— Arthur Hayes (@CryptoHayes) December 19, 2025

Regardless of this, the BOJ raised rates of interest by 25 foundation factors to 0.75%, the very best in 30 years, marking its second hike this yr. Governor Kazuo Ueda indicated that additional will increase could observe in 2026, though actual charges stay unfavorable, preserving Japanese monetary situations accommodative.

The Yen weakened to round 156 per greenback, decreasing the quick dangers of a carry commerce unwind. Bitcoin confirmed volatility in response to the BOJ hike, with previous price will increase traditionally triggering 23–31% declines. US 10-year Treasury yields rose to 4.14%, and the greenback index (DXY) reached 98.52.

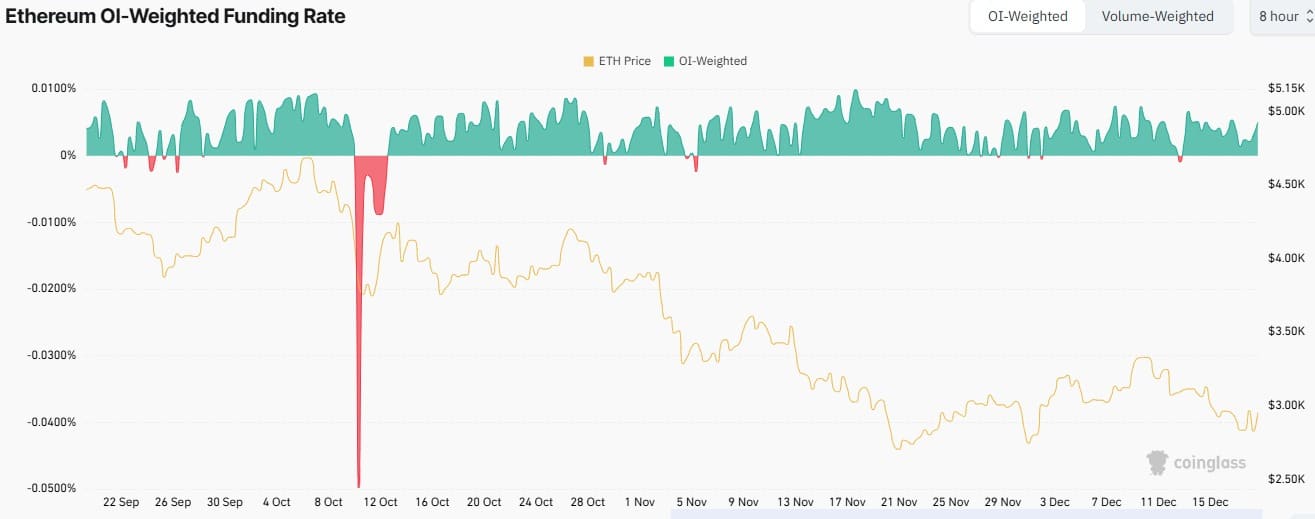

Ethereum Bearish OI-Weighted Funding Spikes, Market Stabilizes

Ethereum’s worth OI-weighted funding price, exhibiting what merchants pay or earn on their positions, was largely constructive. Nevertheless, there are temporary unfavorable spikes round October 10–12, indicating short-term bearish stress.

Regardless of these funding price fluctuations, the ETH worth trended downward general, aligning with unfavorable funding price intervals and exhibiting that short-term bearish stress contributed to the decline.

The funding price has stabilized close to zero, implying a balanced market between longs and shorts. Whereas minor constructive spikes proceed, they haven’t translated into sturdy upward worth momentum, highlighting cautious or impartial sentiment.

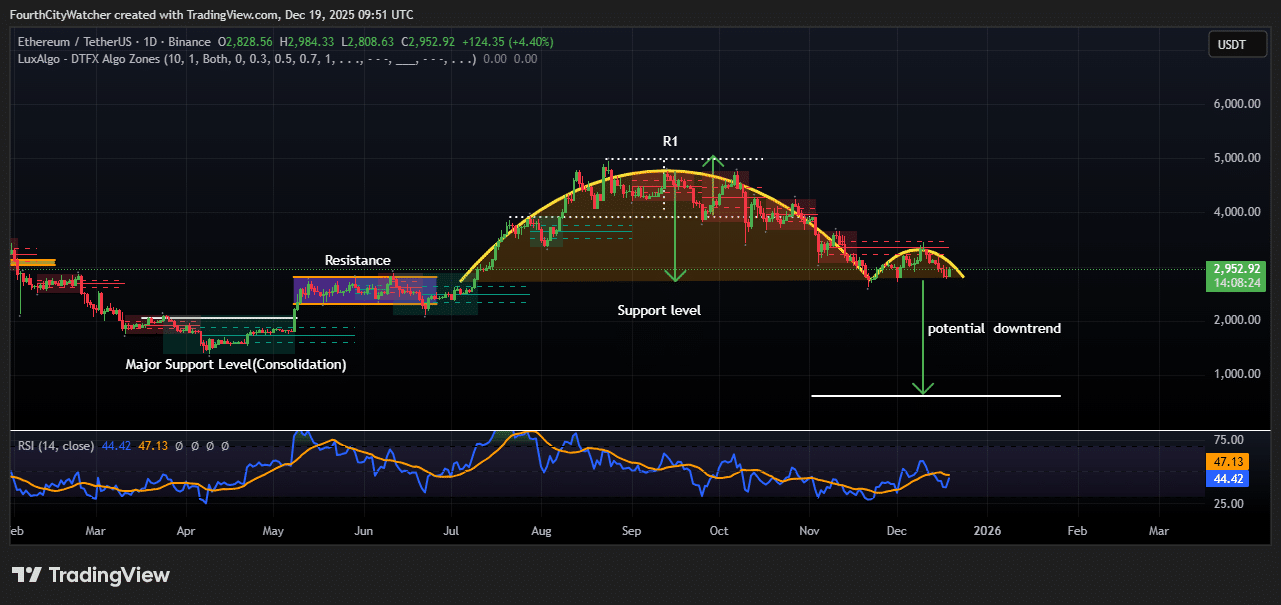

Ethereum Worth Faces Draw back Threat As $2,800 Help Is Examined

The day by day ETH/USDT worth actionshows a transparent transition from consolidation to a doable downtrend between early 2025 and December 19, 2025. From February to April, ETH traded in a good vary and constructed sturdy help across the $2,000 stage.

Throughout this part, worth remained secure as consumers and sellers stayed balanced, making a strong base for the transfer greater that adopted.

In Could, ETH broke out of this consolidation and moved upward, however quickly bumped into resistance. Worth motion slowed and started to maneuver sideways once more, exhibiting hesitation amongst merchants and growing promoting stress as consumers struggled to push the worth greater.

Between June and September, ETH skilled a robust bullish rally that carried the worth towards the $5,000 resistance space. Nevertheless, momentum pale close to this stage, and the chart shaped a rounded prime that peaked in early September.

The earlier help inside the uptrend failed, resulting in a worth decline. Though there have been minor rebound makes an attempt, they had been weak and failed to interrupt earlier highs, preserving the general development unfavorable.

The RSI (14) indicator helps this view, because it moved beneath the 50 stage, exhibiting weakening shopping for momentum and a better threat of additional draw back.

At present, ETH trades round $2,957, slightly below a minor resistance space. If the important thing help close to $2,800 breaks, ETH might proceed falling and retest the earlier main help zone round $1,000–$1,200.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection