On-chain information exhibits the Ethereum change netflow has witnessed a unfavorable spike through the previous week, a possible signal that buyers have been accumulating.

Ethereum Change Netflow Has Been Pink For The Previous Week

As identified by institutional DeFi options supplier Sentora in a brand new put up on X, Ethereum has seen web outflows from exchanges previously week. The indicator of relevance right here is the “Change Netflow,” which measures the web quantity of ETH that’s transferring into or out of wallets related with centralized exchanges.

When the worth of this metric is constructive, it means the buyers are depositing a web variety of tokens to those platforms. As one of many important the reason why holders deposit their cash to exchanges is for selling-related functions, this sort of development will be bearish for the asset’s worth.

Alternatively, the indicator being under zero suggests outflows are dominating the inflows on exchanges. Such a development could be a signal that buyers are in a section of accumulation, which may naturally be bullish for the cryptocurrency.

As the info shared by Sentora exhibits, Ethereum has seen a weekly Change Netflow worth of -$978.45 million, indicating that merchants have made a large quantity of web withdrawals.

The numerous outflows have come as Ethereum has witnessed a decline through the previous week. As Sentora explains:

This indicators aggressive accumulation the place buyers are probably “shopping for the dip” and withdrawing property to chilly storage or on-chain environments, tightening the liquid provide regardless of the unfavorable worth momentum.

The value drawdown previously week has additionally accompanied a drop within the complete transaction charges on the community, that means that switch exercise has gone down. The blockchain noticed about $2.64 million in charges during the last week, which is greater than 15% down week-over-week.

ETH Noticed A Temporary Go to Below $2,800 Earlier than Rebounding

Ethereum noticed a decline to $2,780 on Thursday, however the asset was in a position to bounce again because it’s now floating just below $3,000.

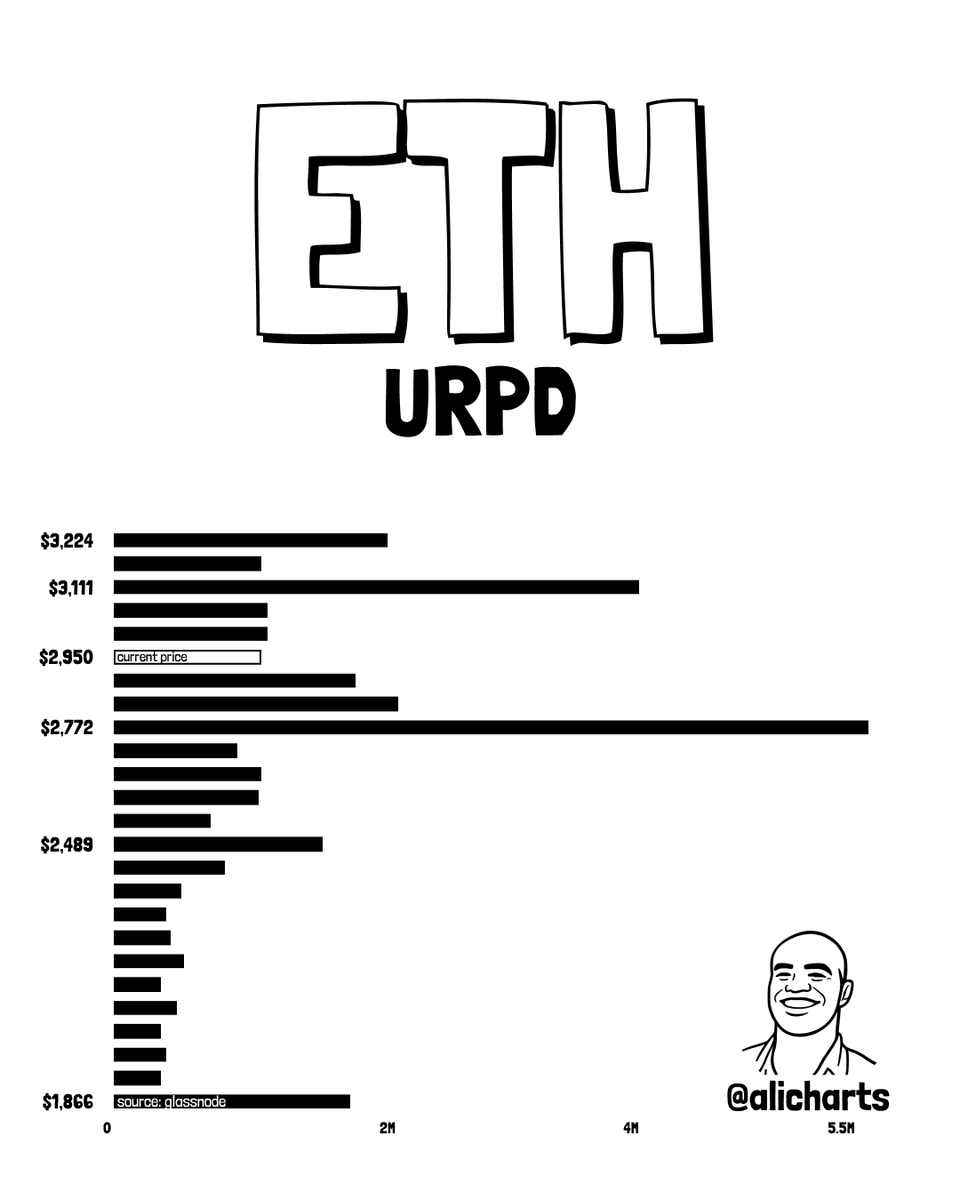

Apparently, ETH’s backside was across the identical stage as a serious on-chain provide cluster, as a chart shared by analyst Ali Martinez in an X put up exhibits.

Within the graph, Martinez has connected the info of the Ethereum UTXO Realized Worth Distribution (URPD) from on-chain analytics agency Glassnode. This metric principally tells us how a lot ETH provide was final transacted on the varied worth ranges that the coin has visited in its historical past.

There’s a large provide zone positioned at $2,772 on the URPD, suggesting a considerable amount of buyers have their price foundation at it. Typically, such ranges act as a help boundary throughout downtrends, as merchants who bought there purchase the dip to defend it.