The worth motion of Bitcoin over the previous week tells an ideal story of its efficiency this yr. The premier cryptocurrency skilled unbelievable ranges of volatility all through the week, oscillating between the $90,000 and $86,000 vary over the previous few days.

The most recent market analysis reveals that the way forward for the Bitcoin value may be trying bleaker than mere intervals of sideways volatility. In keeping with a distinguished cycle, BTC’s value cycle has turned and is getting into a bear market.

Bitcoin Cyclical Habits Relies upon On Demand Cycles: CryptoQuant

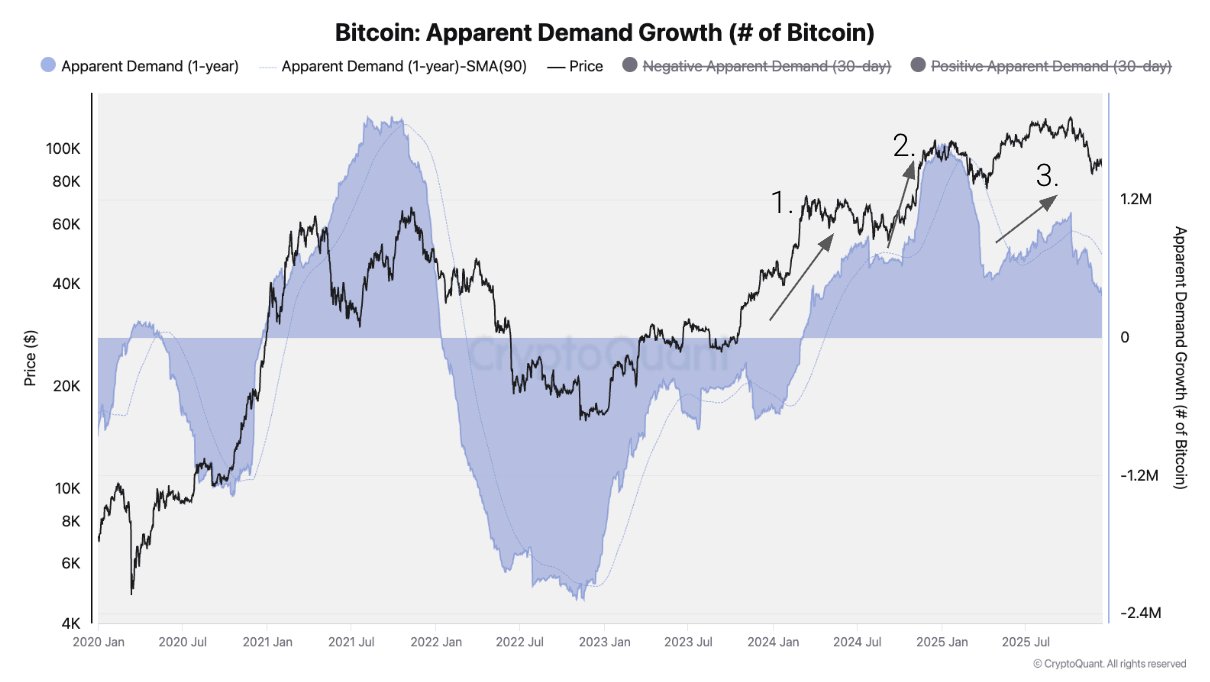

In its newest market report, blockchain analytics agency CryptoQuant has related the regular decline in Bitcoin value with the fading demand growth. In keeping with knowledge on the on-chain platform, the BTC demand development has slowed down in the middle of 2025, signaling the beginning of a bear market.

CryptoQuant highlighted that Bitcoin has witnessed three main spot demand waves—triggered by the US spot ETF launch, the US presidential election consequence, and the Bitcoin Treasury Firms bubble—for the reason that bull cycle began in 2023. Nevertheless, the demand development has slowed down since early October 2025.

Unsurprisingly, this development reversal for the demand development coincides with the October 10 market massacre, one of many largest liquidation occasions in crypto historical past. The Bitcoin value has since struggled to mount any convincing restoration, falling to as little as $82,000 in late November.

Supply: CryptoQuant

CryptoQuant went on to hypothesize {that a} key pillar of value help has been eliminated as most of this cycle’s incremental demand has already been realized. As an illustration, demand from institutional and enormous traders is in a downturn, with US-based Bitcoin exchange-traded funds (ETFs) turning into web sellers in 2025’s fourth quarter.

In keeping with CryptoQuant’s knowledge, the US spot ETF holdings have declined by 24,000 BTC in This fall 2025, which is a far cry from the regular accumulation seen in This fall 2024. “Equally, addresses holding 100–1K BTC—representing ETFs and treasury firms—are rising beneath development, echoing the demand deterioration seen on the finish of 2021 forward of the 2022 bear market,” the blockchain agency added.

In addition to the weakening spot demand, the Bitcoin derivatives market has additionally seen diminished exercise and decreased danger urge for food. CryptoQuant revealed that BTC’s funding charges have fallen to their lowest stage since December 2023, an on-chain sign that means the diminished willingness of merchants to take care of lengthy publicity; this development is commonly related to bear markets.

Finally, the blockchain agency concluded that the Bitcoin four-year cycle hinges extra on demand phases—expansions and contractions in demand development— moderately than on the halving occasion. In essence, a bear market tends to return after the BTC demand development peaks and topples over.

What Subsequent For BTC Worth?

In its report, CryptoQuant revealed that the Bitcoin value construction has worsened according to the demand weak spot. The flagship cryptocurrency is presently buying and selling beneath its 365-day shifting common, a key long-term help stage that has traditionally separated bull and bear phases.

In keeping with CryptoQuant, the draw back reference factors counsel that the Bitcoin bear market may not be as deep as feared. As in earlier bear seasons, the realized value—presently round $56,000—has been recognized because the potential backside.

This means a attainable 55% correction from the most recent all-time excessive, Bitcoin’s smallest drawdown on report (throughout a bear market). In the meantime, the market chief has its intermediate help stage round $70,000.

As of this writing, the worth of BTC stands at round $88,170, reflecting a 3% soar up to now 24 hours.

The worth of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.