Because the market-wide crash in early October, the Bitcoin worth has struggled to renew any important motion to the upside. The flagship cryptocurrency has continued to fall even deeper into bearish territory, breaching a number of assist zones within the course of.

With the crypto market’s scenario portray a bleak image, the prevailing sentiment round its chief can hardly be stated to be bullish. Apparently, a current on-chain analysis places into perspective the important thing gamers behind Bitcoin’s weak point.

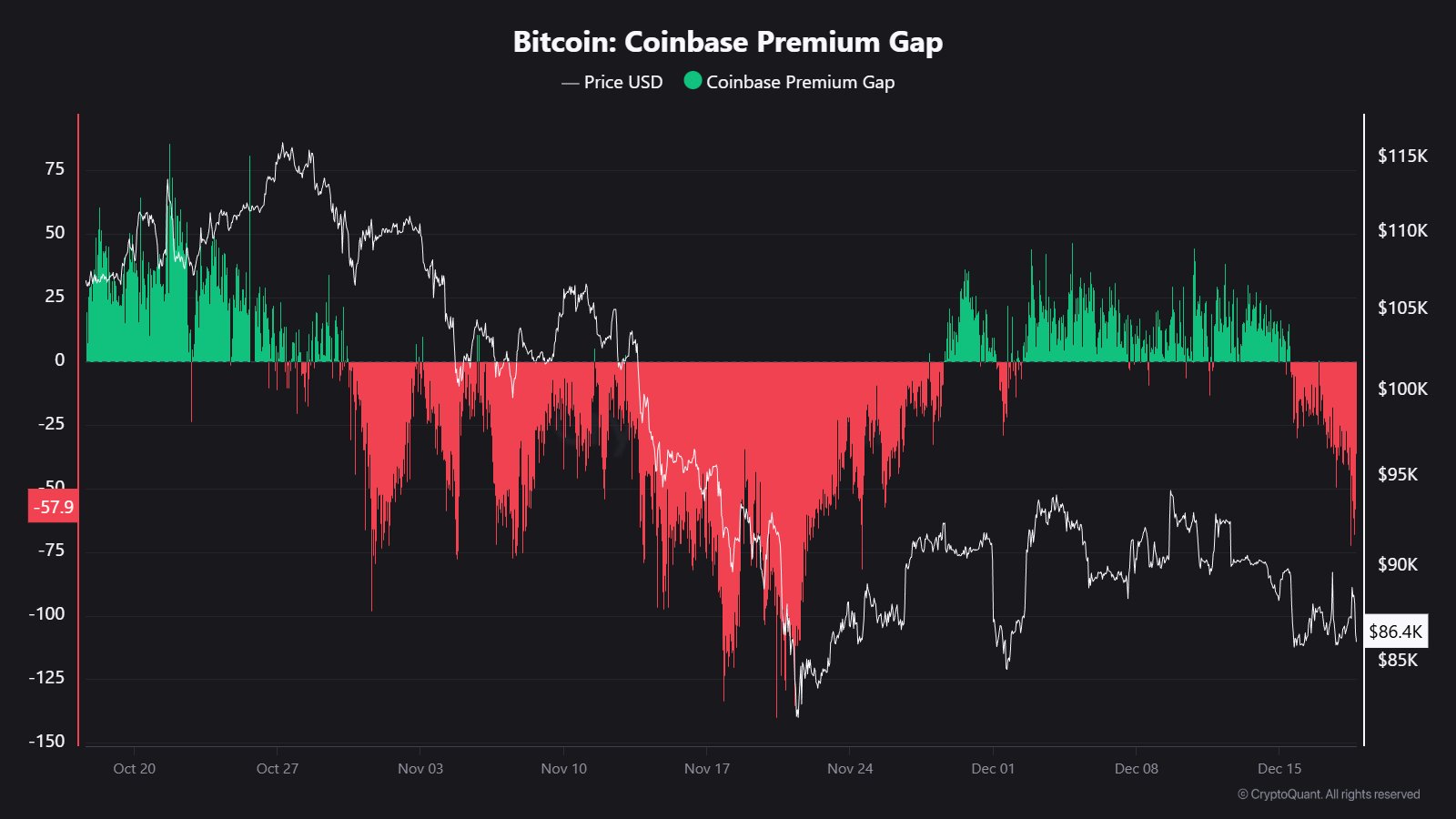

BTC Coinbase Premium Hole Reads –$57

In a current submit on the social media platform X, on-chain analyst Maartunn shared {that a} substantial portion of promote stress seen within the Bitcoin market is perhaps from the actions of US traders. This on-chain commentary is predicated on the Coinbase Premium Hole metric, which measures whether or not US primarily based traders are shopping for or promoting Bitcoin extra aggressively than the remainder of the worldwide market.

Associated Studying

For context, the metric tracks the value hole between Bitcoin on Coinbase and Bitcoin on main offshore exchanges (for instance, Binance). A constructive studying usually signifies that Bitcoin is costlier on Coinbase, which means that US merchants are shopping for aggressively. Alternatively, destructive readings are interpreted as elevated gross sales or decreased curiosity amongst traders in the USA.

In response to the analyst, the Coinbase Premium Hole lately dropped to a -$57 studying. As has been earlier implied, this deep destructive worth reveals that merchants from the US are actively offloading, relatively than accumulating Bitcoin.

Apparently, this heightened promoting exercise accompanies Bitcoin’s worth momentum in direction of decrease ranges. Thus, it turns into clear that the sell-pressure mirrored on Bitcoin’s worth is due primarily to the absence of US demand.

BTC Market Outlook

In response to historic information, Bitcoin’s course within the long-term might go both means. Whereas a destructive Coinbase Premium Hole studying is often indicative of a bearish part within the quick time period, the long-term perspective is rather less easy.

In previous cycles, extended intervals of destructive readings have preceded the formations of market bottoms, after which costs noticed recoveries to the upside. This usually occurs when sell-side stress dwindles, and recent demand enters the Bitcoin market.

Associated Studying

Therefore, if this destructive studying deepens and there’s no recent demand available in the market, the Bitcoin worth might comply with go well with and proceed south. Nonetheless, a reversal of the Coinbase Premium Hole to the upside — pushing it in direction of impartial or constructive ranges — might show pivotal for the world’s main cryptocurrency.

As of this writing, Bitcoin holds a valuation of $88,260, reflecting no important worth motion up to now day.

Featured picture from Dall-E, chart from TradingView