This week-ending snapshot splits into two tracks. First, XRP because the construction commerce with the month-to-month candle defended by the mid Bollinger Band after a deep wick, conserving the larger $3.6 dream goal alive. Second, Midnight (NIGHT) because the narrative commerce with a +40% week powered by a privateness and zero-knowledge pitch.

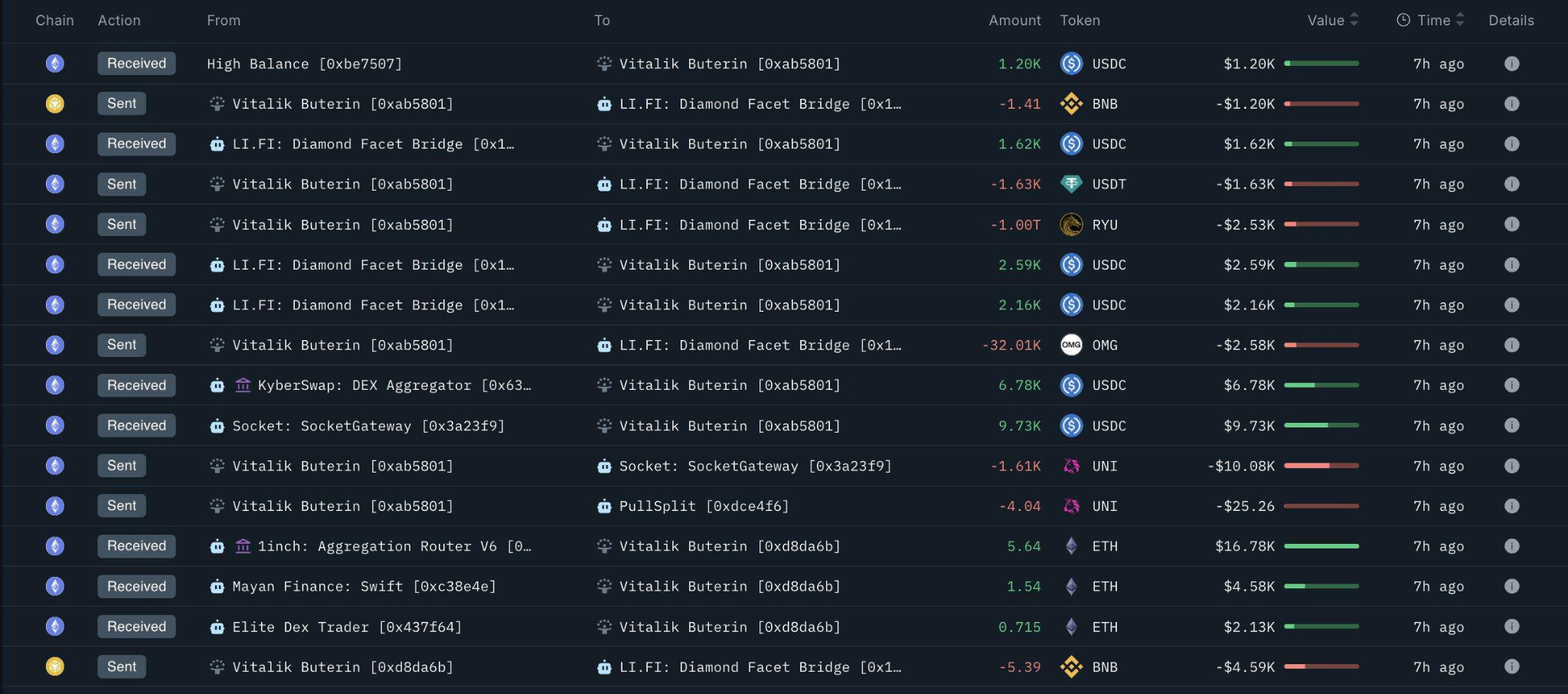

Within the background, Vitalik Buterin-linked wallets preserve trimming non-core tokens like BNB and ZORA, parking in stablecoins and routing a part of the proceeds by means of bridges and privateness rails.

TL;DR

- The $3.6 state of affairs for XRP stays the bottom case as Bollinger Bands preserve the month-to-month construction on-side.

- The “new Cardano” label will get gas from a +40% week pushed by the privateness and zero-knowledge pitch.

- Ethereum creator Vitalik Buterin continues dumping BNB and different tokens, then routes a part of the proceeds by means of Railgun into USDC and ETH.

XRP to $3.6 remains to be foremost state of affairs, Bollinger Bands insist

XRP’s month-to-month chart on TradingView remains to be doing the one factor bulls wanted: holding the mid Bollinger Band after a deep draw back probe. The chart snapshot exhibits the month opened at $2.1549, printed a excessive at $2.2190, then stabbed all the way down to $1.7711 earlier than settling close to $1.9345. That could be a massive drawdown on paper (-10.23%), but the important thing element is the place the market refused to just accept worth.

The mid Bollinger Band on the identical month-to-month window sits close to $1.8227 and the value is buying and selling above that line, which is precisely what bulls wanted to maintain their greater goal in play — the higher band close to $3.6049.

XRP has already proven it will possibly print month-to-month candles that attain into the $3+ zone throughout volatility bursts. With the mid band nonetheless revered, the clear subsequent vacation spot stays a retest of the highest band.

This isn’t about predicting a straight line to $3.60 — it’s concerning the chart conserving the door open for it, and proper now that door remains to be open as a result of the $1.82 space held.

The easy learn for the week ending is that this: $1.82 is the extent the market simply defended, $1.77 is the low that exhibits the place consumers lastly confirmed up, and $3.6 is the ceiling that continues to be on the map so long as the month-to-month mid band retains appearing like a ground.

“New Cardano” Midnight (NIGHT) up 40% in only a week

Midnight, the venture folks preserve tagging because the “new Cardano,” simply printed a 40% week, and the TradingView chart is why it’s getting consideration earlier than the story. NIGHT walked up from the $0.06 space into the low $0.09s, trades close to $0.0911 now and already tagged $0.0962 with out falling aside proper after because it often occurs days after the launch.

The transfer additionally appears organized as an alternative of chaotic. It’s not one candle that spikes and immediately offers every little thing again, it’s a week-long stroll larger that retains printing larger checkpoints after which holding them lengthy sufficient for merchants to deal with them as actual. That’s the reason the $0.06 to $0.09 transition issues, it adjustments the token from “new itemizing” noise right into a chart folks can map ranges on. If the market goes to maintain paying consideration, it would do it by means of these ranges, not by means of slogans.

The following stage is easy for the Midnight token — $0.1. Clear it and the rally will get a recent leg. Reject it and the transfer stays credible provided that $0.08 holds first, then $0.07 behind it. Lose $0.08 and the week pump begins wanting like a quick unwind setup.

Midnight issues within the mild of the privateness renaissance, as a result of the pitch isn’t just “privateness coin” branding. It’s pitched as a zero-knowledge chain with a public-private dual-state ledger meant to run apps on-chain with out leaking consumer and transaction metadata, the stuff that often hyperlinks wallets, exercise and counterparties even when folks assume they’re being cautious.

If that narrative retains touchdown, it offers the rally a second engine past pure rotation, since builders and customers are each on the lookout for methods to get utility with out turning each motion into public surveillance.

Vitalik Buterin sells crypto into crypto winter

The Vitalik Buterin-linked pockets exercise reads like a basic cold-market routine: lower the random cash, convert to stables and ETH, then route a part of the stack by means of privateness rails.

Over the past two days, the creator of Ethereum continued dumping tokens he doesn’t wish to maintain, together with UNI, ZORA, BNB, KNC, OMG and others, then routed proceeds by means of Railgun totaling 564,672 USDC plus 27 ETH valued round $80,364.

Vitalik Buterin’s pockets exercise is sending a easy winter sign: the “additional” luggage are getting cleared, and the exits are being routed like somebody who expects headlines to get uglier earlier than they get higher.

Crypto winter speak is again within the language, liquidity is selective, and rallies are getting handled as tradable spikes as an alternative of latest regimes. In that atmosphere, pockets hygiene turns into headline gas — as a result of it may be learn as preparation, not simply housekeeping.

Crypto market outlook

Into the brand new week, watch whether or not XRP retains month-to-month closes above the $1.82 mid Bollinger Band with a $3.6 retest, whether or not NIGHT can break $0.1 and never lose $0.08 help and whether or not Vitalik Buterin-linked routing stays defensive amid the “crypto winter.”

- XRP: mid Bollinger Band $1.8227 stays the month-to-month line that retains the bullish street map alive; wick low $1.7711 is the draw back reference; higher band $3.6049 is the upside magnet that stays legitimate whereas month-to-month closes preserve respecting the mid band.

- NIGHT: final round $0.0911 with an area excessive close to $0.0962; the plain round-number stage is $0.10; first draw back zones that outline whether or not the week rally holds are $0.08 and $0.07.