[PRESS RELEASE – New York, United States, December 23rd, 2025,]

Stablecoin Insider at present introduced the discharge of its “2025 Stablecoin Yr-Finish Report,” a complete evaluation detailing the structural shift of stablecoins from speculative buying and selling instruments to production-grade monetary infrastructure.

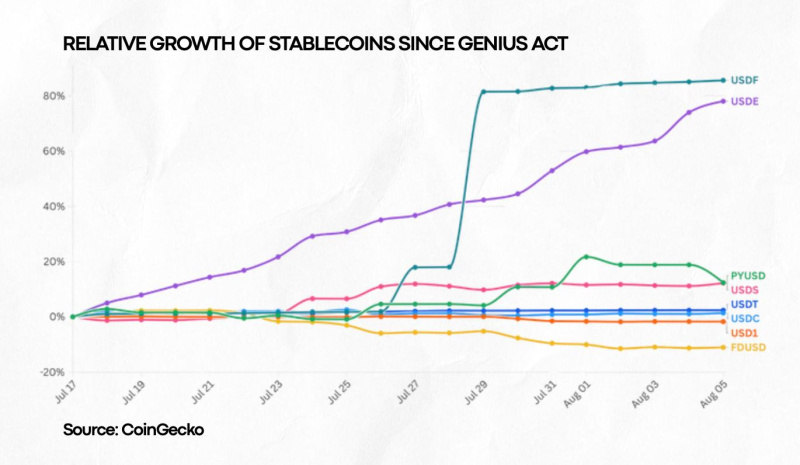

The report highlights 2025 as a decisive inflection level for the stablecoin trade. Over the previous yr, on-chain stablecoin settlement volumes exceeded a number of trillion {dollars}, with every day flows on main networks reaching tons of of billions. This maturation was pushed by landmark regulatory execution, institutional operationalization, and a shift towards purpose-built settlement environments.

“2025 is the yr stablecoins stopped being a crypto facet story and began reshaping how cash strikes globally,” stated Chiara Munaretto, Founding Managing Companion of Stablecoin Insider.

“By year-end, stablecoins are not evolving in parallel to the monetary system, they’re being absorbed into it as a everlasting programmable monetary layer”.

What’s in The Report:

Proprietary Insights from Market Leaders: The report options unique commentary and strategic outlooks from government management at top-tier corporations, together with TRON, Bluechip, MoonPay, and BNB Chain, offering a novel “insider” view of the market.

Regional Adoption Deep-Dives: Achieve granular information on how stablecoins are fixing native fee frictions in high-growth areas like Latin America, Southeast Asia, and the MENA hall, supported by real-world case research from Sorbet and Bloquo.

The Rise of “Bankable” Stablecoins: Evaluation of how infrastructure suppliers like Stride and Kea are bridging the hole between conventional banking programs and on-chain belongings, enabling banks to course of stablecoins with institutional-grade controls.

On-Chain Intelligence & Fraud Prevention: Professional views from Crystal Intelligence and Sumsub on detecting early warning indicators of depegging and combatting the 180% year-over-year improve in refined Al-generated id fraud.

Adoption Companions for Governments and Establishments: Tactical steering from corporations like Mezen and Advix, who function important events serving to establishments, governments, and startups translate advanced regulatory frameworks into scalable, sustainably working programs.

The report concludes that the 2026 outlook might be outlined by additional infrastructure convergence, together with the combination of tokenized financial institution deposits, CBDCs, and controlled fiat-backed stablecoins by shared world rails.

This new report comes simply months after Stablecoin Insider printed their “The place Stablecoins Are Being Spent” report the place it was confirmed that stablecoin utilization is starting to maneuver from mere hypothesis to significant commerce.

Report Companions

To make this report as thorough as potential, Stablecoin Insider partnered with firms from throughout the stablecoin ecosystem, together with issuers, infrastructure suppliers, compliance specialists, and market contributors, together with: Tron, P2P, MoonPay, SumSub, BNB Chain, RWA.io, Utila, BlueChip, Stride, Crystal Intelligence, Rizon, Mezen, Rise, Kea, AUDD, Advix, Bloquo, Digital Economic system Council of Australia, Cybrid, CoinGate, Sorbet, Discover.

About Stablecoin Insider

Stablecoin Insider is the main on-line journal centered completely on stablecoins, masking institutional adoption, stablecoin protocols, insurance policies, and gamers shaping the way forward for digital cash.

The publish Stablecoin Insider Releases 2025 Report on Stablecoins’ Shift to Monetary Infrastructure appeared first on CryptoPotato.