An enormous leverage wipeout hit crypto over the previous 24 hours, with the dashboard displaying $227.93 million in whole liquidations and 79,525 merchants pressured out. However XRP had a special form of standout quantity: a sudden $0 on the short-liquidation line in the midst of all that motion.

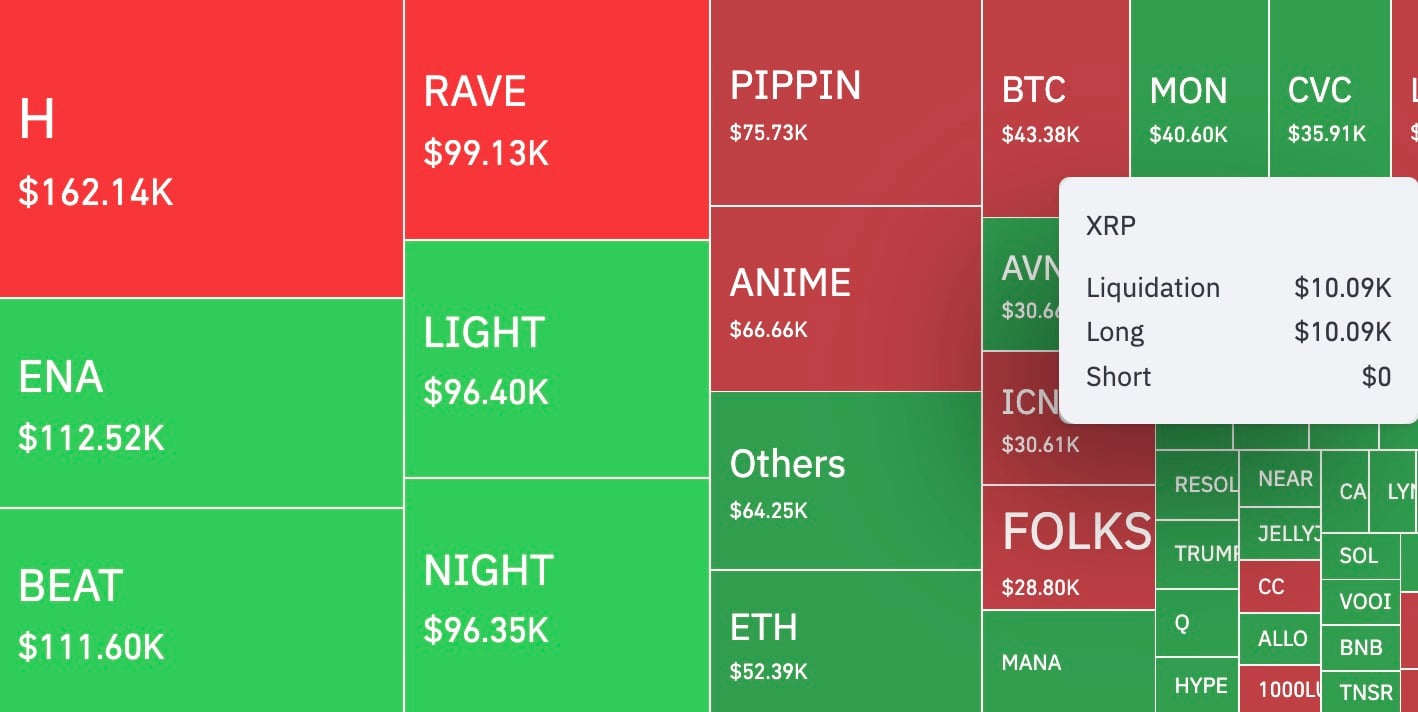

As you may see on the CoinGlass map, XRP’s whole liquidations are at $10,090. The total quantity comes from longs, whereas shorts present a precise zero.

That’s not to say that no person shorted XRP. It’s simply to say that, so far as the snapshot exhibits, the alternate’s liquidation engine didn’t shut any of these shorts forcibly, which is uncommon throughout a session the place it’s clear that leverage is being pushed off the desk throughout a number of tokens.

There are two business-like methods to learn it with out turning it into drama. One, XRP shorts could have been mild or already lowered, so there merely was not sufficient leveraged quick publicity to supply liquidations.

What if?

However there may be one other attention-grabbing angle to contemplate: quick sellers could have been pressured into closing manually earlier than hitting liquidation ranges. This led to losses by regular market buys, charges and slippage.

Nevertheless, there was no “liquidation” print as a result of liquidation is a pressured shut, not a voluntary exit.

For those who zoom out, you may see how lively the washout was elsewhere. There have been $99.83 million in liquidations over 12 hours, $7.72 million over 4 hours and $1.44 million over 1 hour. The most important single liquidation was reported as a $4.43 million BTC/USD hit on Hyperliquid.

If the subsequent push in XRP makes shorts select to exit fairly than combat, the value can journey additional on much less resistance. But when quick liquidations begin printing once more, it indicators that bears are reloading and are prepared to take the warmth.