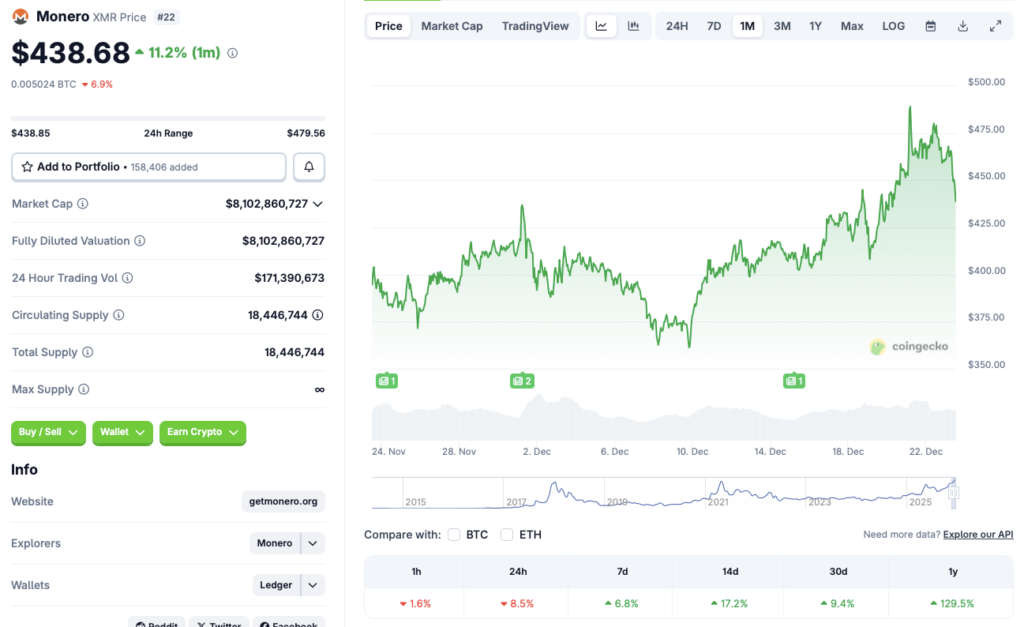

- Monero dropped 8.5% in 24 hours after months of robust outperformance.

- The pullback probably displays profit-taking and fading privacy-coin momentum.

- Broader risk-off sentiment makes a fast rebound much less probably.

Monero spent the previous few months doing what only a few cryptocurrencies managed to do, transferring larger whereas the remainder of the market bled. That divergence has now hit a pause. During the last 24 hours, XMR has suffered a pointy pullback, snapping a streak that had positioned it among the many strongest performers of this cycle. In line with CoinGecko knowledge, Monero is down 8.5% on the day by day chart, a notable shift after weeks of energy.

A Rally That Lastly Wanted to Breathe

Regardless of the sudden dip, Monero’s broader efficiency nonetheless stands out. XMR stays up 6.8% on the weekly timeframe, 17.2% over the past 14 days, 9.4% over the previous month, and an attention-grabbing 129.5% since December 2024. That form of run hardly ever goes uninterrupted. The newest drop seems much less like panic promoting and extra like a traditional cooldown after an prolonged surge.

Privateness-focused cash, together with Monero and Zcash, had adopted a novel trajectory whereas the broader market struggled. Elevated curiosity in privateness tokens probably fueled the rally, however that narrative now appears to be dropping momentum, at the very least briefly.

Revenue-Taking Meets Market Gravity

One probably clarification for at this time’s transfer is profit-taking. After such aggressive positive aspects, some holders are locking in returns, particularly as broader crypto sentiment stays fragile. Bitcoin has did not regain energy since October, and as BTC stalls, altcoins usually wrestle to carry impartial momentum.

XMR tried to withstand that gravity longer than most, however the newest transfer suggests it’s lastly being pulled again into alignment with the broader market development.

A Robust Atmosphere for a Fast Rebound

Wanting forward, a near-term rebound seems unsure. Traders proceed to favor a risk-off strategy, with capital flowing into conventional secure havens like gold and silver, each of which have been setting new highs. In that atmosphere, even property with robust narratives can wrestle to maintain rallies.

The sharp day by day drop might also mark the early phases of a development reversal for Monero, particularly if promoting stress continues over the subsequent few classes. For now, XMR’s spectacular run remains to be intact on larger timeframes, however the market is clearly reassessing how a lot upside stays.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.