- Gemini’s XRP prediction market reveals 73% of customers count on a year-end worth between $1.50 and $2.00

- Bullish expectations above $2.50 have dropped sharply, signaling fading breakout confidence

- XRP continues to commerce close to $1.88, reinforcing the view that worth might stay range-bound into year-end

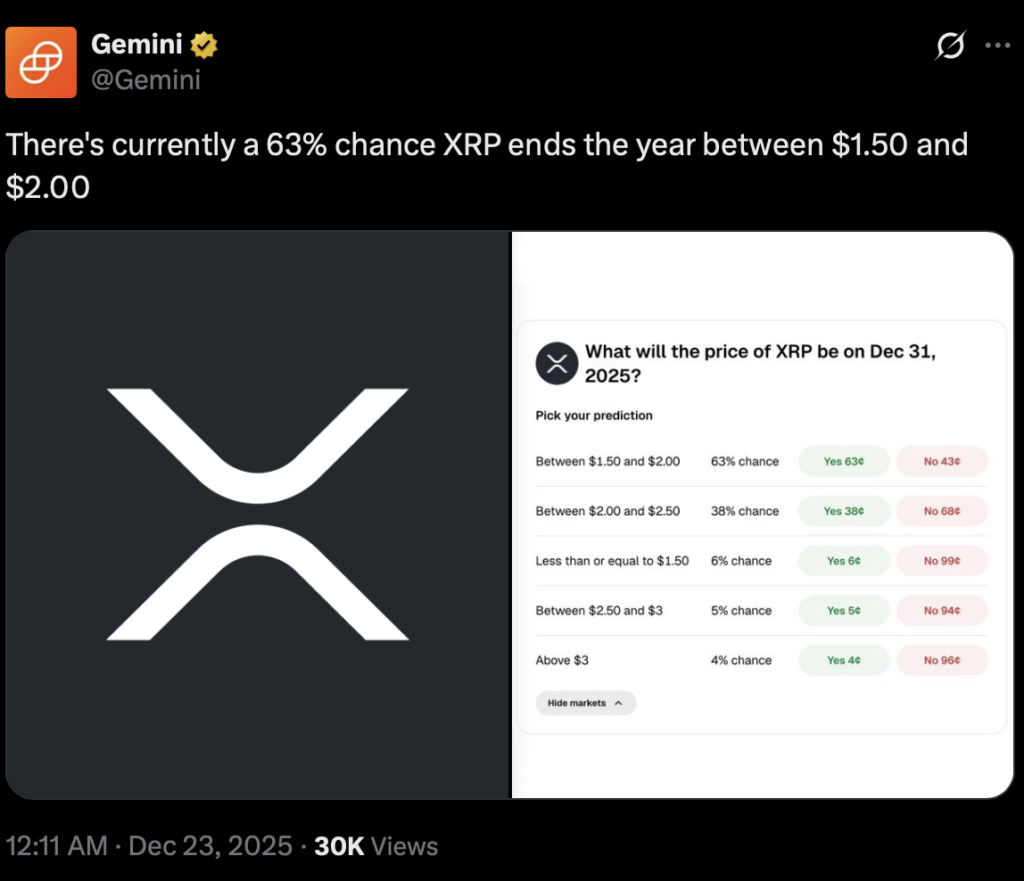

Consumer sentiment round XRP is beginning to look surprisingly calm, no less than in keeping with contemporary information from Gemini. As a substitute of betting on fireworks into year-end, most merchants look like making ready for one thing far much less dramatic, regular worth motion inside a decent vary.

Gemini’s ongoing XRP prediction market reveals a transparent consensus forming round one end result. Nearly all of contributors consider XRP will shut out 2025 buying and selling someplace between $1.50 and $2.00, a comparatively slender band given crypto’s typical volatility. As extra votes have are available in, confidence round that vary has solely strengthened.

Gemini Ballot Reveals Rising Confidence in a Tight Vary

The ballot, which has been energetic since December 12, tracks person forecasts for XRP’s closing worth on the finish of the calendar yr. Early on, about 63% of respondents anticipated XRP to complete above $1.50 however under $2.00. That determine has now climbed to roughly 73%, signaling rising conviction that XRP will stay range-bound via year-end.

This shift suggests merchants are prioritizing preservation over hypothesis. Slightly than chasing upside, most contributors seem comfy with XRP holding its floor close to present ranges.

Bullish Expectations Fade as Breakout Bets Decline

On the similar time, optimism for increased costs has cooled. Earlier within the polling interval, 38% of respondents believed XRP may shut the yr between $2.00 and $2.50. That share has since dropped to round 28%, pointing to diminished confidence in a late-year breakout.

Extra aggressive upside situations are even much less well-liked. Solely a small fraction of customers count on XRP to complete between $2.50 and $3.00, whereas projections above $3.00 stay uncommon, with each outcomes sitting close to a 4% likelihood. The temper has shifted from hopeful to cautious.

Draw back Dangers Stay Restricted however Not Ignored

Whereas stability dominates sentiment, some draw back danger remains to be being priced in. Gemini famous a modest enhance in customers anticipating XRP to finish the yr under $1.50, rising from 6% to 7% after latest market-wide pullbacks.

Even so, that view stays a minority. In comparison with the overwhelming perception in range-bound buying and selling, expectations for a pointy breakdown stay comparatively muted.

How the XRP Prediction Market Will Be Settled

Gemini clarified that the ballot will resolve on December 31, 2025, at 09:00 a.m. (GMT +1), utilizing the GRR-KAIKO_XRPUSD_8UTC benchmark offered by Kaiko. Predictions tied to the $1.50–$2.00 vary will settle positively if XRP’s recorded worth is above $1.50 and doesn’t exceed $2.00 on the decision time.

With roughly every week left within the yr, XRP is buying and selling close to $1.88 and has spent most of mid-December fluctuating between $1.80 and $2.00. That worth habits aligns carefully with the dominant view mirrored within the ballot. Whereas this outlook contrasts sharply with XRP’s earlier rally above $3.60, it displays broader warning throughout the market.

Some contributors proceed to look past year-end, pointing to potential institutional exercise and regulatory developments as longer-term catalysts. For now, although, merchants appear content material betting on stability slightly than breakout.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.