One other day, one other all-time excessive for treasured metals. Gold, silver, and platinum all reached new file ranges at present.

Market consultants view this surge as a warning sign, pointing to declining belief in monetary techniques and protracted inflation dangers. In the meantime, the crypto group is assessing whether or not this momentum in treasured metals may finally translate into capital rotation towards Bitcoin in 2026.

Gold, Silver, and Platinum Mark New All-Time Highs

In keeping with the newest market knowledge, gold surged previous $4,500 for the primary time at present, setting an ATH at $4,526. On the similar time, silver reached a peak of $72.7.

Sponsored

Sponsored

“Silver is up over a buck now, buying and selling above $72.30. It appears like $80 is in play earlier than year-end,” Economist Peter Schiff wrote.

Moreover, platinum’s peak value was recorded at over $2,370. Palladium moved previous the $2,000 mark, a degree final seen in November 2022.

The surge unfold past treasured metals. Copper soared to $12,000 per ton for the primary time, on monitor to file its largest annual achieve since 2009. Nic Puckrin, funding analyst and co-founder of The Coin Bureau, informed BeInCrypto that the stellar efficiency of treasured metals has been pushed by

“A mix of price cuts, geopolitical tensions – that are resurfacing once more this week with Venezuela – and, crucially, the greenback debasement commerce.”

Whereas file costs have sparked optimism about continued upside, some analysts imagine they could be concealing a much more troubling macro actuality. Schiff argued that gold, silver, commodities, bonds, and international trade markets are collectively signaling that the US is heading towards the best inflation in its 250-year historical past.

His warning comes regardless of latest knowledge displaying US GDP progress of 4.3% in Q3, effectively above market expectations. Nonetheless, the economist cautioned in opposition to taking official figures at face worth.

Sponsored

Sponsored

“The CPI is rigged to masks value will increase and conceal inflation from the general public,” he added.

Analyst Andrew Lokenauth warned that the fast enhance in silver costs is “not often a superb signal.” In keeping with him, it suggests declining confidence in political management and fiat currencies.

“This occurred proper earlier than the Fall of Rome, throughout the French Revolution, and when the Spanish Empire collapsed. It doesn’t solely predict chaos, it typically causes it. It triggers an enormous switch of wealth: the poor get left behind with nugatory paper cash and the wealthy shield themselves with gold and silver,” Lokenauth said.

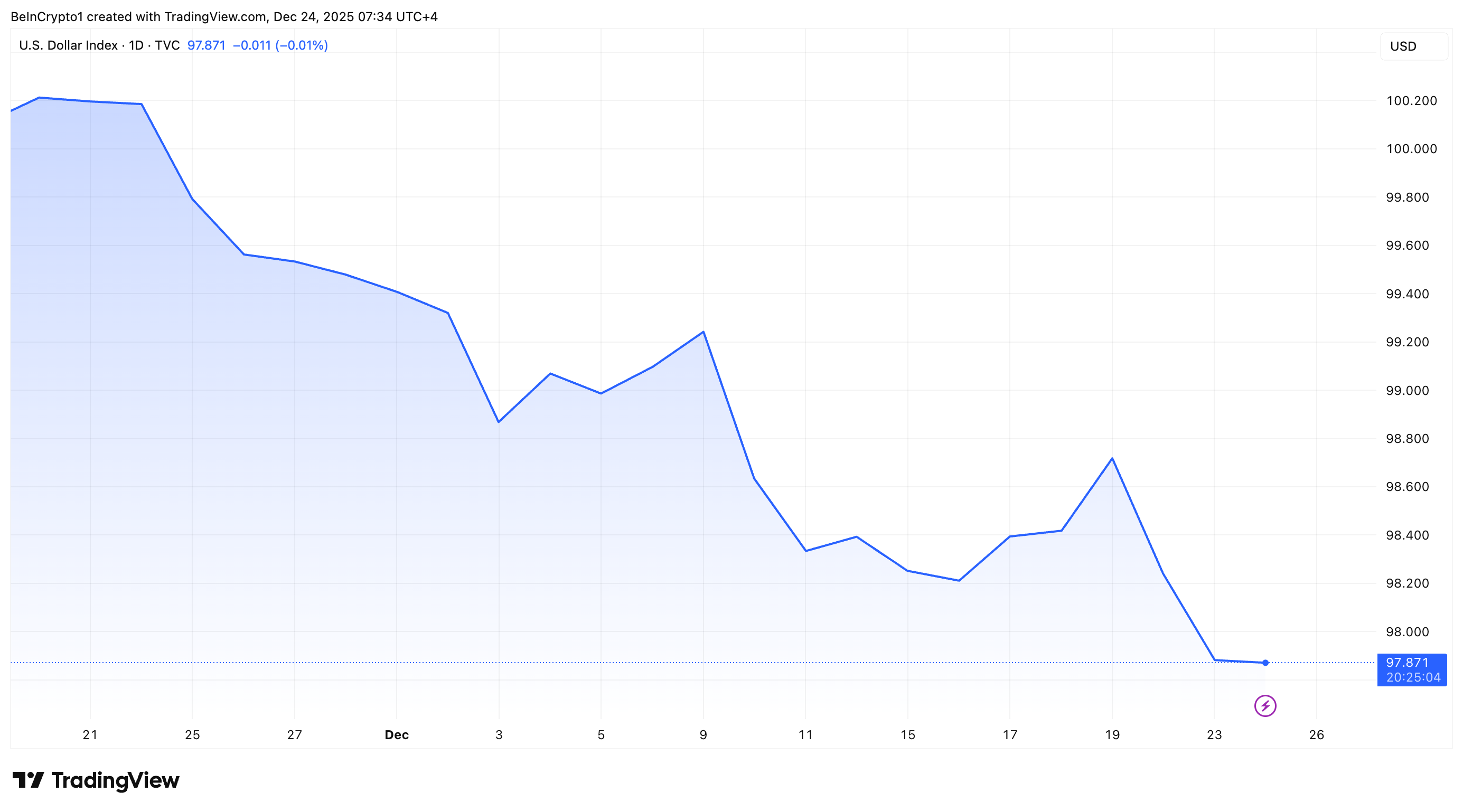

In the meantime, the DXY has weakened considerably all through 2025. Because the yr attracts to an in depth, the index has as soon as once more fallen under 98.

“Greenback index fell to the bottom shut since Oct third,” Neil Sethi posted.

Sponsored

Sponsored

Otavio Costa revealed that the US greenback is approaching a important turning level. He famous that the DXY started the yr at one among its most overvalued ranges on file earlier than declining sharply to a key assist zone that has held for roughly 15 years.

“That assist has now been examined a number of instances, notably in latest months, and for my part we’re approaching a big breakdown — one that would carry profound implications for international markets,” he mentioned.

The analyst talked about that this comes as international central banks transfer towards tighter coverage, whereas the Federal Reserve faces rising stress to ease to handle rising US debt servicing prices. In keeping with Costa, massive commerce and monetary deficits are traditionally resolved via monetary repression, a course of that usually unfolds alongside a weaker greenback somewhat than a powerful one.

From Gold to Crypto? Analysts Look ahead to Capital Rotation Into Bitcoin in 2026

Regardless of the DXY’s weak spot, Bitcoin has continued to battle. The asset has lagged behind each treasured metals and expertise shares in 2025 and is on monitor to put up its worst quarter since 2018.

BeInCrypto additionally highlighted that many new traders are presently favoring conventional shops of worth over crypto publicity. Nonetheless, many within the crypto group stay hopeful that gold’s rally may finally be adopted by an identical transfer in Bitcoin.

Sponsored

Sponsored

Analyst Garrett famous that the upside in silver, palladium, and platinum seems pushed by brief squeezes, warning that such strikes are unlikely to final.

“As soon as they begin to reverse, they’re more likely to drag gold decrease as effectively. The capital will rotate out of treasured metals and into BTC and ETH,” he claimed.

David Schassler, VanEck’s Head of Multi-Asset Options, additionally predicts a comeback for Bitcoin in 2026. He believes the asset is positioned for a rebound as financial debasement intensifies and market liquidity returns.

“Bitcoin is lagging the Nasdaq 100 Index by roughly 50% year-to-date, and that dislocation is setting it as much as be a high performer in 2026. At present’s weak spot displays softer danger urge for food and momentary liquidity pressures, not a damaged thesis. As debasement ramps, liquidity returns, and Bitcoin traditionally responds sharply. We now have been shopping for,” Schassler forecasted.

Lastly, Puckrin identified that Bitcoin reaching new highs in 2026 isn’t an unlikely state of affairs.

“Crucially, there’s nonetheless each chance that Bitcoin will reverse course and hit new ATHs in 2026, whereas gold and silver might start to lose a few of their shine.

Within the months forward, markets will check whether or not treasured metals can uphold file features, or if anticipated profit-taking sparks the capital rotation.