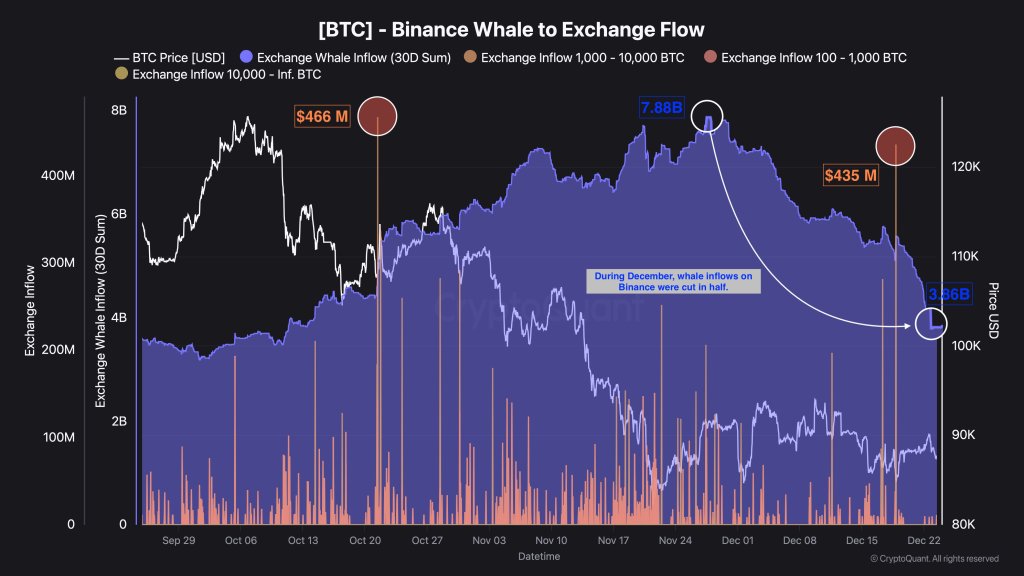

Bitcoin whale deposits to Binance fell sharply in December, a shift CryptoQuant framed as a constructive near-term sign as a result of it implies much less rapid sell-side provide shifting onto the market’s greatest change venue.

Bitcoin Promoting Stress Is Fading For Now

CryptoQuant analyst Darkfost wrote on Dec. 24 that “the newest information exhibits a transparent decline in Bitcoin inflows to Binance coming from whales over the month of December.” He mentioned month-to-month whale inflows dropped from roughly $7.88 billion to $3.86 billion, “successfully being halved inside just some weeks,” calling it “a big slowdown in BTC deposits to Binance by the biggest holders.”

The bullish learn is generally mechanical. Alternate inflows aren’t the identical factor as promoting, however they’re a prerequisite for promoting at scale, and Binance stays the dominant change in exchange-related flows in CryptoQuant’s framing.

Darkfost put it plainly: “Within the present surroundings, the noticed development stays constructive. Binance continues to seize the biggest share of exchange-related flows. When inflows from influential members similar to whales decline on this platform, it typically suggests a discount of their promoting stress.”

Associated Studying

He additionally cautioned {that a} downtrend in mixture deposits doesn’t eradicate the danger of sudden, market-moving transfers. “That mentioned, this broader development doesn’t rule out the incidence of occasional important actions,” Darkfost wrote. “Some inflows can nonetheless influence the market, even when they continue to be comparatively remoted.”

For example, he pointed to a current $466 million spike throughout the 100 BTC to 10,000 BTC cohorts, alongside greater than $435 million in inflows coming particularly from the 1,000 to 10,000 BTC vary.

Associated Studying: The Macro Situations For Bitcoin In 2026: Analyst Breaks Them Down

These bursts matter as a result of they’ll reintroduce volatility even when the baseline is calmer. “These sudden actions are a reminder that whales retain the power to affect volatility at any time, even inside a broader slowdown,” Darkfost mentioned, including that when massive holders “transfer hundreds of BTC in single transactions,” they’ll set off sharp strikes “whether or not by way of sudden volatility spikes or deeper corrections, relying on the volumes deposited and doubtlessly offered.”

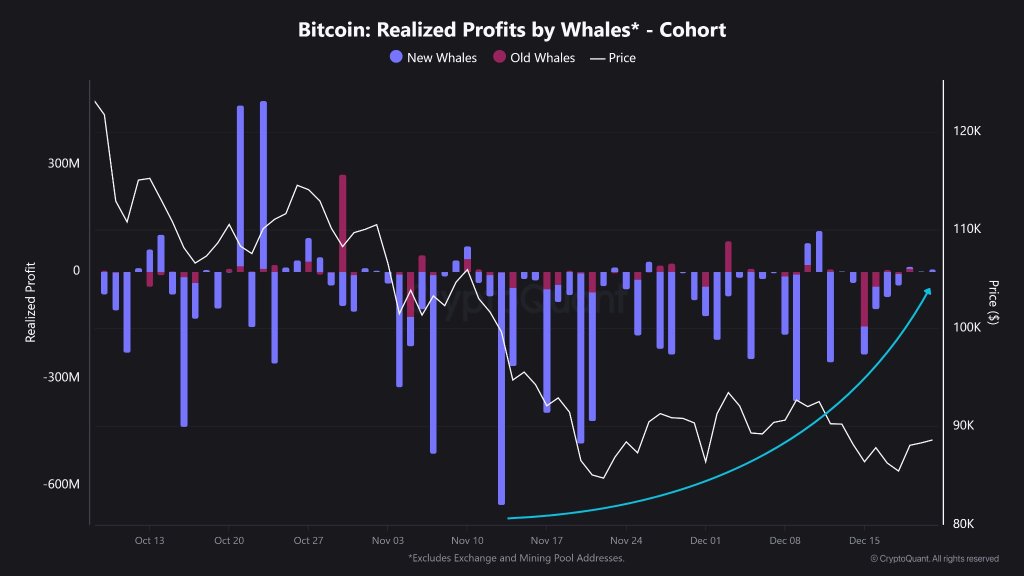

BTC Whale Capitulation On Pause

A separate CryptoQuant replace on Dec. 23 echoed the concept that probably the most acute stress might have eased. “Whale Capitulation on Pause,” the agency wrote, saying realized losses from “new whales” “considerably impacted the value drop from $124K to $84K.” Because the current low, CryptoQuant mentioned, these realized losses “have declined and are actually flat.”

Put collectively, the message is that one key supply of near-term provide stress,massive deposits onto Binance,has cooled, whereas the realized-loss impulse tied to “new whales” is now not intensifying. The caveat is similar one Darkfost emphasised: the market can look quiet in mixture and nonetheless get rattled by a handful of enormous deposits if whales resolve to maneuver measurement once more.

At press time, BTC traded at $87,792.

Featured picture created with DALL.E, chart from TradingView.com