- Bitcoin RSI has fallen under key 12-month and 4-year averages

- Previous cycles present this usually precedes deeper bearish phases

- Capital rotation into gold and silver is pressuring crypto sentiment

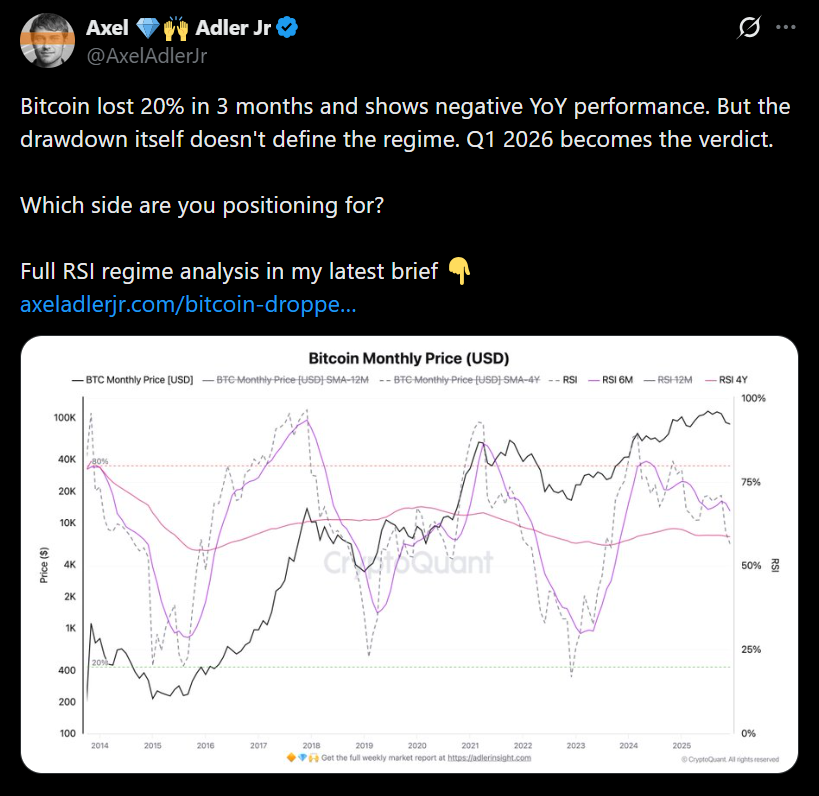

Bitcoin’s current value motion is beginning to increase deeper issues amongst market watchers. The asset is down roughly 20% over the previous three months and about 10% year-over-year, and technical indicators at the moment are flashing early warning indicators that the pullback is probably not simply one other routine correction. Momentum has weakened notably as broader macro forces proceed to weigh on threat belongings.

RSI Breakdown Alerts Rising Draw back Danger

In response to CryptoQuant analyst Axel Adler Jr., Bitcoin’s relative energy index is at the moment sitting at 56.5. This locations it nicely under the 12-month common of 67.3 and slightly below the carefully watched 4-year common of 58.7. Traditionally, this stage has acted as a dividing line between non permanent pullbacks and extra persistent bearish phases.

Adler notes that in prior cycles, together with 2018 and 2022, Bitcoin slipping under its long-term RSI common usually coincided with transitions into deeper downtrends. Whereas this doesn’t assure an prolonged bear market, it does recommend that draw back dangers are rising if momentum fails to recuperate.

Capital Rotation Is Weighing on Bitcoin

Bitcoin’s softer momentum comes as traders proceed rotating into arduous belongings. Gold and silver have dominated 2025, posting a few of their strongest rallies in many years. Silver has climbed to round $72 per ounce, marking a acquire of roughly 148% and pushing its market capitalization past $4 trillion. Gold has surged practically 70% and is on monitor for one in every of its finest years on report.

This shift towards conventional inflation hedges seems to be pulling capital away from crypto, leaving Bitcoin struggling to reclaim management as a macro hedge. So long as metals stay in favor, Bitcoin might discover it tough to regain upside traction.

What This Means Going Ahead

Bitcoin’s long-term construction has not totally damaged down, however the RSI knowledge suggests the market is getting into a extra fragile section. If momentum continues to weaken and RSI stays under its long-term averages, the chance of a protracted bearish stretch will increase. Alternatively, a restoration in threat urge for food or renewed macro catalysts may nonetheless stabilize value motion.

For now, Bitcoin sits at a crossroads the place sentiment, momentum, and macro developments are all working in opposition to it.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.