Silver markets despatched a transparent sign on Christmas Day. Whereas Bitcoin traded quietly in skinny vacation liquidity, silver costs in China surged to document native ranges, pushed by tight bodily provide and robust industrial demand.

The divergence highlights a rising macro theme. In periods of shortage and geopolitical stress, capital is flowing towards exhausting belongings fairly than digital options.

Sponsored

China’s Bodily Silver Tightness Drives the Transfer

The newest silver transfer originated in China, the place native costs reached document ranges on December 25. Evidently, China is going through a scarcity of bodily silver.

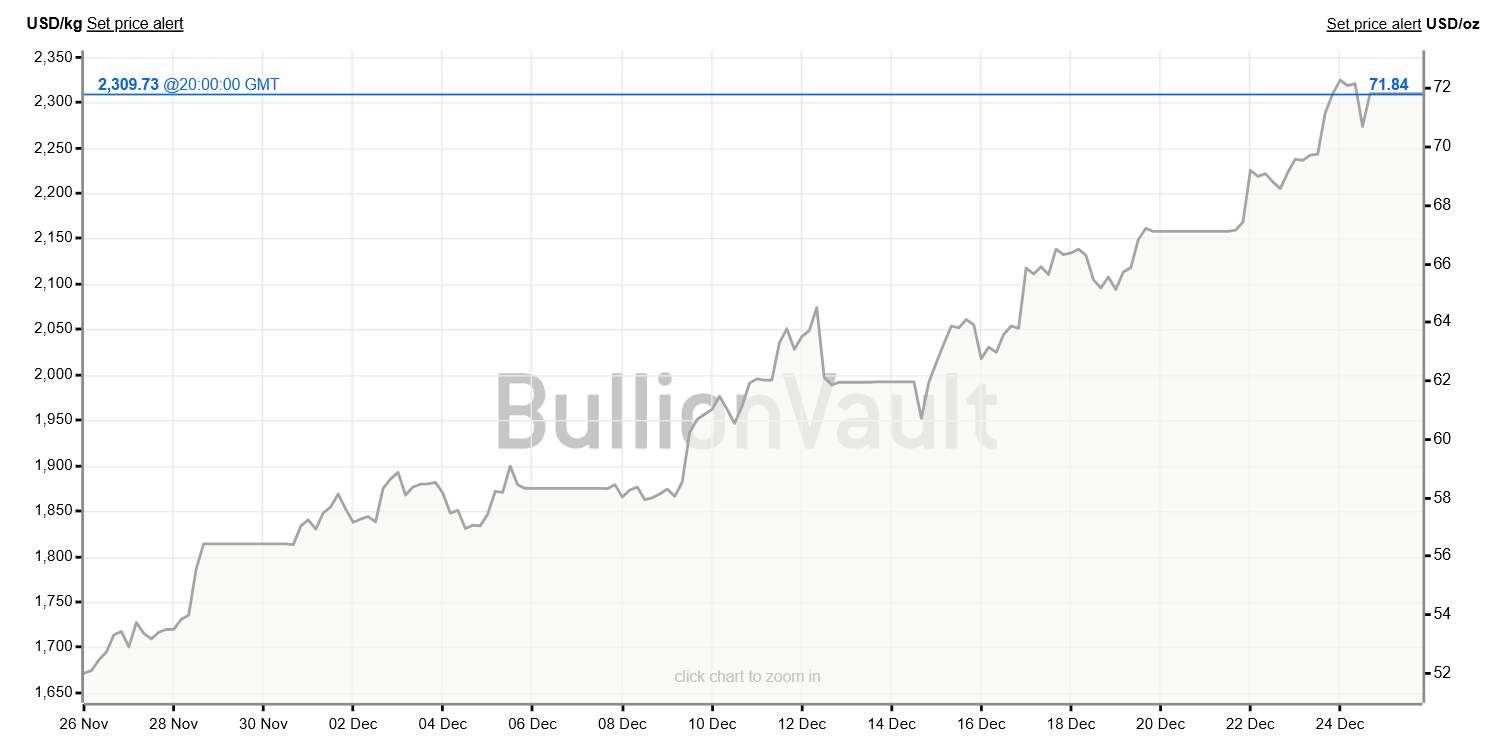

Globally, spot silver hovered close to current all-time highs round $72 per ounce, extending a rally that has pushed costs up greater than 120% in 2025.

Gold additionally posted robust beneficial properties this yr, rising roughly 60%, whereas Bitcoin ended December decrease after peaking above $120,000 in October.

Chinese language spot and futures markets have traded at persistent premiums to London and COMEX benchmarks.

In some instances, contracts briefly moved into backwardation, an indication of instant provide stress. China accounts for greater than half of worldwide industrial silver demand, making native shortages a world challenge.

Sponsored

The strain comes from a number of sources. Photo voltaic manufacturing stays the most important driver, whereas electrical car manufacturing continues to rise.

Every EV makes use of considerably extra silver than a standard automotive, significantly in energy electronics and charging infrastructure.

On the similar time, grid growth and electronics manufacturing have saved demand elevated.

Sponsored

Bitcoin’s Christmas Stagnation Tells a Completely different Story

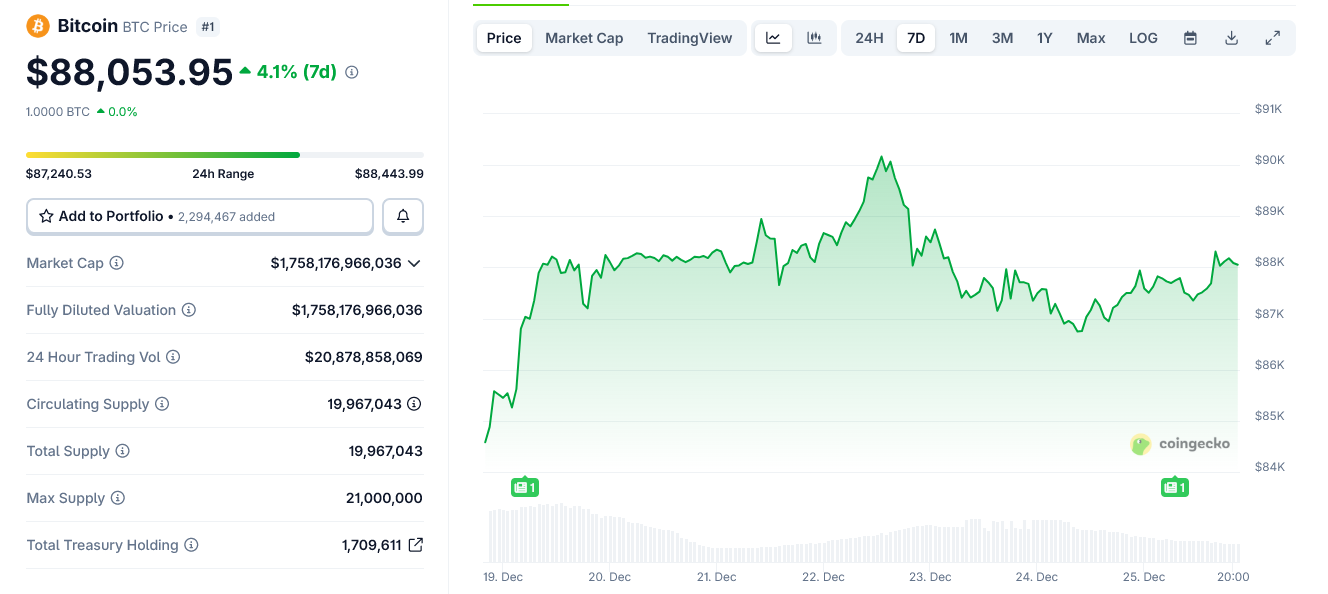

Bitcoin, in contrast, confirmed little response on Christmas Day. Costs moved sideways amid low quantity, reflecting diminished institutional participation fairly than a shift in fundamentals.

Nevertheless, the shortage of defensive inflows stands out.

In late 2025, Bitcoin has traded extra like a high-beta liquidity asset than a disaster hedge. When bodily shortage and supply-chain stress dominate the narrative, traders have favored metals over digital belongings.

Sponsored

Geopolitical dangers reinforce that pattern. Rising protection spending linked to conflicts in Ukraine and the Center East has elevated demand for silver in navy electronics and munitions.

In contrast to funding silver, a lot of this metallic is completely consumed.

The divergence between silver and Bitcoin displays a broader macro level. Digital shortage alone has not been sufficient to draw capital throughout supply-driven shocks.

Bodily shortage, particularly when tied to power, protection, and industrial coverage, continues to matter.

As markets head into 2026, that distinction might form asset efficiency greater than narratives round threat urge for food alone.