- WLFI is the highest every day gainer among the many high 100 cryptocurrencies by market cap

- The rally is probably going tied to USD1 stablecoin reaching a $3 billion market cap

- Sustainability stays unsure amid a weak crypto market and rising threat aversion

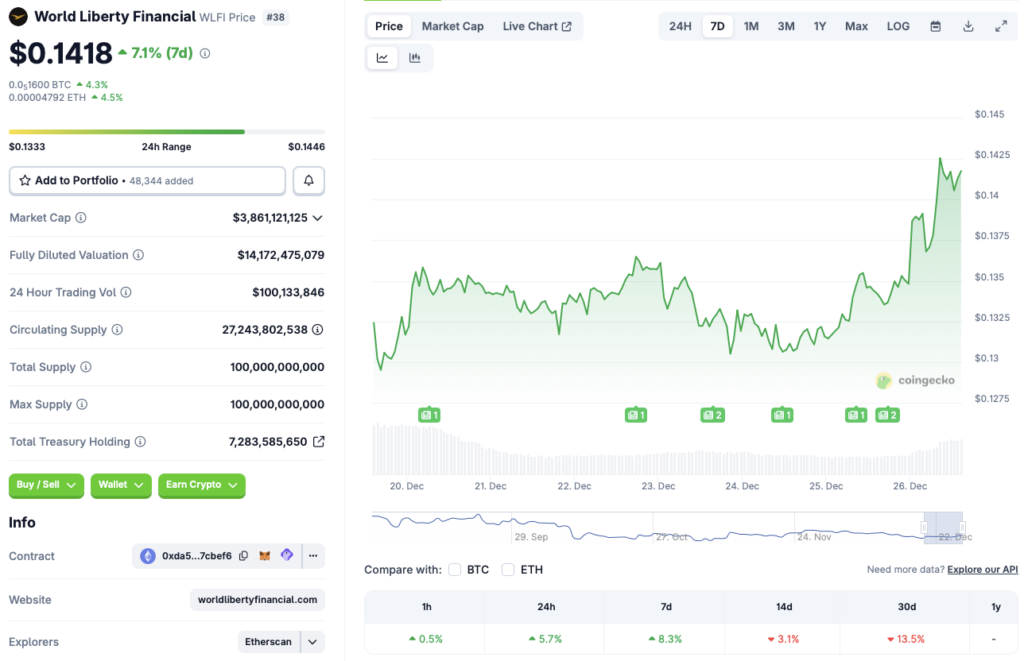

World Liberty Monetary (WLFI) has emerged because the best-performing cryptocurrency among the many high 100 tasks by market capitalization during the last 24 hours. In keeping with CoinGecko information, WLFI is up 5.7% on the day and eight.3% over the previous week, standing out whereas the broader crypto market stays beneath heavy stress. Regardless of the short-term bounce, the token continues to be down 3.1% during the last 14 days and 13.5% over the previous month, elevating questions on whether or not this rally has actual endurance.

USD1 Stablecoin Development Sparks Contemporary Curiosity

The first catalyst behind WLFI’s sudden power seems to be the speedy growth of its USD1 stablecoin. USD1 just lately crossed the $3 billion market capitalization milestone, a notable achievement at a time when stablecoins proceed to achieve significance throughout each CeFi and DeFi ecosystems. Stablecoins have develop into one of the crucial resilient segments of the crypto market, even throughout broader downturns, and USD1’s development has doubtless boosted confidence within the World Liberty Monetary ecosystem.

Sentiment could have been additional lifted by Binance’s USD1 Increase Program, which goals to extend engagement by providing extra rewards to USD1 holders. Packages like this typically entice short-term capital and renewed consideration, particularly during times when merchants are looking for property exhibiting relative power.

Can WLFI’s Rally Maintain in a Weak Market?

Whereas WLFI’s worth motion is spectacular, sustainability stays unsure. The broader crypto market continues to be in a fragile consolidation section, with Bitcoin struggling to carry above the $89,000 stage. Traditionally, remoted rallies throughout weak market situations typically fade as soon as profit-taking units in, significantly if BTC resumes its downward pattern.

Given the risk-off surroundings, some buyers could select to lock in short-term good points from WLFI and rotate capital into safer property. This cautious habits is bolstered by the continued surge in gold and silver costs, which means that many market contributors are prioritizing stability over speculative publicity.

Danger Aversion Stays a Key Headwind

The continuing power in treasured metals indicators that capital continues to be flowing towards conventional secure havens. If this pattern continues, WLFI may face renewed promoting stress regardless of its robust every day efficiency. With out broader market help or continued optimistic developments round USD1 adoption, the present rally could battle to increase a lot additional.

For now, WLFI stands out as a uncommon vibrant spot in a troublesome market, however its subsequent transfer will doubtless rely upon whether or not stablecoin-driven optimism can outweigh broader macro and crypto-specific headwinds.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.