- Ethereum whales have gathered almost 4.8 million ETH since late November, defending the $2,796 long-term holder price foundation

- ETH dominance is rebounding towards 13%, hinting at underlying energy regardless of weak altcoin rotation

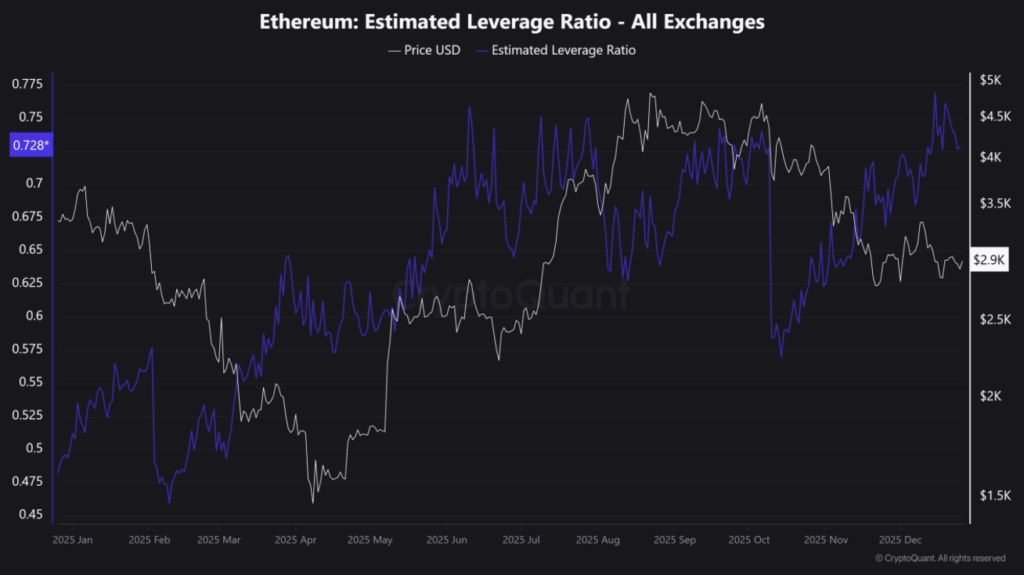

- Rising leverage and the shortage of a macro catalyst depart ETH weak to volatility if whale conviction fades

Regardless of the broader market leaning risk-on once more, capital nonetheless isn’t rotating the best way many merchants anticipated. Bitcoin stays the principle gravity effectively, absorbing consideration and liquidity, whereas different belongings battle to draw constant follow-through.

Traditionally, this sort of setup retains portfolios BTC-heavy for longer than folks wish to admit. On the floor, this cycle feels acquainted. However one metric is quietly suggesting that one thing barely completely different could also be forming beneath.

Ethereum Dominance Hints at Quiet Power

On the each day charts, Ethereum’s dominance has been holding its floor higher than anticipated. After dipping to roughly 11.5% in late November, ETH dominance printed a collection of decrease highs earlier than rebounding towards the 13% space. That transfer strains up intently with ETH worth chopping sideways between $3,000 and $3,500.

This sort of consolidation doesn’t look random.

As an alternative, it seems supported. On-chain knowledge reveals Ethereum whales repeatedly defending their $2,796 price foundation, which represents the realized worth for long-term holders. Value has bounced off that degree three separate instances now, suggesting deliberate positioning fairly than passive holding.

Whenever you overlay this with the construction in ETH dominance, the image turns into clearer. Ethereum’s range-bound motion round $3,000 has been actively supported by giant holders. The open query is whether or not ETH’s return profile finally justifies that conviction, or whether or not it begins to check it.

Whales Defend ETH With no Macro Security Web

What makes this case extra attention-grabbing is the absence of a transparent macro tailwind. There’s no contemporary liquidity wave, no coverage pivot, no apparent catalyst to lean on. That leaves conviction doing many of the work.

Ethereum whales have leaned into that position. Since November 21, they’ve gathered roughly 4.8 million ETH, about 4% of the circulating provide. Their mixed holdings rose from 22.4 million ETH to 27.2 million over that interval, a pointy and intentional shift.

It’s no coincidence that Ethereum dominance stabilized throughout the identical window. The $2,796 realized worth has successfully develop into a line within the sand, one which whales seem unwilling to surrender simply.

At present costs, these positions sit on an estimated $4.8 billion in unrealized revenue. That cushion issues, nevertheless it doesn’t remove threat.

Leverage Builds as Threat Lingers

The true strain level now could be leverage. Ethereum’s estimated leverage ratio just lately climbed to a six-month excessive close to 2.96. In easy phrases, for each greenback of ETH held with out leverage, there’s nearly three {dollars} price of borrowed publicity layered on prime.

That type of construction can work superbly in a clear uptrend. In a uneven, catalyst-light market, it turns into fragile.

With leverage rising, volatility nonetheless elevated, and rotational flows into altcoins remaining weak, the chance of a sudden unwind hasn’t disappeared. If whales start to de-risk or take income close to resistance, ETH might rapidly slip into one other liquidation-driven transfer decrease.

For now, Ethereum stays supported. However assist constructed on conviction alone has a behavior of being examined, particularly when the broader market hesitates to observe by means of.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.