Prime Tales of the Week

US Readability Act unlikely to be ‘world-shaking’ for Bitcoin’s value: Brandt

Veteran dealer Peter Brandt mentioned the potential passage of the US Readability Act is unlikely to have a major affect on Bitcoin’s value after indications that it might go Congress as quickly as January.

“Is it a world-shaking macro growth? Nope. Wanted for positive, however not one thing that ought to redefine worth,” Brandt informed Cointelegraph on Friday. “Having an asset regulated, notably an asset for which die-hard traders by no means needed to be regulated, will not be an earth-shattering occasion,” he added.

His feedback got here after White Home crypto and AI czar David Sacks mentioned on Thursday, ”We’re nearer than ever to passing the landmark crypto market construction laws.”

US Senate confirms pro-crypto Selig to guide CFTC, Hill to go FDIC

The US Senate has confirmed crypto-friendly lawyer Mike Selig as the brand new chair of the Commodity Futures Buying and selling Fee (CFTC) and has elevated Travis Hill to chair the Federal Deposit Insurance coverage Corp.

The 2 confirmations have been included in a package deal of practically 100 different nominees that the Trump administration had chosen for numerous roles throughout the federal government, which handed the Senate in a 53-43 vote on Thursday.

Selig, who has earlier expertise on the CFTC and the Securities and Alternate Fee, pledged to make crypto a precedence when he was nominated in October to take over from the earlier nominee, Brian Quintenz.

How a single copy-paste mistake price a consumer $50M in USDt

A single transaction error led to one of many largest onchain losses seen this yr, after a consumer mistakenly despatched practically $50 million in USDt to a rip-off handle in a traditional handle poisoning assault.

Based on pseudonymous onchain investigator Web3 Antivirus, the sufferer misplaced 49,999,950 USDt after copying a malicious pockets handle from their transaction historical past.

Handle-poisoning scams depend on look-alike pockets addresses being inserted right into a sufferer’s transaction historical past by way of small transfers. When victims later copy an handle from their transaction historical past, they might unknowingly choose the scammer’s look-alike handle as an alternative of the meant recipient.

UK crypto regulation is coming: What the FCA’s new session means

The UK is taking a decisive step towards totally regulating its crypto market. This week, the Monetary Conduct Authority launched a wide-ranging session outlining proposed guidelines for crypto exchanges, staking companies, lending platforms and decentralized finance.

The proposals comply with new secondary laws from the UK Treasury that formally brings crypto actions into the nation’s monetary companies framework, with a goal implementation date of Oct. 25, 2027.

On this week’s episode of Byte-Sized Perception, Cointelegraph explored what this session indicators for the UK crypto market and the way business leaders are deciphering the regulator’s course.

Constancy macro lead calls $65K Bitcoin backside in 2026, finish of bull cycle

Bitcoin could have ended its historic four-year cycle, signaling an incoming yr of draw back regardless of widespread analyst expectations for an prolonged cycle pushed by regulatory tailwinds.

Bitcoin’s $125,000 all-time excessive on Oct. 6 could have signaled the highest of the present four-year Bitcoin halving cycle, each when it comes to “value and time,” based on Jurrien Timmer, the director of worldwide macroeconomic analysis at asset administration agency Constancy.

“Whereas I stay a secular bull on Bitcoin, my concern is that Bitcoin could effectively have ended one other 4-year cycle halving part,” wrote Timmer in a Thursday X submit.

“Bitcoin winters have lasted a few yr, so my sense is that 2026 may very well be a “yr off” (or “off yr”) for Bitcoin. Assist is at $65-75k.”

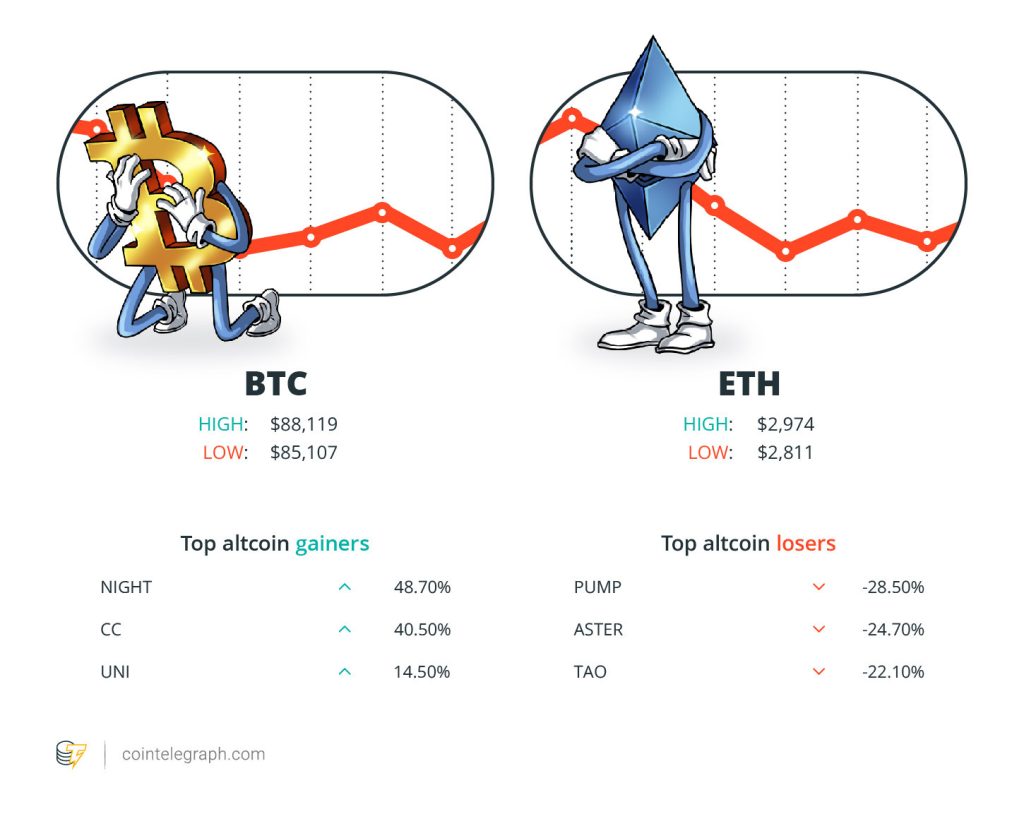

Winners and Losers

On the finish of the week, Bitcoin (BTC) is at $88,119, Ether (ETH) at $2,974 and XRP at $1.92. The entire market cap is at $2.99 trillion, accordingto CoinMarketCap.

Among the many greatest 100 cryptocurrencies, the highest three altcoin gainers of the week are Midnight (NIGHT) at 48.70%, Canton (CC) at 40.50% and Uniswap (UNI) at 14.50%.

The highest three altcoin losers of the week are Pump.enjoyable (PUMP) at 28.50%, Aster (ASTER) at 24.70% and Bittensor (TAO) at 22.10%. For more information on crypto costs, be certain that to learn Cointelegraph’s market evaluation.

Prime Prediction of the Week

Crypto ETPs might see a flood of liquidations by 2027: Analyst

Greater than 100 crypto exchange-traded merchandise are prone to hit the market in 2026, however lots of them will shortly be shuttered because of an absence of demand, Bloomberg analyst James Seyffart mentioned.

Learn additionally

Artwork Week

Defying Obsolescence: How Blockchain Tech Might Redefine Creative Expression

Options

Why Digital Actuality Wants Blockchain: Economics, Permanence and Shortage

Seyffart said on Wednesday that he agreed with a 2026 prediction from crypto asset supervisor Bitwise that over 100 crypto ETFs would launch, however he mentioned that many wouldn’t final.

“We’re going to see a whole lot of liquidations in crypto ETP merchandise. Would possibly occur at [the] tail finish of 2026 however doubtless by the tip of 2027,” Seyffart mentioned, including that over 126 ETP functions are at the moment awaiting an end result from the US Securities and Alternate Fee.

Prime FUD of The Week

Adam Again slams Bitcoiner VC for ‘uninformed noise’ about quantum threat

Blockstream CEO Adam Again has criticized Fort Island Ventures founding accomplice Nic Carter for amplifying considerations about quantum computing threats to Bitcoin.

“You make uninformed noise and attempt to transfer the market or one thing. You’re not serving to,” Again mentioned in an X submit on Friday, after Carter defined in an X submit why Fort Island Ventures invested in Undertaking Eleven, a startup centered on defending Bitcoin and different crypto property from the specter of quantum computing.

Again mentioned the Bitcoin group will not be in denial about the necessity to analysis and develop protections in opposition to potential quantum computing threats, however is as an alternative doing that work “quietly.” Nonetheless, Carter refuted Again’s remark, arguing that many Bitcoin builders are nonetheless in “complete denial” concerning the threat of quantum computing to Bitcoin.

SEC confirms years-long director bans for former Alameda, FTX executives

Former Alameda Analysis CEO Caroline Ellison and former FTX executives Gary Wang and Nishad Singh might be barred from assuming firm management roles for eight to 10 years following a court docket judgment.

Learn additionally

Options

Polkadot’s Indy 500 driver Conor Daly: ‘My dad holds DOT, how mad is that?’

Options

State of Play: India’s Cryptocurrency Business Prepares For A Billion Customers

In a Friday discover, the US Securities and Alternate Fee mentioned that it had obtained closing consent judgments in opposition to Ellison, Wang and Singh for his or her roles within the misuse of investor funds at FTX from 2019 to 2022.

The previous Alameda CEO consented to a 10-year officer-and-director bar, whereas Wang and Singh consented to eight-year officer-and-director bars every. All three are additionally topic to five-year ”conduct-based injunctions,” based on the SEC.

Professional-crypto US Senator Lummis gained’t search reelection in 2026

Wyoming Senator Cynthia Lummis, probably the most outspoken advocates for digital property within the present session of the US Congress, will go away workplace in 2027.

In a Friday X submit, Lummis introduced that she wouldn’t search reelection to the Senate in 2026. She was elected to a six-year time period and assumed workplace in January 2021, shortly establishing herself as a blockchain and Bitcoin-focused politician who later aligned with US President Donald Trump’s crypto agenda.

“Deciding to not run for reelection does symbolize a change of coronary heart for me, however within the tough, exhausting session weeks this fall I’ve come to just accept that I wouldn’t have six extra years in me,” mentioned Lummis. “I’m a religious legislator, however I really feel like a sprinter in a marathon. The power required doesn’t match up.”

Prime Journal Tales of The Week

Bitcoin’s crucial degree is $82.5K, Ethereum ‘not carried out but’: Commerce Secrets and techniques

A Bitcoin analyst says institutional shopping for might be crucial over the “subsequent week or so,” Ethereum could surge quickly: Commerce Secrets and techniques.

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Editorial Workers

Cointelegraph Journal writers and reporters contributed to this text.