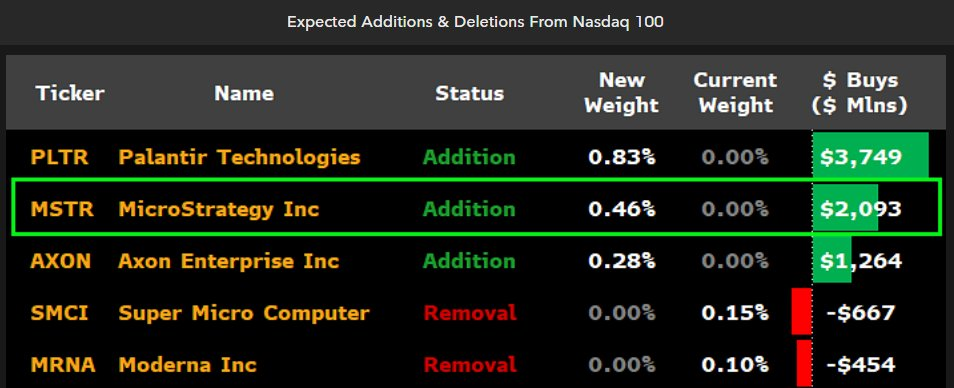

Based on Eric Balchunas and James Seyffart, two revered ETF analysts, MicroStrategy might quickly enter the Nasdaq 100. MicroStrategy continues to be labeled as a tech inventory, circumventing the restriction that finance firms are ineligible.

If this prediction comes true, it would happen this Friday for a list on December 23.

MicroStrategy on Nasdaq 100?

Balchunas first declared this prediction through social media put up yesterday, claiming that MicroStrategy would change Moderna, a COVID-19 vaccine producer.

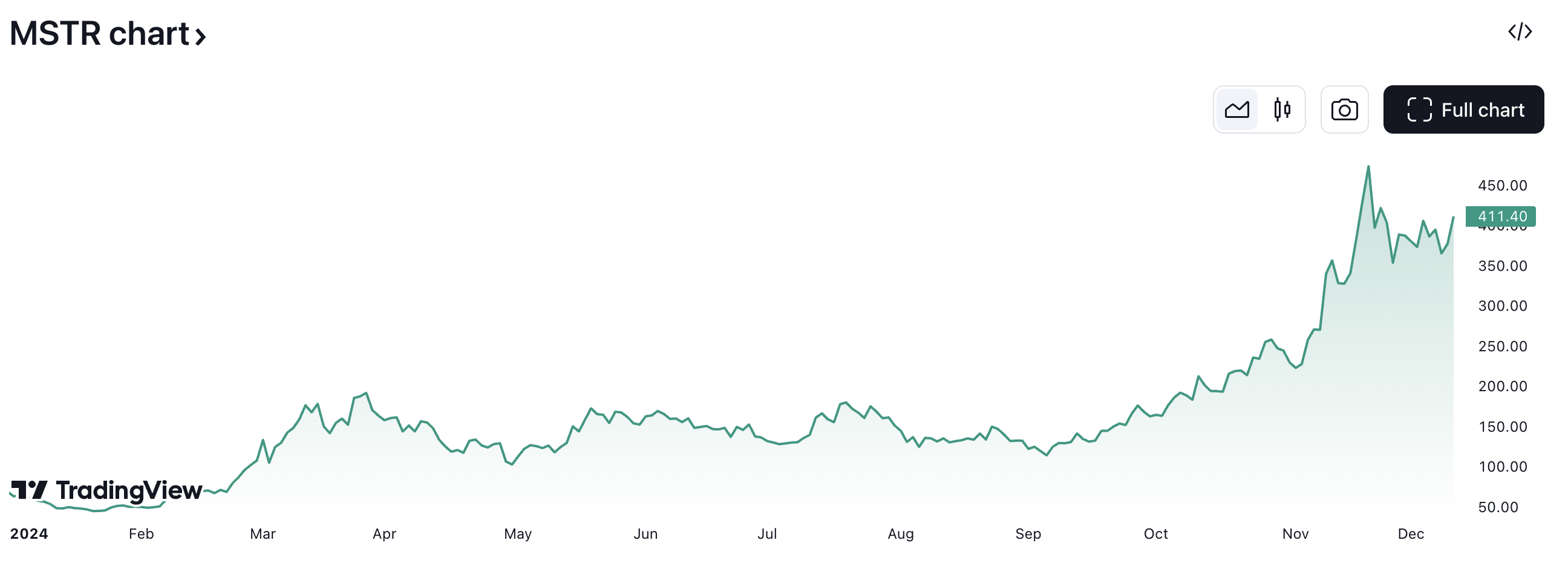

Pushed by its consecutive Bitcoin purchases, MicroStrategy’s inventory value has been surging, and it has not too long ago develop into one of many high 100 publicly traded US firms. Nevertheless, NASDAQ should approve it to place it on the checklist.

As a publicly traded firm, Nasdaq has made restricted entries to the crypto business in recent times. Final yr, the SEC halted its plans to launch a crypto custody enterprise, and the change hasn’t publicly mentioned restarting them.

In August, it did facilitate BlackRock’s efforts to get choices buying and selling on its Ethereum ETF. Past that, nevertheless, Nasdaq has been quiet on the crypto entrance.

In the meantime, James Seyffart concurred with Balchunas’ opinions through one other put up. He identified that Nasdaq doesn’t allow finance firms to be on its checklist, and MicroStrategy might technically qualify.

The corporate’s destiny is inexorably tied to Bitcoin’s efficiency, and thus, it’s arguably a finance firm. Nevertheless, it’s presently listed as a tech inventory, and it might’t be reassessed till March.

“Listed below are the dates for ICB [Industry Classification Benchmark] reclassification. So except they’ve already began the method of reclassifying MicroStrategy as a financials inventory… we predict it needs to be in. That mentioned — that is the first danger for not getting included in my view,” Seyffart claimed.

Certainly, MicroStrategy is without doubt one of the world’s largest Bitcoin whales, however the agency began as a tech firm. Though it routinely invests large quantities of capital into Bitcoin, which contributed primarily to its 500% inventory market progress this yr, MicroStrategy continues to be a tech inventory in Nasdaq’s consideration.

Finally, that is solely a prediction, albeit one from two seasoned ETF analysts. In any occasion, there are necessary deadlines to think about. If MicroStrategy is coming into the Nasdaq 100, the announcement will come by the tip of the week.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.