Quantum computer systems might finally be able to breaking Bitcoin’s safety, however making an attempt to make use of it that manner might be solely pointless, in accordance with multimillionaire entrepreneur Kevin O’Leary.

“When you’re going to take a quantum pc stack and dedicate it to cracking Bitcoin, is that one of the best use of the facility and that facility, or is there one other strategy to earn a living?” O’Leary says throughout an interview with Journal.

“I’ve heard the narrative for nearly six years,” O’Leary, wearing his trademark black go well with, says, brushing apart a long-held concern from the crypto business.

The 71-year-old — recognized to followers of US actuality tv sequence Shark Tank as “Mr Fantastic” — says, in a deeply skeptical tone, that anybody hoping to revenue from such an effort would first have to wager towards Bitcoin itself, by shorting it, and genuinely imagine that throughout the subsequent three to 5 years, “you can really crack it.”

Crypto business divided over quantum’s menace to Bitcoin

A number of business executives have been saying for some time now that quantum computer systems — which make the most of the rules of quantum mechanics to carry out calculations — might finally turn out to be highly effective sufficient to crack Bitcoin’s safety throughout the subsequent decade.

Solana founder Anatoly Yakovenko has recommended there’s a “50–50” likelihood that the danger might emerge as early as 2030.

Nevertheless, a number of high-profile Bitcoin advocates,comparable to Blockstream CEO Adam Again, anticipate that Bitcoin may have preventative measures in place lengthy earlier than quantum is an actual menace.

O’Leary is extra impartial; he doesn’t dismiss the danger to Bitcoin, however argues that quantum computing could be way more profitable when deployed in areas with better financial upside, comparable to accelerating AI-driven medical analysis.

“I imply, that may be very helpful,” he says. Medical researchers have not too long ago echoed an analogous sentiment, stating that quantum computer systems might assist in designing extra advanced molecules and improve therapy precision.

Bitcoin has already been priced in for quantum menace

Though there is no such thing as a quick menace to Bitcoin, O’Leary says that the quantum computing danger is already, to some extent, mirrored in Bitcoin’s present worth.

“The value of Bitcoin anticipates, regardless of the chance of that’s, that somebody would make it their life’s work, and it will take a variety of years, we predict, to discover a strategy to crack it,” he says, as Bitcoin trades round $90,000.

It raised the plain query for Journal to ask: Is O’Leary hedging his bets towards potential danger by investing in quantum computing shares?

For now, he says they’re not on his radar.

“One of many issues is the problem that they don’t earn a living. And so, you realize, I desire on the finish of the day to get some money circulate,” he says, which could be very on model for O’Leary.

O’Leary reiterates his agency conviction in allocating 5% of his total portfolio to Bitcoin, together with some publicity to Ethereum.

“I see the advantage to blockchain,” he says. “We’ve been speaking about blockchain and monetary providers for 12 years now, so I believe that’s fascinating. After which collectively, it’s diversified.”

Nevertheless, O’Leary has little curiosity within the broader crypto market, saying the 2 largest cryptocurrencies present all of the publicity he wants.

“I don’t want way more. If we now have a great day…I seize 97.5% of the upside with simply two names. Like, that’s all I want,” he says.

Learn additionally

Options

Charles Hoskinson, Cardano and Ethereum – for the file

Options

I spent every week working in VR. It was principally horrible, nonetheless…

O’Leary stated that exterior of Bitcoin and Ethereum, he has publicity to crypto via “picks and shovels.”

These embrace investments in crypto alternate Coinbase, brokerage platform Robinhood and crypto platform WonderFi, as they’re “not agnostic to costs.”

“I like a number of volatility for these guys, as a result of that’s how I earn a living,” he says.

Kevin O’Leary’s stance on crypto has modified considerably

O’Leary is without doubt one of the extra well-known advocates for crypto in mainstream media, however his tone towards the asset class wasn’t all the time so good.

In truth, it was downright unfavourable only some years in the past.

As not too long ago as January 2021, O’Leary had some nasty issues to say about digital property, referring to crypto as “crypto crap” and particularly calling Bitcoin “not an actual forex” and a “big nothing burger.”

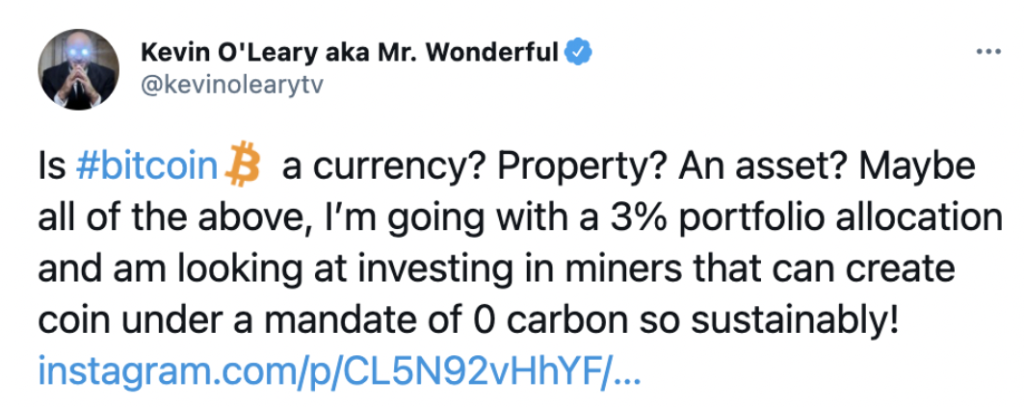

However two months later, in March 2021, O’Leary did an entire 180-degree flip, asserting in a put up on X (then Twitter) that he deliberate to allocate 3% of his portfolio to Bitcoin whereas exploring investments in environmentally sustainable cryptocurrency mining.

A month later, he stated that Ether would all the time rank second to Bitcoin.

Sadly, O’Leary turned enamored with crypto in the identical 12 months he turned a paid spokesperson for FTX, which might turn out to be one among crypto’s most notorious collapses.

When the crypto alternate collapsed in November 2022, O’Leary quickly realized that the deal was solely pointless for him, and he claimed he had successfully misplaced the almost $15 million that FTX had paid him for the function.

Who’s Mr. Fantastic?

O’Leary has had an eye fixed for promising startups, having been a founding member of Shark Tank, on which he has appeared since 2009.

Most not too long ago, he turned a strategic investor in Bitzero, a knowledge heart firm targeted on Bitcoin mining and AI computation.

Learn additionally

Asia Specific

Stablecoin for cyber-scammers launches, Sony L2 drama: Asia Specific

Options

Off The Grid’s ‘largest replace but,’ Rumble Kong League evaluation: Web3 Gamer

“I’m simply mainly investing in it for infrastructure. It’s probably not a Bitcoin mining firm, in my opinion; I’m not investing in it that manner as a result of the facility is much extra invaluable to the AI,” he says.

O’Leary stated he was drawn to Bitzero as a result of the corporate has secured land and long-term land leases, in addition to energy contracts priced under 6 cents per kilowatt hour.

Kevin O’Leary’s Bitcoin short-term forecast

As for the place Bitcoin’s worth goes, O’Leary doesn’t see a lot occurring till the US authorities indicators off on the CLARITY Act.

“I don’t suppose it’s going to shut this 12 months a lot increased than the place it’s,” O’Leary says, pointing to the worth it was buying and selling at publication, round $90,000.

“There’s no catalyst. We’ve got to get the CLARITY Act signed,” he says.

“When that happens, then you definitely’ll begin to see allocation on the sovereign wealth stage, and then you definitely’ll begin to see worth appreciation.”

Nevertheless, he seen the current $19 billion crypto market liquidation on Oct. 10 favorably.

“Lots of leverage has been squeezed out of the fashions, which is sweet. I believe what really occurred could be very wholesome,” he says.

“I’m holding onto my positions; they’re down from the start of the 12 months,” he says with none indicators of concern.

“I’ve seen this film so many occasions with Bitcoin, over and again and again, and so volatility is its center identify. I’m good with it.”

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Ciaran Lyons

Ciaran Lyons is an Australian crypto journalist. He is additionally a standup comic and has been a radio and TV presenter on Triple J, SBS and The Venture.