Prime Journal Tales of The Week

2,000 Bitcoin on the transfer: Uncommon Casascius cash awaken after 13 years

Two long-dormant Casascius cash — every backed by 1,000 Bitcoin — have simply been activated as of Friday, unlocking greater than $179 million stashed away for greater than 13 years.

Onchain information signifies that one of many Casascius cash was minted in October 2012, when Bitcoin was buying and selling for $11.69.

The opposite was minted earlier in December 2011, when Bitcoin was valued at solely $3.88, giving that Casascius coin a theoretical return of about 2.3 million p.c, not together with the price of minting.

Casacius cash are bodily metallic cash or bars created by Utah-based entrepreneur Mike Caldwell, which had been minted between 2011 and 2013.

Caldwell would take Bitcoin and mint the worth into bodily cash; these cash are thought-about some of the sought-after bodily collectibles associated to Bitcoin.

Peter Schiff fails to authenticate gold bar throughout onstage take a look at with CZ

A panel that includes gold advocate Peter Schiff and Binance co-founder Changpeng “CZ” Zhao at Binance Blockchain Week highlighted the challenges of verifying bodily gold, after Schiff was unable to substantiate whether or not a gold bar introduced to him was real.

The controversy concerned whether or not tokenized gold or Bitcoin is a greater retailer of worth asset based mostly on divisibility, portability, verifiability, sturdiness and provide constraints — key elements in assessing an asset’s viability as cash.

CZ argued that BTC is a greater medium for storing worth for a number of causes, together with the power for any consumer to immediately confirm the cryptocurrency via a full node or different strategies that test a cryptographically safe public ledger.

IMF lays out tips for addressing stablecoin dangers, past rules

The Worldwide Financial Fund (IMF) launched a complete report on the potential affect of the rising stablecoin market and the adequacy of world rules in dealing with it.

Within the “Understanding Stablecoins” report launched on Thursday, the IMF analyzed the varied approaches areas, together with the US, the UK, Japan and the European Union, had taken in establishing a regulatory framework for stablecoins.

Though the report famous that rising rules may mitigate dangers to macrofinancial stability, the panorama was “fragmented,” each in policymakers’ approaches and the way stablecoins are issued.

“The proliferation of latest stablecoins throughout totally different blockchains and exchanges raises issues about inefficiencies as a result of potential lack of interoperability,” mentioned the IMF. “Furthermore, this could introduce variations and roadblocks amongst international locations, as a result of totally different regulatory remedy and transaction hurdles.”

Tether solvency fears are ‘misplaced’ as firm sits on giant surplus: CoinShares

Considerations about stablecoin issuer Tether’s monetary stability resurfaced this week after BitMEX co-founder Arthur Hayes warned the corporate may face severe hassle if the worth of its reserve property had been to fall. However CoinShares’ head of analysis, James Butterfill, pushed again on these claims.

In a Dec. 5 market replace, Butterfill mentioned fears over Tether’s solvency “look misplaced.”

He pointed to Tether’s newest attestation, which reviews $181 billion in reserves towards roughly $174.45 billion in liabilities, leaving a surplus of practically $6.8 billion.

“Though stablecoin dangers ought to by no means be dismissed outright, the present information don’t point out systemic vulnerability,” Butterfill wrote.

Tether stays some of the worthwhile firms within the sector, producing $10 billion within the first three quarters of the yr — an unusually excessive determine on a per-employee foundation.

Kalshi faucets Solana to tokenize betting contracts: Report

Predictions platform Kalshi has reportedly begun permitting customers to purchase and promote tokenized variations of its occasion contracts on the Solana blockchain.

Based on a Monday CNBC report, Kalshi has moved to courtroom cryptocurrency customers by providing tokenized contracts, which are actually stay on Solana. The transfer tokenized bets on the predictions platform, which incorporates US elections, sports activities and extra, making them tradeable on the blockchain.

“There’s a number of energy customers in crypto,” John Wang, Kalshi’s head of crypto, instructed CNBC. “That is about tapping into the billions of {dollars} of liquidity that crypto has, after which additionally enabling builders to construct third-party entrance ends that make the most of Kalshi’s liquidity.”

Most Memorable Quotations

“I don’t truly suppose the Fed’s gonna minimize in December.”

Kevin O’Leary, entrepreneur and investor

“I’m trying ahead to having an innovation exemption that we’ve been speaking about now. We’ll be capable to get that out in a month or so.”

Paul Atkins, chair of the US Securities and Alternate Fee

“Anybody who reads the story rigorously can see that they strung collectively a bunch of anecdotes that don’t assist the headline.”

David Sacks, AI and crypto czar for the US White Home

“There’s nothing about MSTR’s worth dropping beneath NAV [net asset value] that may power it to promote.”

Matt Hougan, chief funding officer at Bitwise

“All of the hundreds of different tokens, not the stablecoins which can be backed by US {dollars}, however all of the hundreds of different tokens, you need to ask your self, what are the basics? What’s underlying it… The investing public simply wants to pay attention to these dangers.”

Gary Gensler, former chair of the US Securities and Alternate Fee

“As President Trump has directed, we’re going to hold the US [dollar] the dominant reserve forex on the earth, and we are going to use stablecoins to try this.”

Scott Bessent, US secretary of the treasury

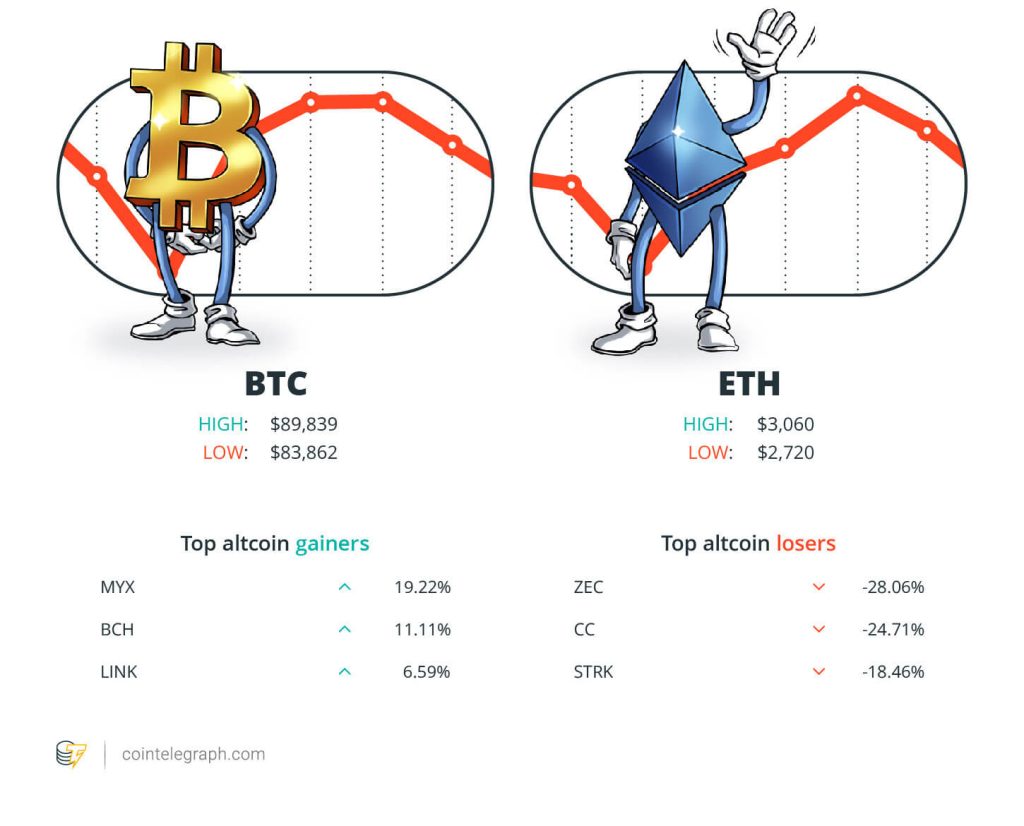

Winners and Losers

On the finish of the week, Bitcoin (BTC) is at $89,839, Ether (ETH) at $3,060 and XRP at $2.03. The whole market cap is at $3.06 trillion, in keeping with CoinMarketCap.

Among the many largest 100 cryptocurrencies, the highest three altcoin gainers of the week are MYX Finance (MYX) at 19.22%, Bitcoin Money (BCH) at 11.11% and Chainlink (LINK) at 6.59%.

The highest three altcoin losers of the week are ZCash (ZEC) at 28.06%, Canton (CC) at 24.71% and Starknet (STRK) at 18.46%. For more information on crypto costs, make certain to learn Cointelegraph’s market evaluation.

Prime Prediction of The Week

XRP faces ‘now or by no means’ second as merchants eye rally to $2.50

XRP defended its $2 psychological ground this week, rebounding nearly 6% on Tuesday after a short liquidity sweep on Monday.

Whereas the asset remained in a multimonth downtrend relationship again to July, the $2.28–$2.30 resistance band now stands because the defining pivot for bullish continuation.

Learn additionally

Options

The dangers and advantages of VCs for crypto communities

Options

The authorized risks of getting concerned with DAOs

XRP’s bounce to $2.17 occurred after tapping the honest worth hole simply beneath $2, an space created throughout the Nov. 21 rebound from $1.80. This retest prompt that consumers stay lively at discounted pricing zones even inside a broader downtrend.

Structurally, XRP continued to print decrease highs, however the compression beneath $2.30 resembled a coil forming below a serious resolution level.

Prime FUD of The Week

Pepe memecoin web site exploited, redirecting customers to malware: Blockaid

The official web site for the Pepe memecoin has been compromised by attackers, who’re redirecting customers to a malicious hyperlink.

“Blockaid’s system has recognized a front-end assault on Pepe. The location accommodates a code of inferno drainer,” the cybersecurity firm mentioned on Thursday. Blockaid’s Risk Intelligence Crew instructed Cointelegraph:

“Blockaid detected Inferno drainer code on the Pepe entrance finish, matching a recognized drainer household we usually establish. It is a front-end compromise, the place customers are redirected to a faux website that injects malicious code to empty wallets.”

BlackRock’s Fink calls Bitcoin an ‘asset of worry,’ softens crypto stance

Larry Fink, chair and CEO of asset administration firm BlackRock, defined his “massive shift” from associating cryptocurrencies with illicit actions to having the most important spot Bitcoin exchange-traded fund.

Learn additionally

Options

Ethereum’s roadmap to 10,000 TPS utilizing ZK tech: Dummies’ information

Options

Creating ‘good’ AGI that received’t kill us all: Crypto’s Synthetic Superintelligence Alliance

Talking at The New York Occasions’ DealBook Summit on Wednesday, Fink addressed questions associated to his views on crypto and Bitcoin to journalist Andrew Ross Sorkin.

The BlackRock CEO mentioned his transfer from associating crypto primarily with cash laundering to having publicity to billions of {dollars} in BTC was “a really evident public instance of an enormous shift in [his] opinions.”

“My thought course of at all times evolves,” mentioned Fink.

SEC sends warning letters to ETF issuers focusing on untamed leverage

The US Securities and Alternate Fee (SEC) despatched warning letters to a number of exchange-traded fund (ETF) suppliers, halting purposes for leveraged ETFs that provide greater than 200% publicity to the underlying asset.

ETF issuers Direxion, ProShares and Tidal obtained letters from the SEC citing authorized provisions below the Funding Firm Act of 1940.

The regulation caps publicity of funding funds at 200% of their value-at-risk, outlined by a “reference portfolio” of unleveraged, underlying property or benchmark indexes. The SEC mentioned:

“The fund’s designated reference portfolio supplies the unleveraged baseline towards which to match the fund’s leveraged portfolio for functions of figuring out the fund’s leverage danger below the rule.”

Prime Journal Story of The Week

6 causes Jack Dorsey is unquestionably Satoshi… and 5 causes he’s not

A deep dive into why some imagine Jack Dorsey is Bitcoin’s creator — and why others insist he’s not.

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Editorial Employees

Cointelegraph Journal writers and reporters contributed to this text.

Learn additionally

Hodler’s Digest

GameStop mayhem, Robinhood scandal, Musk tweets, DOGE explodes: Hodler’s Digest, Jan. 24–30

Editorial Employees

9 min

January 30, 2021

The most effective (and worst) quotes, adoption and regulation highlights, main cash, predictions and way more — one week on Cointelegraph in a single hyperlink!

Learn extra

Hodler’s Digest

SBF pleads not responsible, crypto layoffs, and financial institution run on Silvergate: Hodler’s Digest, Jan. 1-7

Editorial Employees

5 min

January 7, 2023

FTX would be the topic of a U.S. Senate listening to, authorities take HashFlare founders into custody and New York finalizes its PoW ban.

Learn extra