The New 12 months weekend compresses the crypto market into three screens, with Instances Sq. flashing a 589 joke the XRP crowd can not ignore, SHIB ending December purple whereas January has a behavior of flipping the script and Bitcoin parking on its mid-Bollinger like it’s choosing a route for 2026.

TL;DR

- Instances Sq. “589” coincidence revives the $589 fable within the XRP neighborhood.

- December is purple for Shiba Inu (SHIB), however January seasonality is the bull argument.

- For Bitcoin, month-to-month mid-Bollinger is the road — maintain for $125,000, lose and draw back opens.

XRP stuns Instances Sq. with $589 twist

A random broadcast point out about gentle bulbs became the largest symbolic win XRP followers may hope for. The official 2026 numbers unveiled in Instances Sq. had been stated to include 589 bulbs — tall metal frames, seven ft excessive, counted on dwell tv and immediately reposted throughout crypto X with captions that wrote themselves.

For the XRP crowd, 589 is not only a quantity, it’s folklore — the legendary worth prediction that has been echoing by means of boards and YouTube thumbnails for half a decade, the shorthand for “in the future XRP will go the place logic stops.”

When the town’s personal countdown show lands on that precise determine, it doesn’t matter whether it is coincidence or cosmic advertising. Inside minutes, “589” was trending once more below each put up with “Instances Sq.” in it.

XRP itself trades close to $1.86 with quantity scaling down into year-end, holding its assist vary after December’s mid-month flush. The quantity on the display screen could also be unintentional, nevertheless it dropped proper when XRP wanted a morale jolt.

For a token that lives on symbolism as a lot as on charts, 589 shining lights on the world’s most televised intersection simply handed the neighborhood a narrative to run with into 2026. Coincidence or not, you can’t purchase that type of narrative alignment.

Can Shiba Inu (SHIB) delete zero in January?

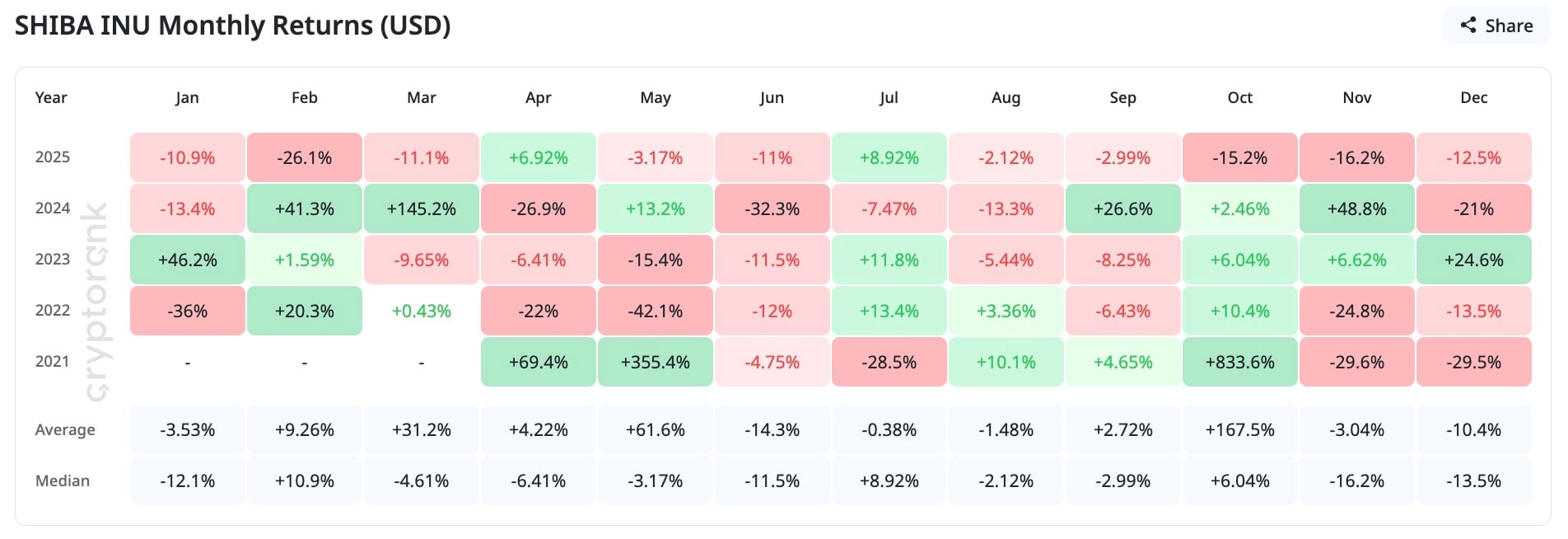

If there’s one factor the Shiba Inu coin has carried out higher than most meme cryptocurrencies, it’s staying predictable in its chaos. The ultimate 2025 returns chart paints a painful image: -10.9% in January, -26.1% in February and an unpleasant -12.5% for December, turning what began as a speculative revival 12 months into one other purple calendar.

January will not be some computerized SHIB wake-up month, it’s a coin flip that has largely landed purple currently: -10.9% in 2025, -13.4% in 2024 and -36% in 2022, with median -12.1%, as per CryptoRank. The bull case is that when it hits, it hits arduous, and 2023’s +46.2% is proof that one inexperienced January can erase plenty of injury quick.

On the TradingView chart, SHIB/USDT holds round $0.00000734 with a slender unfold, caught between the ground at $0.00000699 and resistance at $0.000009. Above that sits $0.00001102 after which $0.00001203, which is the extent that will actually delete one zero from the quote and set off each Shiba Inu fan account to begin tweeting rockets once more.

This time, the query is much less about sentiment and extra about math. SHIB’s market cap at this degree leaves sufficient headroom for a 20-30% transfer with out breaking construction, and its burn tracker, which slowed throughout December’s chilly week, may spike once more as soon as fuel prices normalize.

Add the token’s sample of bouncing proper after a multi-month bleed, and also you get the right January hypothesis narrative: SHIB deleting a zero is not only hopium, however a statistical déjà vu ready for the primary inexperienced candle of the 12 months to gentle up.

Bitcoin has three days to show 40% run

Each month-to-month shut tells a narrative, however this one comes with a deadline. Bitcoin’s December candle is balancing proper on the mid Bollinger band close to $88,929 — the precise technical line that splits euphoria from panic.

An in depth above it this December confirms the channel growth that targets $125,571 on the higher band, a straight +40% rally potential heading into Q1 of 2026. Slip beneath it, and the dialog flips immediately towards $52,286, the decrease band assist that will imply a full correction and the loss of life of the “ETF supercycle” narrative earlier than it even completed printing.

The candle construction is brutal in its simplicity: open $90,352, excessive $94,603, low $83,821, present $87,826. Nothing dramatic, simply indecision stretched throughout 4 weeks of declining ETF inflows and vanishing quantity. The vacation slowdown hit Bitcoin hardest as a result of the macro image refuses so as to add momentum — charges are steady, the greenback index flatlined, and miner reserves have stopped dropping. With three days left in December, Bitcoin has precisely one process: defend that midline.

If it does, January may begin with renewed shopping for as funds rebalance positions round ETF renewals. If not, the identical Bollinger construction that delivered final 12 months’s rally turns into the rationale for a retrace that takes months to restore.

Both means, these ultimate candles commerce like coin flips with billion-dollar penalties. The irony is that after all of the noise about establishments and liquidity, Bitcoin’s subsequent 40% transfer might come right down to nothing greater than the place this candle closes on Tuesday.

Crypto market outlook

Vacation symbolism and technical thresholds collide into year-end. Instances Sq. arms XRP a numerical present, SHIB leans on its seasonal sample for a recent run, and Bitcoin stands on the final checkpoint earlier than a possible Q1 growth.

Three buying and selling days stay for the market to determine whether or not the story of 2026 begins with $125,000 BTC headlines or one other spherical of fears, uncertainty and doubts.