Indian crypto holders department out past Bitcoin: Survey

The common crypto holder on the favored Indian crypto trade CoinDCX is beginning to diversify their portfolio, in keeping with latest survey outcomes.

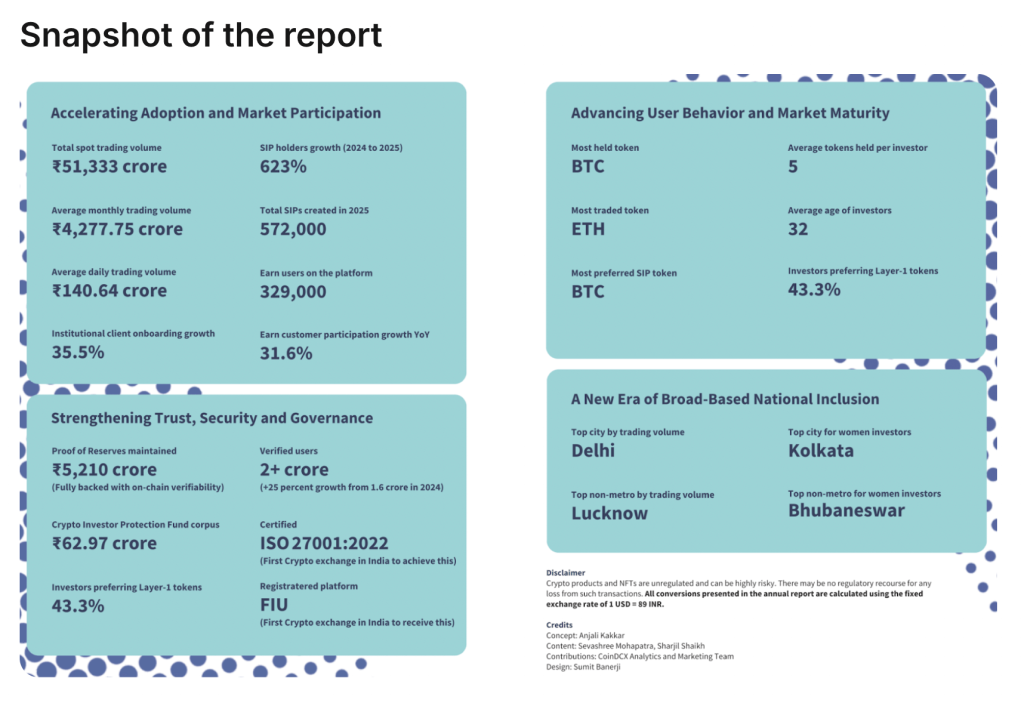

“The Indian crypto investor immediately holds a mean of 5 tokens per portfolio,” CoinDCX stated in an annual report launched on Thursday. Its survey signifies the typical investor in India has virtually doubled the vary of crypto tokens they maintain, up from round two to a few tokens in 2022.

CoinDCX stated that traders are more and more exploring the potential of different blockchain networks quite than focusing solely on Bitcoin.

“Buyers are evolving past Crypto equals Bitcoin”

Layer-1 tokens had been the preferred class, most well-liked by 43.3% of respondents, which CoinDCX described as “a transparent indicator of research-driven diversification quite than single-asset hypothesis.”

Bitcoin adopted with 26.5%, whereas memecoins accounted for 11.8% of investor choice.

The survey additionally highlighted the rising geographic unfold of crypto adoption in India, with 40% of traders based mostly in non-metro cities quite than main city facilities.

The findings come solely months after Coinbase Ventures, the funding arm of the US-based crypto trade Coinbase, invested an undisclosed quantity in CoinDCX, amid the nation’s bolstering crypto adoption.

CoinDCX lately claimed to serve greater than 20 million clients in India and the United Arab Emirates, following its acquisition of native crypto trade BitOasis in late 2024.

Ripple secures approval to develop operations in Singapore

Singapore’s central financial institution has given the inexperienced mild to fee issuer Ripple to additional develop providers inside the nation.

“The @MAS_sg has authorized an expanded scope of fee actions for our Main Fee Establishment license – enabling us to ship end-to-end, absolutely licensed fee providers to our clients within the area,” Ripple stated on Monday.

Ripple stated the license will permit them to construct the infrastructure that monetary establishments must “transfer cash effectively, shortly, and safely.”

Fiona Murray, Ripple Asia Pacific vp and managing director, stated that the Asia Pacific area leads the world in crypto utilization, and Singapore sits “on the middle of that development.”

The Financial Authority of Singapore (MAS) has been collaborating with a variety of crypto firms lately to strengthen crypto innovation within the nation.

Main crypto trade Coinbase lately launched operations in Singapore, citing its “latest foundational work” with MAS as a key issue behind the choice.

Learn additionally

Options

4 out of 10 NFT gross sales are faux: Study to identify the indicators of wash buying and selling

Options

Hong Kong isn’t the loophole Chinese language crypto corporations suppose it’s

The event comes as Ripple continues to interact carefully with regulators worldwide. On Nov. 11, Ripple President Monica Lengthy stated she welcomed the UK’s Financial Secretary to the Treasury, Lucy Rigby, to Ripple’s Singapore workplace.

Japan to tax crypto like shares in huge shake-up

Japan is reportedly contemplating a plan to set a flat tax on cryptocurrency positive factors at 20%, aligning it with the tax therapy of shares and different investments.

If applied, the change might present important reduction for high-income earners. Below the present tax system, crypto positive factors are mixed with wage and different revenue and may be taxed at charges of as much as 55%, in keeping with a report printed by Nippon on Monday.

Learn additionally

Options

Hodler’s Weekly TEMPLATE ONLY: DUPLICATE, DO NOT PUBLISH

Options

Grokipedia: ‘Far proper speaking factors’ or much-needed antidote to Wikipedia?

Many market members anticipate this to be a bullish transfer for the nation and doubtlessly one that can result in extra capital flowing into the crypto sector.

It was only some months in the past that Dragonfly Capital managing companion Haseeb Quirishi stated, “Japan is a sleeping big in crypto.” In the meantime, Kaia’s official account stated on Monday that, “Japan’s 20% flat tax places it forward of most Asian international locations on crypto.”

The transfer comes as the federal government can be reportedly planning tighter regulation of crypto property subsequent yr.

On Nov. 21, it was reported that the Monetary Providers Company in Japan would require cryptocurrency exchanges to keep up legal responsibility reserves as a part of measures to protect towards hacks or unexpected occasions.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Ciaran Lyons

Ciaran Lyons is an Australian crypto journalist. He is additionally a standup comic and has been a radio and TV presenter on Triple J, SBS and The Challenge.