- Ethereum is holding key weekly assist however has but to verify a breakout or breakdown.

- Main resistance above will doubtless determine ETH’s broader route heading into 2026.

- Day by day charts present ETH caught in a spread, with volatility presumably delayed till subsequent 12 months.

Ethereum has continued to grind sideways, holding weekly assist with out exhibiting any actual urgency to interrupt larger. Value just lately hovered close to $2,947 on the weekly ETHUSD chart, sitting simply above a broader structural assist zone highlighted by analysts at Extra Crypto On-line. In keeping with their view, an upside response continues to be doable from this space, although the market hasn’t dominated out yet one more dip early subsequent 12 months earlier than selecting a clearer path.

What stands out is the endurance in worth motion. ETH isn’t collapsing, but it surely isn’t convincing patrons both, and that stability typically reveals up forward of larger choices. As issues stand, Ethereum appears to be like prefer it’s ready, possibly longer than merchants would love.

Weekly Construction Units the Stage for 2026

On the upper timeframe, Ethereum is resting above a layered assist band marked round $2,618, $2,252, and $1,818. These ranges line up with key Fibonacci references and have traditionally acted as areas the place draw back momentum slows. For now, they continue to be intact, which retains the broader construction from turning outright bearish.

Above worth, nevertheless, sits a dense resistance zone stretching roughly from $3,348 to $4,619. This cluster is seen as the primary main hurdle ETH would wish to reclaim to shift the long-term setup. Analysts notice that how worth behaves as soon as it reaches that zone, if it does, will doubtless decide which bigger state of affairs takes management heading into 2026.

Analysts Say the Market Hasn’t Chosen But

Extra Crypto On-line emphasised that neither bullish nor bearish eventualities have been invalidated at this stage. As an alternative of forcing a directional name, the present construction merely outlines situations that would information the subsequent transfer. Possibilities, they argue, will solely shift as soon as worth confirms habits at these main zones, not earlier than.

In different phrases, Ethereum hasn’t made its determination but. And till it does, expectations want to remain versatile, even when that’s uncomfortable for short-term merchants.

Ethereum Stays Vary-Certain on the Day by day Chart

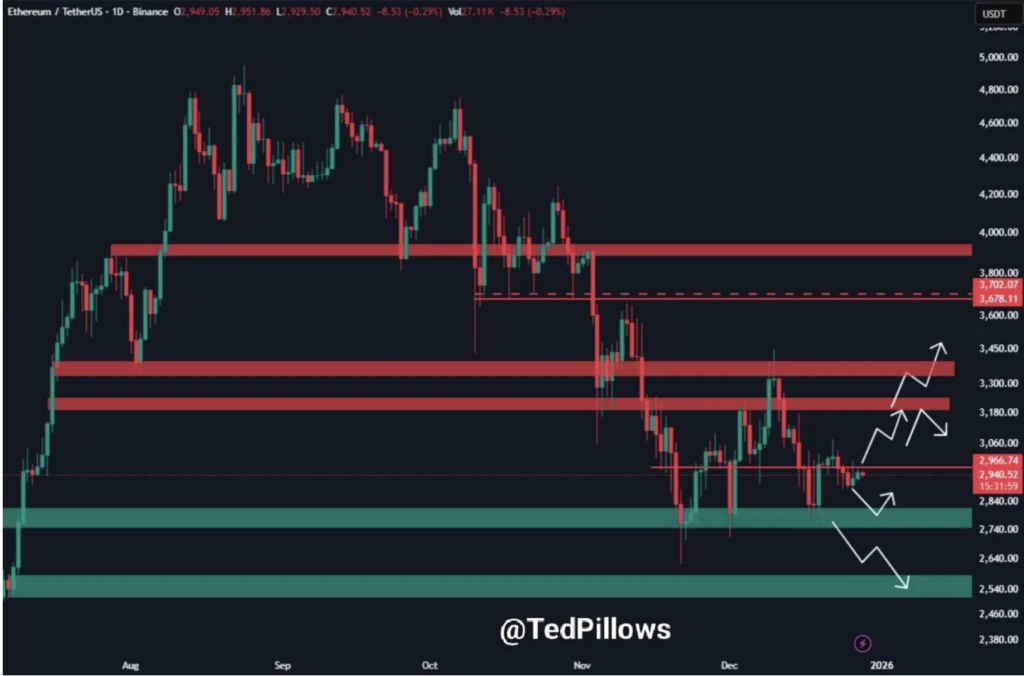

That hesitation reveals up clearly on the each day timeframe too. Analyst Ted Pillows identified that ETH has gone nearly nowhere just lately, hovering across the $2,940 space on the ETH/USDT chart. Makes an attempt to reclaim larger resistance have stalled, protecting worth locked inside a well-recognized vary.

The chart reveals a number of overhead provide zones, with resistance clustered within the low $3,000s and one other band nearer to the mid $3,000s. Beneath, a inexperienced assist zone stretches towards the higher $2,000s, marking the draw back space merchants watch if the vary lastly breaks.

Volatility Could Wait Till 2026

Ted Pillows described Ethereum as “caught in a spread,” suggesting that significant volatility might not arrive till 2026 begins. The setup maps out a number of doable paths, together with a push into resistance, a pullback to assist, or continued sideways drift, so long as worth stays trapped between these zones.

For now, Ethereum seems content material to consolidate. The larger transfer should still be forward, however endurance, as soon as once more, is the value of admission.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.