- XRP and Cardano forward

- Mature infrastructure

A protracted-standing downside in cryptocurrency is instantly addressed by Charles Hoskinson’s current assertion that legacy finance is attempting to construct what XRP and Midnight are already doing at a scale 100x past their ambitions. Worth hype shouldn’t be on the middle of the argument. It issues architectural intent, infrastructure maturity and the distinction between Web3-native methods and institutional rebrandings of the identical ideas.

XRP and Cardano forward

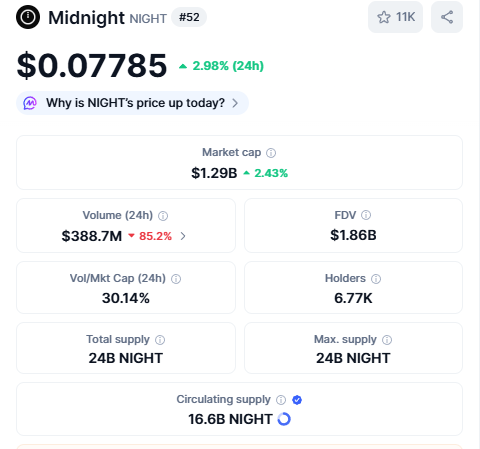

Based on Hoskinson, XRP Ledger and Cardano operationalized decentralized settlement id and compliance-aware design years in the past. Excessive-throughput low-cost institutional settlement was XRP’s preliminary focus. Cardano pursued a regulated-friendly mannequin with out compromising decentralization with its layered design and forthcoming Midnight privateness stack.

These points are basically being rediscovered by Canton and different TradFi-led tasks however with extra stringent governance, extra restricted permissioning and longer iteration cycles. The 100x framing originates from this. And Hoskinson shouldn’t be speaking concerning the value of the aforementioned property, however the depth of improvement.

Cardano is much forward of most enterprise chains that also depend on off-chain ensures and trusted validators because of its formal verification stack prolonged UTXO mannequin and on-chain governance.

The disparity shouldn’t be solely quantitative but in addition qualitative. That is partially mirrored out there construction. Lengthy compression phases have been skilled by XRP and ADA as a substitute of parabolic extra. The property displayed on the charts have already undergone years of redistribution drawdowns and hypothesis.

Mature infrastructure

That’s sometimes the looks of mature infrastructure previous to capital rotation not following. Lengthy cycles, delayed recognition and eventual repricing as soon as fundamentals overcome narrative fatigue are all according to Hoskinson’s earlier prediction that Bitcoin may hit $250,000 in 2026.

The truth that XRP and Cardano are assured moonshots shouldn’t be the primary lesson. The difficulty is that they’ve already resolved points that TradFi is simply now acknowledging. Institutional capital is not going to reimagine Web3 if it genuinely desires programmable settlement privateness with compliance and global-scale neutrality; as a substitute, it is going to combine with what already capabilities.

Hoskinson’s criticism is direct however true: legacy finance continues to confuse management for innovation. There was by no means a advertising and marketing benefit to Web3. It was surviving chaos delivery first and remaining right here.