- Zcash surged over 30% in late December, flipping Solana in perpetual futures quantity.

- Privateness tokens dominated 2025 efficiency, whereas memecoins suffered heavy losses.

- Rising shielded ZEC provide and alternate outflows help additional upside, with $600+ in focus.

Zcash caught the market off guard with a pointy Santa rally, climbing roughly 30% at the same time as Bitcoin drifted sideways and broader momentum stayed muted. On December 27 alone, ZEC jumped 17% to round $515, capping off a 43% restoration for the month and wiping out almost half of its This fall losses. It was a type of strikes that feels sudden, however not solely random.

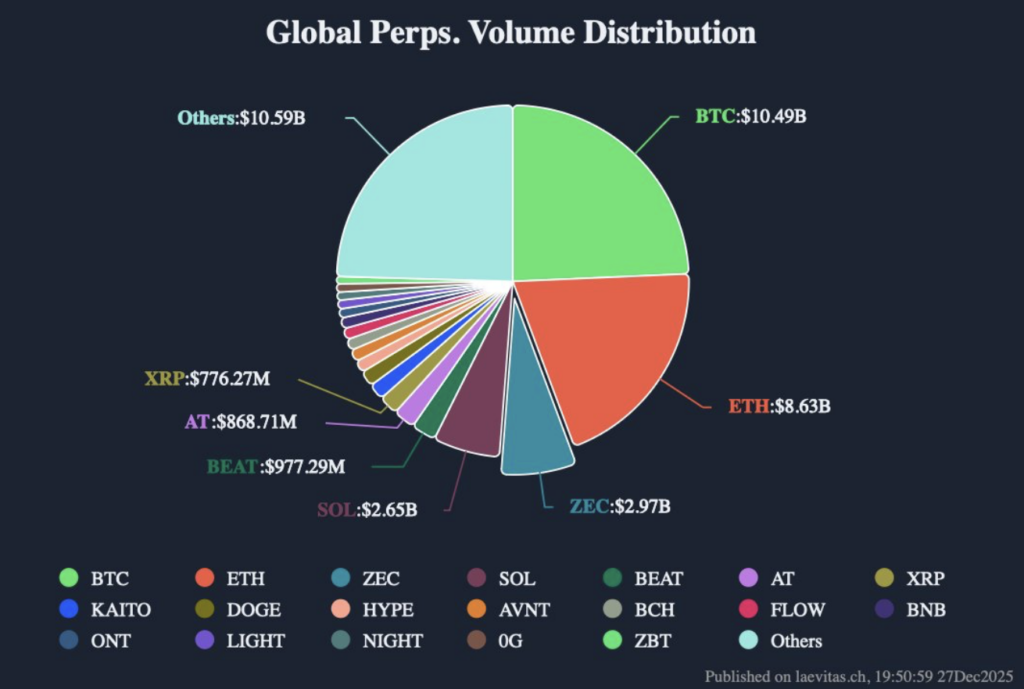

What actually stood out was the place the exercise confirmed up. Within the futures market, Zcash quietly overtook Solana in international perpetual quantity, a transparent signal that speculative curiosity had shifted. Over the previous 24 hours, ZEC’s perp quantity reached about $2.9 billion, giving it roughly a 7% share of the entire market and putting it third behind Ethereum and Bitcoin. SOL, for as soon as, slipped to fourth.

Privateness Narrative Overtakes the Meme Commerce

The power in ZEC isn’t nearly derivatives. Information from Artemis reveals that the privateness narrative emerged because the top-performing theme of 2025, led by Zcash, Monero, and associated belongings. On common, privacy-focused tokens delivered annual returns north of 250%, a staggering quantity in comparison with most different sectors.

Memecoins, against this, had a tough yr. Dominated largely by the Solana ecosystem, that class ranked close to the underside, posting a median annual lack of round 62%. The shift was fairly stark, and it didn’t assist SOL’s efficiency both. In a yr the place narratives mattered, privateness clearly received the rotation.

Utilization Progress Backs Up the Value Motion

Past value and hypothesis, Zcash has additionally seen actual utilization development. By late 2025, the quantity of shielded ZEC provide climbed to round 5 million tokens, almost doubling in only a few months. That regular growth suggests rising demand for personal transactions, not simply short-term buying and selling.

Analyst Peter Costi framed the transfer bluntly, arguing that persons are changing into extra conscious of how damaged present techniques really feel and the way a lot private information will get stripped away every day. In his view, the increasing shielded pool is the actual story, whereas the worth rally is extra of a second-order impact. Value adopted utilization, not the opposite method round, which is uncommon in crypto.

Momentum Builds, however Key Ranges Nonetheless Matter

Trying forward, alternate information reveals notable accumulation over the previous week, with extra ZEC leaving exchanges than getting into. That usually factors to longer-term positioning somewhat than fast flips. If momentum holds, restoration targets round $600, and even $750, begin to look lifelike. The current December push additionally reclaimed the 50-day transferring common, tilting the technical image again in favor of bulls.

Nonetheless, threat hasn’t vanished. A drop again under the $450 short-term help might rapidly derail the restoration and shake confidence. For now although, ZEC has momentum, narrative help, and bettering on-chain indicators, a mix that’s arduous to disregard.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.