- Over $585M in tokens are set to unlock this week throughout main crypto tasks.

- Hyperliquid, Sui, and EigenCloud lead the provision occasions, with contributor and investor allocations.

- Quick-term volatility could rise relying on how newly unlocked tokens are dealt with by recipients.

The crypto market is heading right into a supply-heavy week, with greater than $585 million value of tokens scheduled to unlock over the following seven days. A number of main tasks are concerned, together with Hyperliquid, Sui, and EigenCloud, every releasing recent tokens into circulation.

These occasions don’t mechanically imply costs will drop, however they do have a tendency to extend short-term volatility. When new provide enters the market, particularly in dimension, merchants often begin watching on-chain flows carefully, searching for indicators of distribution, or restraint.

Hyperliquid (HYPE) Unlock Places Deal with Contributors

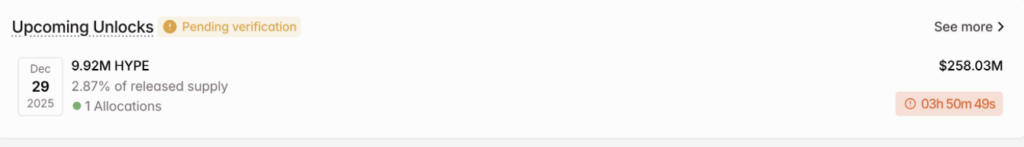

Hyperliquid kicks issues off on December 29 with the discharge of 9.92 million HYPE tokens. That quantity represents slightly below 1% of the entire provide, however roughly 2.87% of the at the moment circulating provide, making it a significant addition at present costs. The unlock is valued at round $258 million, so it’s not small by any measure.

All of those tokens are allotted to core contributors, which is value noting. Contributor unlocks can generally result in promoting, generally not, it will depend on incentives and timing. On high of this, Hyperliquid can also be set to distribute one other 1.2 million HYPE tokens to group members on January 6, including a second provide occasion shortly after the primary.

Sui (SUI) Continues Its Month-to-month Vesting Cycle

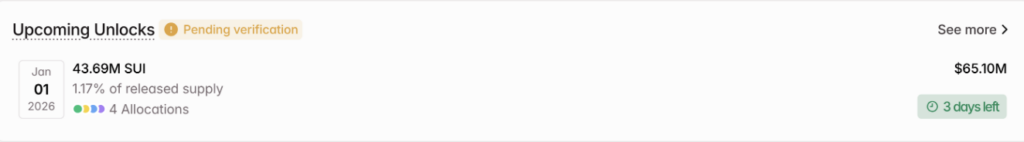

Sui’s subsequent unlock arrives on January 1, with 43.69 million SUI tokens scheduled to enter circulation. This batch represents about 0.44% of the entire provide and roughly 1.17% of the launched provide, valued close to $65 million. It’s a part of Sui’s common month-to-month vesting schedule, so the occasion itself isn’t sudden.

The distribution is cut up throughout a number of teams. Sequence B traders obtain the biggest portion, adopted by allocations to the neighborhood reserve and early contributors. Mysten Labs additionally receives a smaller share. Whereas routine, these unlocks nonetheless matter, particularly if broader market circumstances stay fragile.

EigenCloud (EIGEN) Provides Noticeable Relative Provide

EigenCloud, previously often called EigenLayer, may also unlock tokens on January 1. The community plans to launch 36.82 million EIGEN, representing simply over 2% of complete provide and almost 10% of the launched provide. In relative phrases, that makes this unlock one of many extra impactful of the week, even when the greenback worth, roughly $14.7 million, is smaller.

The cut up is easy. Buyers obtain about 19.75 million tokens, whereas early contributors take the remaining 17.07 million. Given EigenCloud’s positioning as a verifiable cloud layer for Web3 infrastructure, merchants will likely be watching carefully to see how recipients deal with the brand new provide.

Extra Provide Occasions Add to the Combine

Past these three, a number of different tasks are additionally unlocking tokens this week. Ethena, Kamino, and Renzo will all introduce new provide, including to the general stress throughout the altcoin market. Individually, these could seem manageable, however collectively, they contribute to a heavier-than-usual provide backdrop.

As all the time, the true influence gained’t come from the unlocks themselves, however from what occurs after. Change inflows, pockets actions, and market sentiment will decide whether or not this provide is absorbed quietly, or turns into a short-term headwind.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.