XRP is ending December with an ETF move profile that appears totally different from the remainder of the large names, and the timing is lining up with a brand new safety narrative slightly than one other pace pitch.

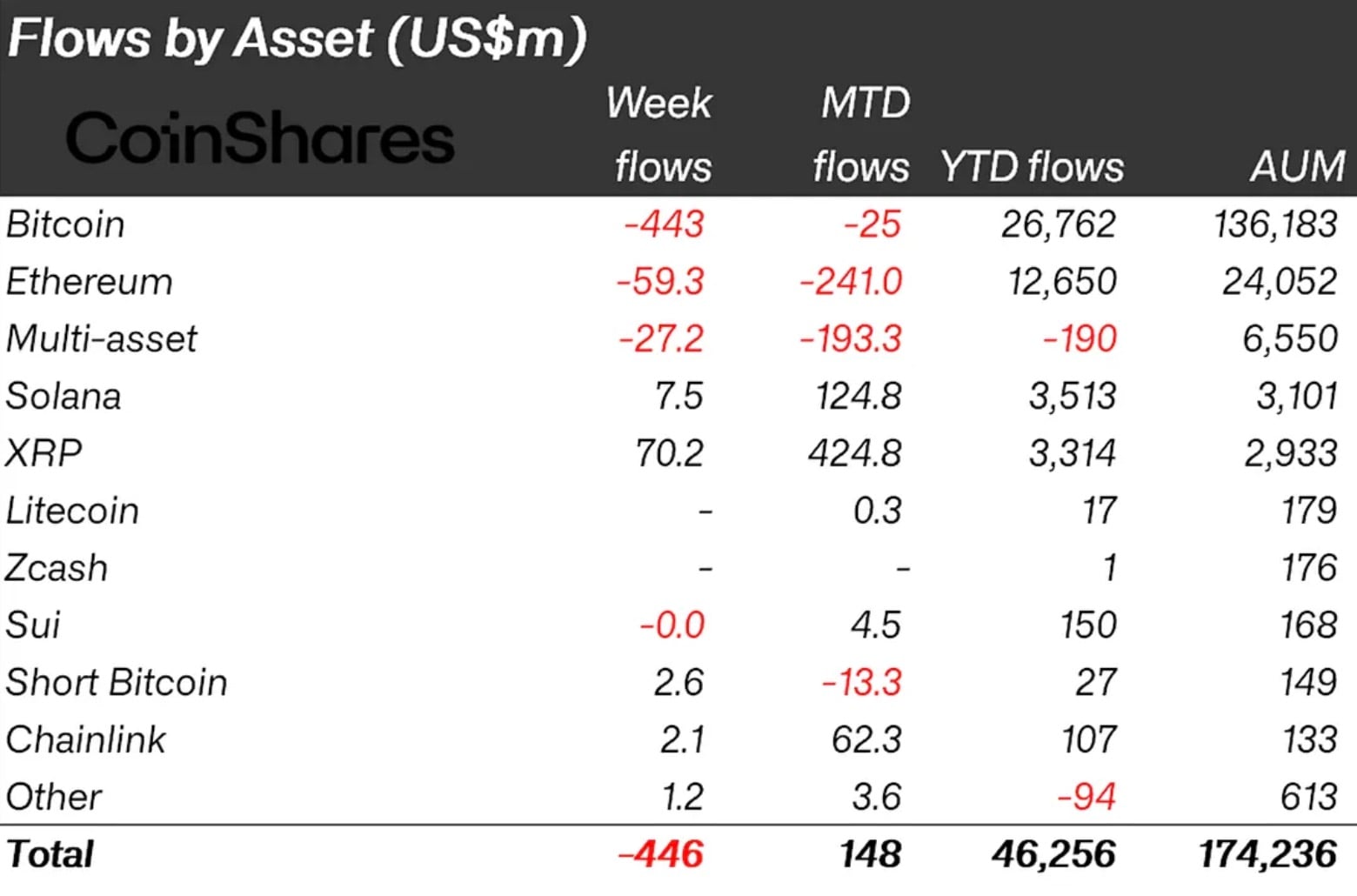

CoinShares information for the week ending Dec. 27 present XRP funding merchandise taking in $70.2 million, whereas Bitcoin merchandise noticed $443 million in outflows, with whole digital-asset merchandise down $446 million for the week.

The month-to-date image is much more eloquent. XRP sits at $424.8 million of month-to-date inflows, whereas Bitcoin is at -$25 million, and Ethereum is at -$241 million, a setup that implies allocators are rotating right into a story they’ll clarify to danger committees when all the pieces else seems like year-end positioning.

That story could also be a post-quantum readiness. As reported beforehand by U.Right now, the XRP Ledger’s AlphaNet has rolled out Dilithium-based cryptography, and builders can now create quantum-resistant accounts and execute transactions secured by the brand new algorithm.

There are nuances

It’s a take a look at community, not the primary ledger, however it places a sensible demo on the desk whereas most chains are nonetheless writing whiteboard timelines.

On the other aspect, Bitcoin’s path is longer by design. Outstanding contributor Jameson Lopp has mentioned a network-wide transition might take 5-10 years as a result of nodes, wallets and saved cash would want coordinated migration to new cryptographic guidelines.

The dialogue will get sensitive round older wallets, together with Satoshi Nakamoto’s estimated 1.1 million BTC, price about $98 billion at latest costs, and proposals have circulated about freezing weak cash to restrict worst-case outcomes.

As of now, it appears its XRP has pushed again on “Q-Day” alarm framing, and the cash move proves that notion.