- ADA has erased its 2024 election rally and is again on the $0.32–$0.36 help zone.

- RSI divergence and a MACD cross trace that draw back momentum could also be fading.

- Holding help retains a transfer towards $0.42 and $0.50 alive, whereas a breakdown dangers $0.24.

Cardano has come full circle. Inside a 12 months, ADA has worn out your entire 300% rally it posted in the course of the 2024 U.S. election surge, dragged decrease by the late-2025 market selloff. Worth has now settled again into the $0.32–$0.36 help zone, the identical space that launched the explosive transfer final 12 months, which naturally raises a well-recognized query, can it occur once more?

This stage isn’t simply psychological, it’s structural. It’s the place patrons beforehand stepped in with conviction, and it’s now being examined beneath very totally different market situations. Whether or not bulls can repeat historical past, even partially, will depend upon how ADA behaves right here, not what it did earlier than.

Momentum Indicators Trace at a Potential Backside

Since mid-December, ADA has proven delicate however notable indicators of resilience. Whereas value printed decrease lows by way of November and December, the each day RSI quietly moved increased, forming a bullish divergence. That divergence suggests promoting stress has weakened, even when value hasn’t absolutely responded but.

Momentum indicators added to that image. ADA lately flashed a MACD golden cross, which lined up with a post-Christmas bounce of round 10%. The token climbed from roughly $0.34 to $0.37, a modest transfer, however one which issues given the broader weak point. If this help holds, that upswing might stretch additional.

Bulls Face a Clear Technical Take a look at

For now, the restoration thesis hinges on one stage. ADA must reclaim its 50-day transferring common close to $0.42. Till that occurs, rallies stay corrective, not trend-changing. A clear break and maintain above that common would shift momentum extra decisively and put the previous 2025 help close to $0.50 again into focus.

Liquidity information helps that roadmap. The one-month liquidation heatmap exhibits upside liquidity swimming pools clustered round $0.39 and $0.42, lining up neatly with the 50-day MA. On the draw back, leveraged longs sit close to $0.34, reinforcing that zone as a short-term magnet if value slips.

Holder Losses Cut back Promote Strain

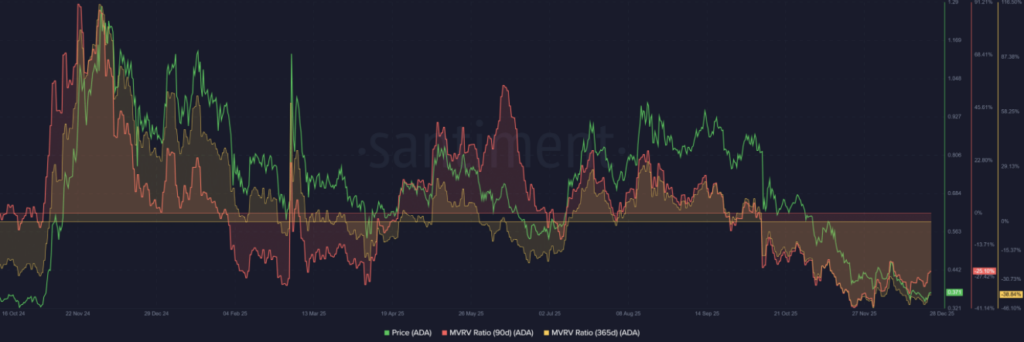

From a longer-term perspective, on-chain information paints a special type of image. MVRV ratios present that each short- and long-term holders are underwater. Three-month holders are down roughly 25%, whereas these holding ADA for over a 12 months face unrealized losses close to 38%.

In easy phrases, many holders are already hurting. That tends to scale back promote stress at present ranges, since merchants are much less desirous to exit deep within the crimson. As a substitute, they usually watch for a bounce towards breakeven, which might quietly help value and create alternative for accumulation.

Danger Nonetheless Lurks Beneath Assist

That stated, this setup isn’t bulletproof. If ADA breaks decisively under the $0.32–$0.36 help zone, the restoration narrative falls aside shortly. In that state of affairs, value might revisit the 2023 lows close to $0.24, resetting expectations completely.

For now, ADA sits at a well-recognized crossroads. The symptoms lean cautiously constructive, holder ache limits promoting, and historical past provides intrigue. However help should maintain, in any other case the market received’t hesitate to push decrease once more.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.