Be part of Our Telegram channel to remain updated on breaking information protection

Technique government chairman Michael Saylor has hinted that his agency will announce one other Bitcoin buy later right now after pausing acquisitions final week.

“Again to Orange,” Saylor wrote in a Dec. 28 X submit that included a screenshot of the SaylorTracker chart. Traditionally, comparable posts have been adopted by bulletins that Technique has purchased extra BTC.

If the current submit is adopted by a Bitcoin purchase announcement, the acquisition will come amid an ongoing decline in Technique’s share worth and low crypto investor optimism.

Probabilities That BTC Will Shut 2025 At $100K Plummet To 1%

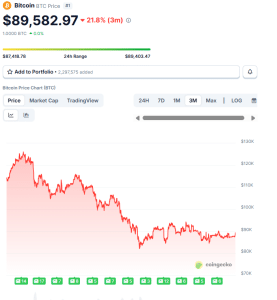

Bitcoin, together with the remainder of the crypto market, has plunged over the previous 3 months. Throughout this era, the market’s chief, BTC, has seen its worth drop over 21%.

The crypto had reached a brand new all-time excessive (ATH) of $126,080 on Oct. 6, however has since crashed greater than 29%, information from CoinGecko exhibits. As of 11:35 a.m. EST, BTC trades at $89,582.97.

BTC worth (Supply: CoinGecko)

With Bitcoin’s worth remaining beneath the $90K mark, merchants on the decentralized prediction markets platform Polymarket solely see a 1% likelihood that BTC will shut the yr off at or above $100K.

Including to the detrimental outlook, the Crypto Concern & Greed Index exhibits that traders are at present extraordinarily fearful.

Technique’s Share Worth Continues To Slide As Business Govt Warns Most DATs Will Fizzle Out

Technique is at present the most important company holder of BTC, and holds 671,268 cash on its stability sheet, in accordance to Bitcoin Treasuries.

The corporate’s final buy of 10,645 BTC for round $980 million was introduced on Dec. 15, 2025. Technique then paused its accumulation final week, and as a substitute elevated its USD reserves by $748 million.

Technique has elevated its USD Reserve by $748 million and now holds $2.19 billion and ₿671,268. https://t.co/EPtguJfWxR

— Michael Saylor (@saylor) December 22, 2025

These giant BTC holdings have seen the corporate change into a type of proxy for the worth of Bitcoin. As such, the crypto market chief’s decline has added to the already-existing stress on Technique’s share worth (MSTR) after the hype round crypto treasury firms began to chill off prior to now few months.

In simply the final month, MSTR has plunged over 10%, Google Finance exhibits. This added to the longer-term downtrend for the inventory, with MSTR now greater than 60% within the pink on the six-month time-frame.

The share costs of a number of different Bitcoin Treasury firms and digital asset treasury (DAT) companies have undergone the same correction within the second half of this yr, and business executives say that the declines are more likely to proceed in 2026.

“Going into the following yr, I believe that the outlook for DATs is wanting a bit bleak,” mentioned MoreMarkets CEO Altan Tutar in a current interview

He then predicted that “most Bitcoin treasury firms will disappear” together with the remainder of the DATs. Tutar speculated that crypto treasuries which can be targeted on altcoins “would be the first to go,” as a result of they received’t be capable of maintain their firm’s market worth above the worth of their crypto holdings.

“I think that the flagship DATs for big property like Ethereum, Solana, and XRP will observe that means fairly shortly too,” he added.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection