Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value has surged 1% within the final 24 hours to commerce at $87,900 as of 12 a.m. EST, whilst US-listed spot Bitcoin ETFs skilled heavy outflows over the Christmas week.

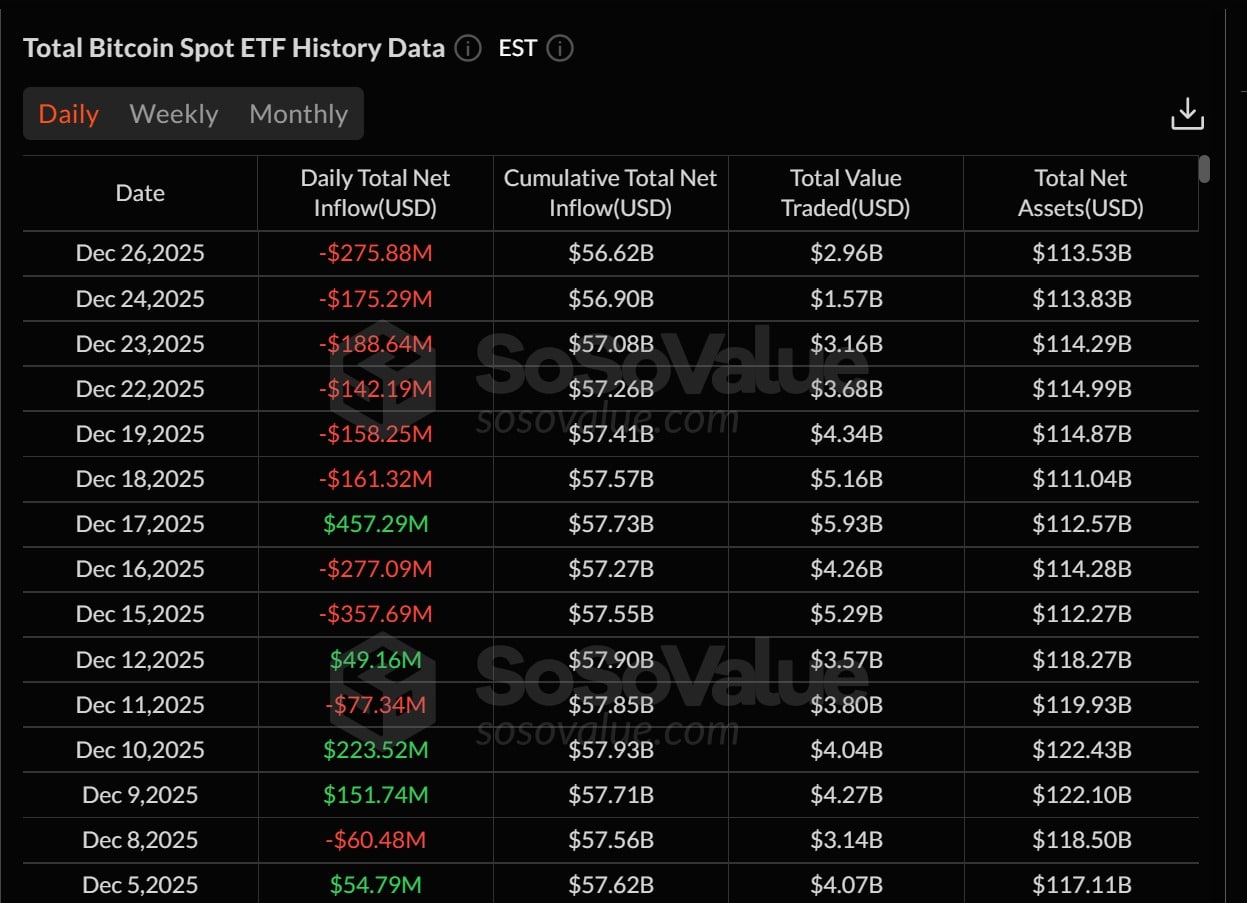

Buyers withdrew a complete of $782 million from these funds, with the biggest single-day exit of $276 million occurring on Friday. BlackRock’s IBIT led the losses with almost $193 million leaving the fund, adopted by Constancy’s FBTC at $74 million, whereas Grayscale’s GBTC continued to see modest redemptions.

Due to these exits, whole internet property in US spot Bitcoin ETFs fell to roughly $113.5 billion, down from peaks above $120 billion earlier in December. Friday additionally marked the sixth consecutive day of outflows, the longest streak since early autumn, with cumulative withdrawals exceeding $1.1 billion in over six days.

Analysts say these outflows are doubtless momentary. Vincent Liu, CIO at Kronos Analysis, famous that vacation buying and selling and skinny liquidity typically drive ETF promoting throughout Christmas. He expects flows to normalize in early January as establishments return.

Liu added that expectations of Federal Reserve charge cuts in 2026, presently priced at 75–100 foundation factors, might assist Bitcoin ETF demand. Rising bank-backed crypto infrastructure may additionally make it simpler for giant buyers to re-enter the market.

Nevertheless, knowledge from Glassnode exhibits Bitcoin and Ether ETFs have been in a sustained outflow section since early November, signaling a extra cautious strategy from institutional buyers amid tighter market liquidity.

This means that whereas vacation outflows could also be momentary, general institutional demand has cooled after a yr wherein giant allocators had been a significant driver of the crypto market.

Bitcoin Struggles to Break Resistance as Bears Preserve Management

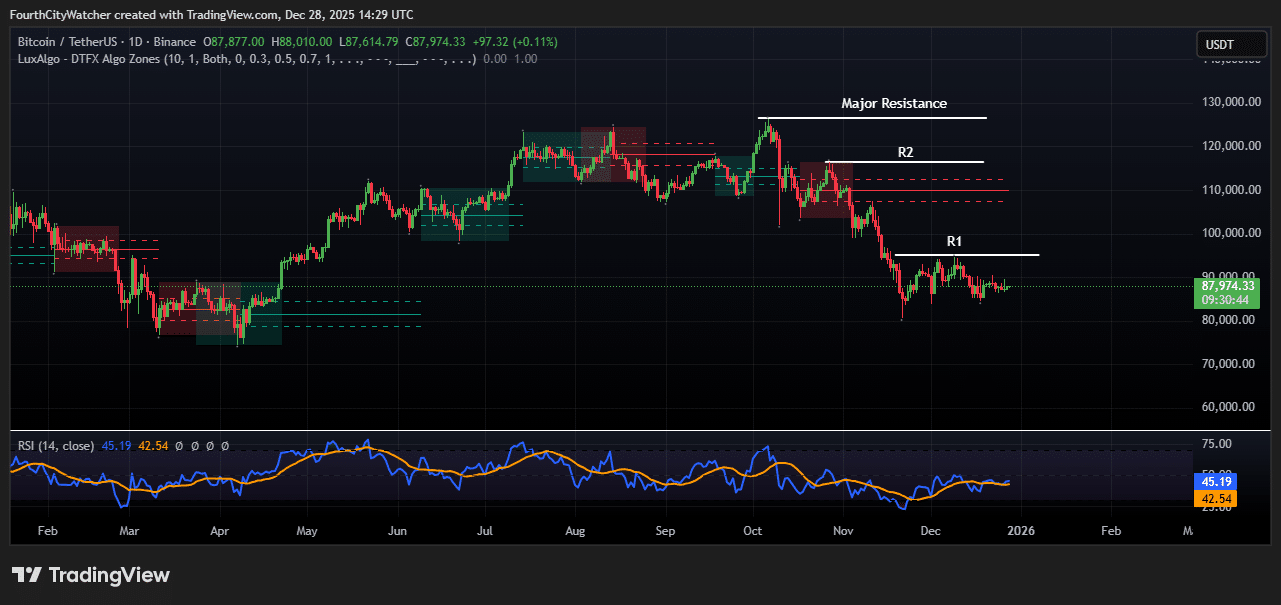

Bitcoin is presently buying and selling at $87,976, reflecting a minor acquire of 0.11% on the day. The value motion exhibits that Bitcoin has been in a sustained downtrend since mid-October, after reaching a peak close to $123,000. Since then, the market has fashioned a sequence of decrease highs and decrease lows, indicating persistent bearish stress.

Instant assist is situated round $87,600, which has held a number of latest day by day closes. A stronger assist zone exists between $82,000 and $84,000, marking the low seen in early December. On the upside, resistance is obvious close to $90,000, with a extra important barrier round $95,000 to $96,000, equivalent to earlier consolidation durations in late November.

The shaded pink and inexperienced zones on the chart spotlight these key provide and demand areas, displaying the place promoting and shopping for stress have traditionally been strongest. Momentum indicators, notably the 14-day Relative Energy Index (RSI), presently learn 45.20, barely beneath the impartial 50 degree.

BTCUSDT Evaluation Chart. Supply: Tradingview

This means that Bitcoin is neither overbought nor oversold, although bearish momentum stays barely dominant. The RSI has been trending sideways following a restoration from oversold ranges in December, indicating that the market is consolidating reasonably than displaying sturdy upward momentum.

The broader development stays bearish, as confirmed by the sample of declining peaks and valleys. Whereas short-term bounces have occurred, Bitcoin has repeatedly failed to interrupt above resistance ranges, indicating that sellers proceed to dominate at increased costs.

Holding assist may result in a possible restoration, whereas a breakdown beneath $87,600 might push the value towards the subsequent important assist close to $82,000, which may function a key accumulation space.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection