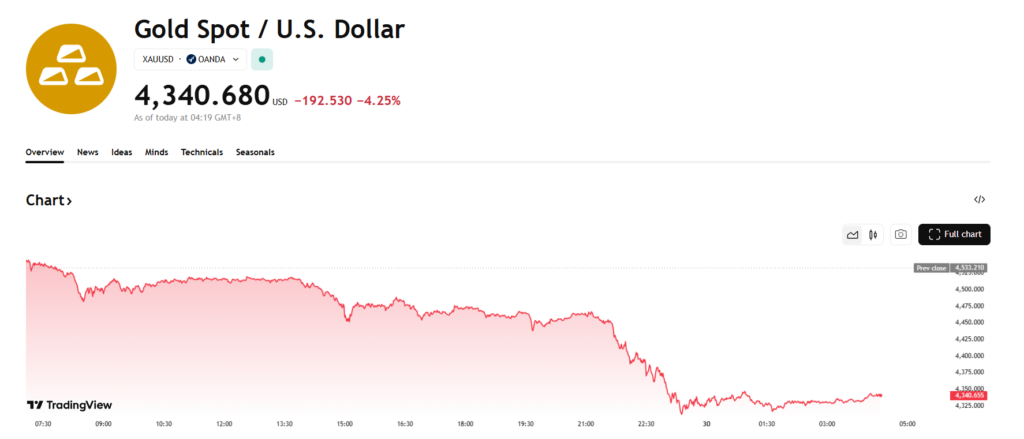

- Gold posted its largest one-day drop since October, falling over 4%.

- A repeat of prior selloff patterns factors to draw back threat close to $4,040.

- Failure to carry former resistance raises the chance of deeper technical injury.

Spot gold noticed a violent selloff on Monday, recording its largest one-day drop since October 21 and sending a transparent warning sign to merchants. That earlier breakdown in the end led to a virtually $495 decline over six classes, and the present transfer is beginning to echo that sample. If an analogous trajectory performs out, subtracting that prior loss from Friday’s excessive close to $4,536 factors to a possible draw back goal round $4,041 by early January, a degree that may additionally push gold decisively under its 50-day shifting common.

At round 19:17 GMT, XAUUSD was buying and selling close to $4,335, down roughly $198 on the day, or about 4.4%. Costs had bounced modestly off the intraday low close to $4,302, however the restoration lacked conviction and did little to ease the broader technical injury.

Yr-Finish Revenue-Taking Seemingly Behind the Sudden Drop

The most definitely rationalization for the abrupt transfer is year-end positioning. As portfolios are squared and income locked in, promoting stress can hit immediately, particularly in markets which have delivered robust positive factors. Gold buying and selling, for a lot of contributors, is much less about conviction and extra about enterprise, and companies have a tendency to comprehend income earlier than the calendar flips. That dynamic typically catches retail merchants off guard.

Weak Observe-By way of From October Highs Raises Concern

One element that stands out is how little upside gold managed to generate earlier than rolling over. From the October 20 excessive close to $4,381 to the late-December peak round $4,536, the advance totaled simply $155. That modest acquire was fully erased — after which some — in a single session. When a market provides again weeks of progress in sooner or later, it typically indicators exhaustion somewhat than wholesome consolidation.

Outdated Resistance Fails to Flip Into Assist

One other purple flag is gold’s transfer again under the earlier breakout degree close to $4,381. There’s a long-standing rule in technical evaluation that outdated resistance ought to develop into new help. If worth fails to stabilize close to that space, it suggests merchants who purchased the breakout at the moment are trapped. That’s typically when promoting accelerates, as these positions search for any alternative to exit.

Sellers Might Drive a Deeper Reset

If sellers keep management, consideration shifts to decrease worth zones. A cluster of technical ranges sits between roughly $4,211 and $4,171, the place the 50% retracement and the 50-day shifting common converge. Markets dominated by robust sellers are likely to push weak longs into capitulation, particularly as some try to common down and solely worsen their publicity.

From Quick-Time period Commerce to Lengthy-Time period Drawback

This transfer additionally highlights the traditional distinction between evaluation and execution. Fundamentals could not have modified, however worth motion has. There’s an outdated saying that it solely takes one loss to show a short-term dealer right into a long-term investor, and gold could now spend weeks working by means of the injury. If hedge funds are caught on the flawed facet, margin calls might spill over into fairness markets as positions are liquidated elsewhere. The following few classes could show decisive.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.