Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth slid greater than 3% up to now 24 hours to commerce at $88,810 as of 12:09 a.m. EST on buying and selling quantity that rose 54% to $45.1 billion.

The drop comes even because the crypto market dropped 2.7% to a $3.041 trillion market capitalization, shedding over $100 billion.

Because of the dramatic drop, lengthy merchants have been massively liquidated, with whole liquidations totalling $207 million, in line with Coinglass knowledge.

This selloff stems from a common “flight from danger” amongst traders in response to the accelerating launch of spot BTC exchange-traded funds (ETFs).

Knowledge from Coinglass reveals that spot BTC ETFs have recorded consecutive 7 days of web outflows, shedding $19 million on Monday alone.

In the meantime, Michael Saylor’s Technique remains to be betting on a BTC rally, after the corporate bought an extra 1,229 BTC for $108.8 million. After the latest buy, the agency now owns 672,497 Bitcoin, acquired for $50.44 billion at a median worth of $74,997 per BTC.

Technique has acquired 1,229 BTC for ~$108.8 million at ~$88,568 per bitcoin and has achieved BTC Yield of 23.2% YTD 2025. As of 12/28/2025, we hodl 672,497 $BTC acquired for ~$50.44 billion at ~$74,997 per bitcoin. $MSTR $STRC $STRK $STRF $STRD $STRE https://t.co/5VvOgBYwhk

— Michael Saylor (@saylor) December 29, 2025

Bitcoin Worth Gearing Up In direction of A Breakout

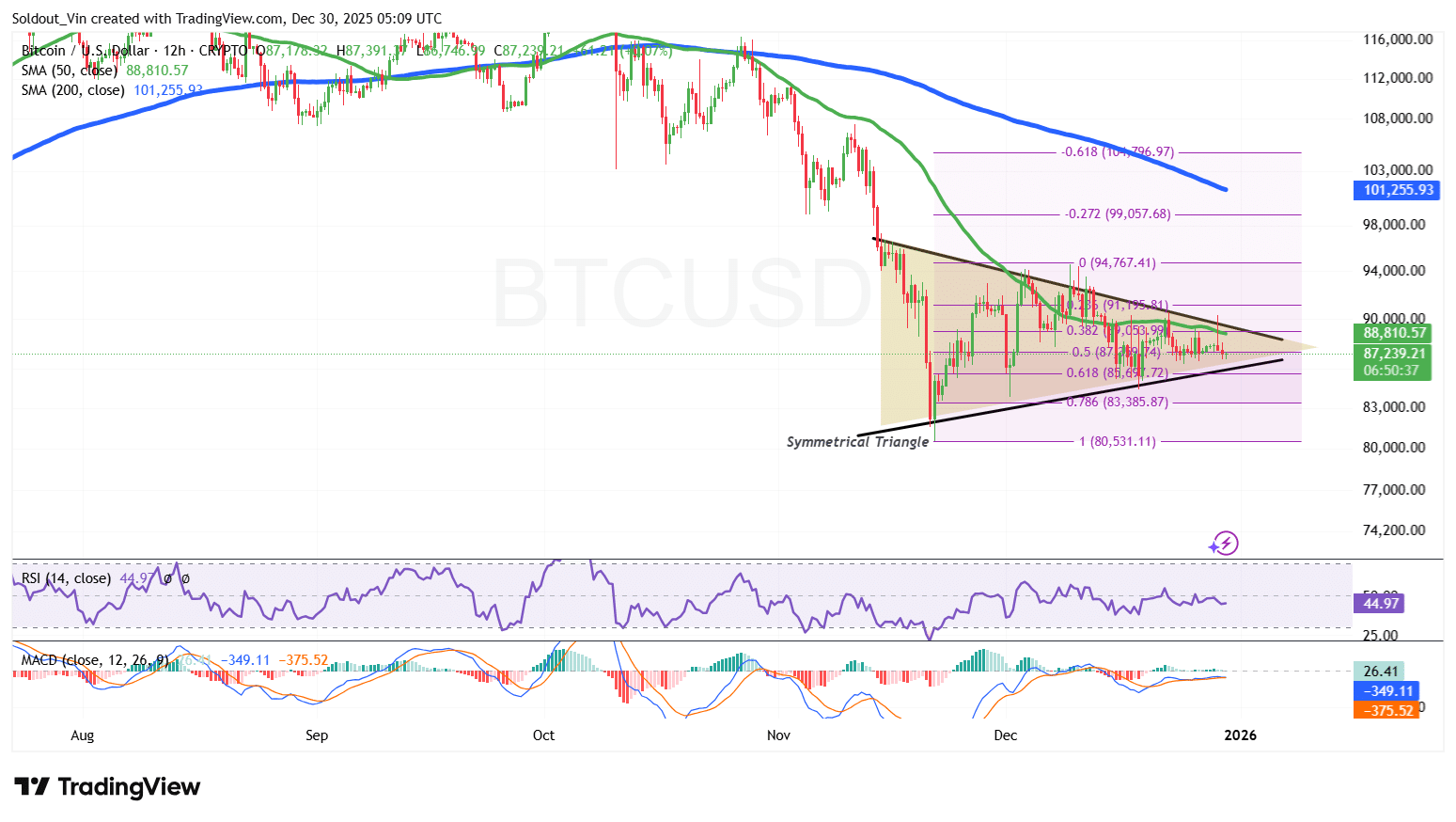

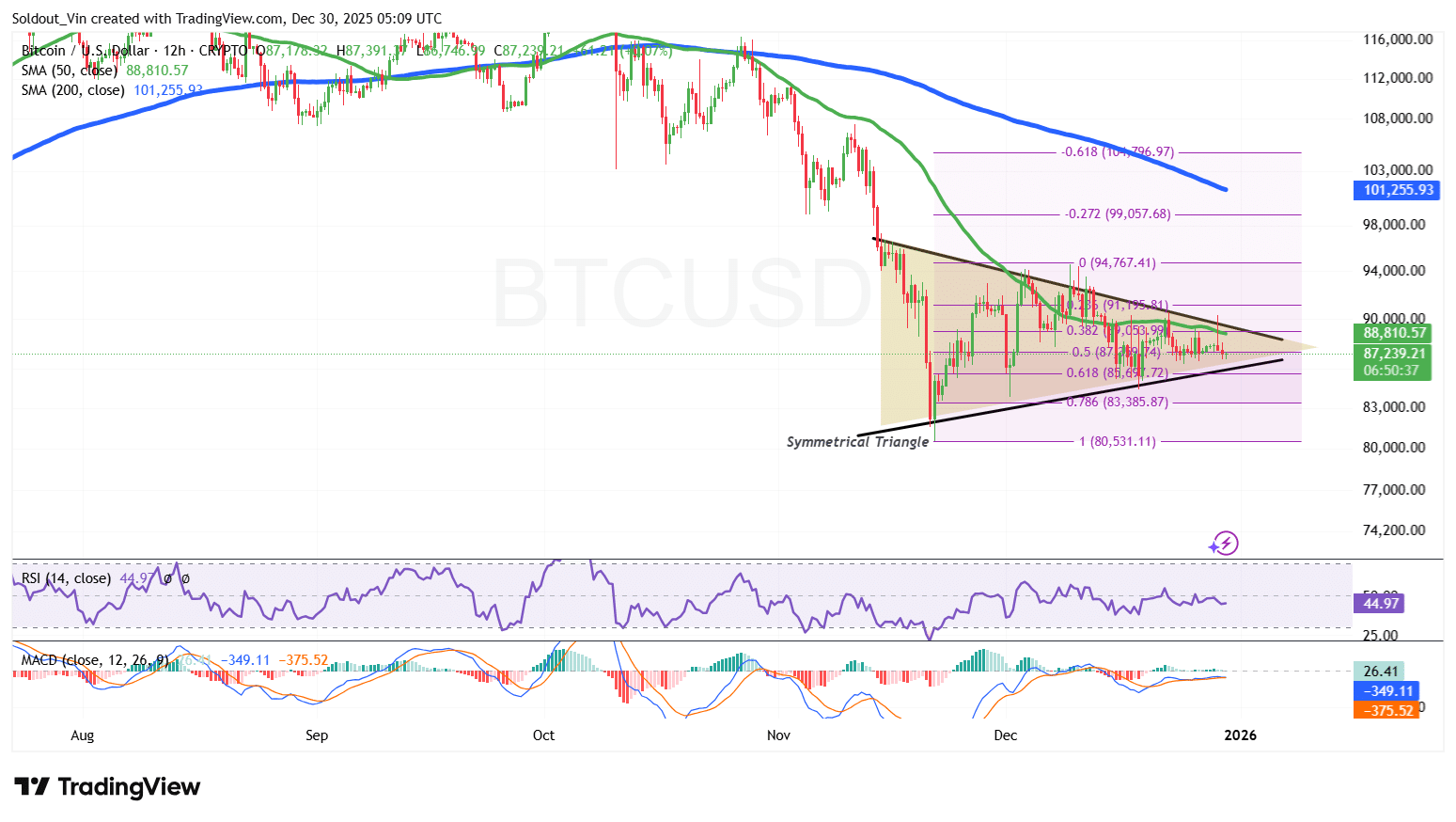

After what seemed to be sustained consolidation above $100,000 from August to late October, the BTC worth misplaced momentum, taking a dramatic hit that despatched it to ranges close to the $81,000 assist.

The assist allowed the bulls to ascertain this degree as a requirement space, with Bitcoin buying and selling constantly above it and consolidating inside a symmetrical triangle sample.

In response to the chart, BTC tried a aid rally within the final 12-hour candle, however the present one has dropped to commerce under the 50-day Easy Shifting Common (SMA), making the $88,810 zone a hurdle for any bullish makes an attempt.

Bitcoin now trades under each the 50-day and 200-day SMAs, putting it below constant bearish strain however inside a symmetrical triangle sample.

Based mostly on the evaluation, Bitcoin remains to be consolidating between the 0 Fib degree round $94,000 and the 0.618 Fib space at $85,600, forming a serious sideways sample zone earlier than any breakout try.

In the meantime, the Relative Power Index (RSI) additionally helps the consolidation narrative, because it trades throughout the 40-50 zone, in a tug-of-war between bulls and bears.

As bears and bulls battle for dominance, the Shifting Common Convergence Divergence (MACD) is displaying indicators of some optimistic momentum, with the blue MACD line crossing above the orange sign line.

Indicators counsel traders are cautious, as BTC bulls maintain the demand zone.

BTC Worth Prediction

In response to the BTC/USD chart evaluation on the 12-hour timeframe, the BTC worth is gearing up for a breakout above the symmetrical triangle.

If the bulls maintain strain above the 0.5 Fibonacci retracement degree at round $87,000, BTC may rally to the higher boundary of the triangle, with the bulls focusing on the higher resistance at round $94,000.

In the long run, bulls may goal the 200-day SMA at $101,255.

Michaël van de Poppe, a preferred analyst on X with over 816K followers, helps the bullish narrative, as Bitcoin has shaped a large bullish divergence on the every day timeframe for BTCUSD vs. Gold.

Large bullish divergence on the every day timeframe for BTCUSD vs. Gold.

Gold comes down, #Bitcoin consolidates and this begins to look higher.

On prime of that, on condition that this can be a legitimate bullish divergence, it implies that Bitcoin is more likely to outperform Gold within the coming… pic.twitter.com/cX2Vgn9NO1

— Michaël van de Poppe (@CryptoMichNL) December 29, 2025

On the draw back, if the bearish momentum picks up and the bears win the dominance battle, Bitcoin may drop below the 0.618 Fib zone, with $80,000 appearing as a cushion towards any downward strain.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection