Welcome to the US Crypto Information Morning Briefing—your important rundown of an important developments in crypto for the day forward.

Seize a espresso, settle in, and suppose past the each day value swings of Bitcoin. What if the story isn’t about timing the market, however about how an organization’s construction quietly compounds worth through the years? That’s the argument Try CIO Jeff Walton is making about MicroStrategy (MSTR), a inventory that, on the floor, strikes with crypto, however beneath, he says, operates like a machine steadily rising Bitcoin publicity per share.

Crypto Information of the Day: Try CIO Jeff Walton on Why Shopping for MSTR at 2.5x mNAV Nonetheless Beats Spot Bitcoin

Jeff Walton, Chief Danger Officer at Try and founder and CEO of its subsidiary True North, says most buyers essentially misunderstand MicroStrategy (MSTR).

Reflecting on his personal 2021 purchases, Walton argues the inventory shouldn’t be considered as a leveraged Bitcoin proxy. Slightly, buyers ought to view MSTR as a capital markets engine designed to extend Bitcoin publicity per share over time.

Sponsored

Sponsored

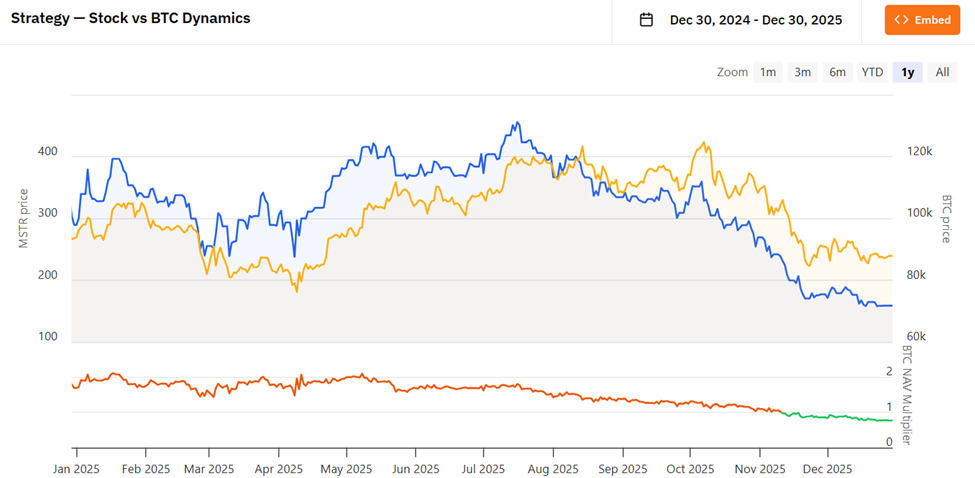

Walton revealed he started shopping for MSTR in June 2021 at roughly 2.5x mNAV, believing the inventory was already down 50%.

“Little did I do know, the inventory would fall one other 80% from my price foundation,” he wrote, as MSTR collapsed almost 90% from its February 2021 peak.

By late 2022, the corporate was buying and selling close to 1.3x mNAV, holding 129,999 Bitcoin whereas its notional debt briefly exceeded asset worth. Regardless of being “down dangerous on paper,” Walton mentioned the underlying math by no means broke.

“The corporate had REAL laborious cash, debt covenants weren’t egregious, and structurally every thing on the horizon for crypto was bullish,” he mentioned, citing the halving cycle, ETFs, elections, and rate of interest shifts.

By mid-2023, Walton mentioned he went “all in,” satisfied the capital construction, not value motion, was the actual thesis.

That conviction, he argues, is what allowed long-term holders to outlive one of many harshest drawdowns in crypto fairness historical past.

How Time and Construction Modified the Danger Equation for MicroStrategy

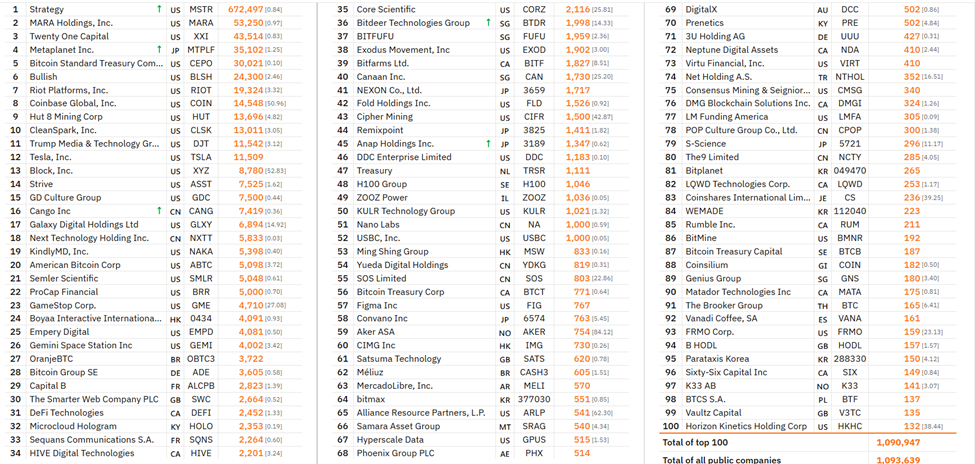

Quick ahead to late 2025, Walton notes that MicroStrategy now holds 672,497 Bitcoin. Notably, that is greater than 12 occasions the dimensions of the next-largest publicly traded company holder.

Extra importantly, he says, the chance profile of his authentic shares has undergone a elementary change.

Sponsored

Sponsored

“The 1x NAV per share value is 160% higher than the two.5x mNAV shares I bought again in June of 2021,” Walton wrote, including that the rising NAV ground now sits above his authentic price foundation.

In his view, capital market exercise steadily de-risked frequent fairness whereas amplifying Bitcoin publicity per share.

From this level ahead, Walton argues his 2021 shares can structurally outperform Bitcoin even when the corporate acquires zero further BTC.

“There’s materially extra Bitcoin publicity in EACH share I bought in 2021 than after I purchased them,” he mentioned, emphasizing that extra Bitcoin publicity has been accreted by dilution, most well-liked fairness, and long-dated debt reasonably than value appreciation alone.

That framing drew assist from market commentators, who argued buyers had been shopping for a system, not leverage.

“Bitcoin is a bearer asset. MicroStrategy is an working system for buying Bitcoin utilizing public-market incentives,” commented one analyst.

In Walton’s view, volatility itself grew to become an enter, successfully serving as gasoline for accretion reasonably than a menace to the thesis.

Sponsored

Sponsored

However Is It A Structural Edge or a Cycle-Dependent Commerce?

Try CEO Matt Cole has echoed Walton’s view, lately stating that MSTR has outperformed Bitcoin and gold over 5 years. In line with Cole, this might stay true even at $75,000 BTC or 1x mNAV.

Nevertheless, not everybody agrees that the structural edge is assured going ahead. Contrarian narratives argue that whereas five-year outperformance was actual by mid-2025, MSTR materially underperformed Bitcoin throughout the second-half drawdown. Additional, it has traded close to or under 1x mNAV in current weeks.

Elsewhere, Barchart signifies that MicroStrategy was the worst-performing Nasdaq-100 inventory of 2025, down roughly 65% from its peak amid a broader crypto winter.

Critics like Peter Schiff dismissed the technique totally, arguing that Technique’s common Bitcoin price implies modest annual returns.

Others warned that sustained sub-1x mNAV circumstances may theoretically immediate Bitcoin gross sales, a situation CEO Phong Le has acknowledged would make “mathematical” sense, though administration has burdened that it’s unlikely.

Nonetheless, indicators of institutional curiosity persist. In line with business commentary, massive US banks are actually exploring partnerships with Technique, with Michael Saylor framing financial institution adoption, not value, because the defining Bitcoin narrative for 2026.

Sponsored

Sponsored

Will MSTR’s construction show cycle-proof? Walton argues that point and capital construction do the actual work, not timing.

Chart of the Day

Byte-Sized Alpha

Right here’s a abstract of extra US crypto information to observe at the moment:

Crypto Equities Pre-Market Overview

| Firm | Shut As of December 29 | Pre-Market Overview |

| Technique (MSTR) | $155.39 | $155.99 (+0.39%) |

| Coinbase (COIN) | $233.77 | $234.39 (+0.27%) |

| Galaxy Digital Holdings (GLXY) | $23.16 | $23.47 (+1.345) |

| MARA Holdings (MARA) | $9.49 | $9.50 (+0.12%) |

| Riot Platforms (RIOT) | $13.21 | $13.30 (+0.76%) |

| Core Scientific (CORZ) | $15.08 | $15.09 (+0.066%) |