Be a part of Our Telegram channel to remain updated on breaking information protection

The Ethereum worth has slid under $3k to commerce at $2,950 as Tom Lee’s crypto agency, Bitmine, stepped up its accumulation through the current market pullback.

Whereas ETH has struggled to carry key psychological help, institutional consumers look like utilizing the weak spot as a long-term entry alternative. Bitmine lately elevated its Ethereum holdings by including 44,463 ETH in a transaction valued at roughly $130 million.

This newest buy lifted the corporate’s whole ETH reserves to round 4.11 million tokens, giving it management of roughly 3.41% of Ethereum’s whole provide. The transfer additional strengthens Bitmine’s place as one of many largest institutional holders of ETH.

⚡ Flash Information

🐳 Bitmine Immersion expands Ethereum publicity@Bitmine Immersion added 44,463 $ETH over the previous week, bringing whole holdings to 4,110,525 $ETH and strengthening its place inside the @Ethereum provide. pic.twitter.com/tKaM8zlRG2

— Crypto Financial system Information (@CryptoEconomyEN) December 29, 2025

The agency is actively positioning itself to turn into the world’s largest Ethereum treasury. As a part of this technique, Bitmine has already staked 408,627 ETH, permitting it to earn yield whereas supporting the Ethereum community. Wanting forward, the corporate plans to develop its staking operations by adopting the MAVAN validator community beginning in 2026.

In line with Tom Lee, Bitmine has been the biggest supply of recent ETH shopping for through the current interval of market weak spot. He defined that year-end circumstances, together with seasonal tax-loss promoting, positioned stress on crypto costs and created enticing accumulation home windows. Bitmine took benefit of this setting to construct its place at scale.

Bitmine’s long-term technique mirrors a broader development of institutional accumulation additionally seen amongst Ethereum-focused treasury corporations resembling Development Analysis. The corporate’s final purpose, described because the “alchemy of 5%,” is to ultimately personal 5% of Ethereum’s whole provide, elevating questions on how sustained institutional demand may have an effect on ETH liquidity and circulation over time.

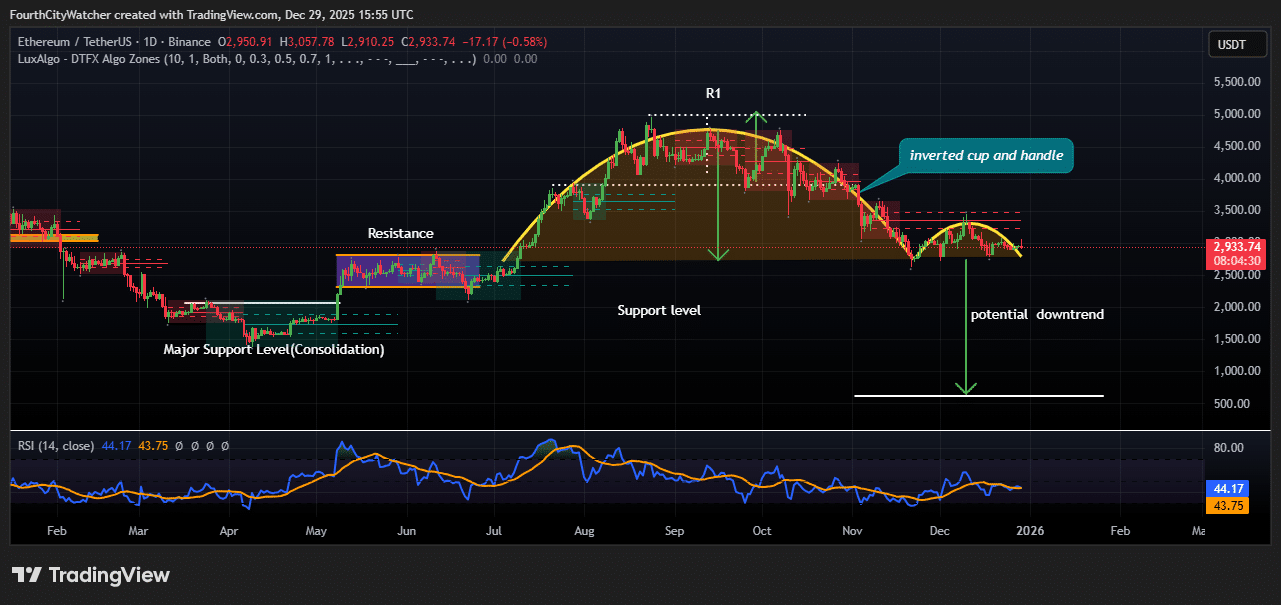

Ethereum Dangers Deeper Drop as Bearish Chart Sample Takes Form

The Ethereum worth stays underneath stress after failing to carry above the $4,500–$5,000 area earlier within the 12 months. On the every day chart, worth motion now reveals a transparent inverted cup and deal with formation, a sample that always indicators continuation to the draw back.

ETH is at the moment buying and selling round $2,950, sitting simply above a key help zone that might resolve the following main transfer. Earlier, Ethereum spent a number of months consolidating across the $1,500–$1,600 space, which acted as a powerful base for the rally that adopted, ultimately peaking close to the $5,000 mark.

Nevertheless, after reaching that top, bullish momentum light. The value started forming decrease highs and decrease lows, confirming a shift right into a broader downtrend.

ETHUSDT Chart Evaluation Supply: Tradingview

The $2,900–$3,000 space is now appearing as an vital help degree. This zone beforehand served as each resistance and help, making it technically important. A every day shut under this degree would strengthen the bearish case and will open the door for a deeper decline.

Primarily based on the inverted cup and deal with construction, a breakdown may expose ETH to a transfer towards the following main help zone close to $1,000–$1,200 over the medium time period. The Relative Power Index (RSI) is at the moment round 44, under the impartial 50 degree. This reveals that consumers are dropping management, and promoting stress stays dominant.

Whereas ETH is just not but oversold, the weak RSI suggests restricted upside until sturdy shopping for returns. On the upside, Ethereum would wish to reclaim $3,200 first to sign short-term reduction. A stronger restoration would require a break above the $3,500–$3,600 resistance space, the place earlier promoting stress was heavy. With out such a transfer, any bounce is more likely to stay corrective slightly than trend-changing.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection