When Donald Trump took the oath of workplace again on January twentieth this 12 months, the funding narrative was largely led by one massive prediction: an explosion in cryptocurrency costs primarily based largely on favorable regulation (or deregulation).

But it surely wasn’t solely the crypto business that was conserving its fingers crossed for a rally. Recall that Trump additionally promised to chop company tax charges to fifteen% from 21% for corporations that make their product in America, to take away taxes on suggestions, to remove taxes on social safety, to make automotive loans totally tax-deductible, and far more. All of this led to expectations of a booming US economic system, with thriving small companies pushed by tax reduction and authorities help.

The fact, although? Nicely, practically one 12 months later, we’ve the numbers, and so they inform a radically totally different story.

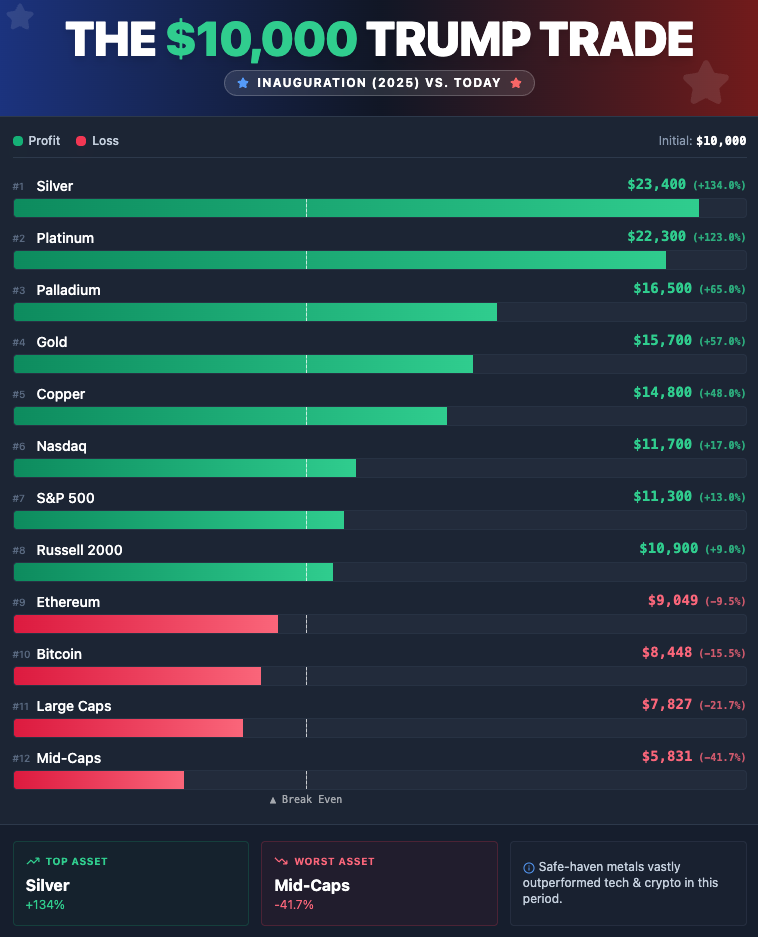

Monitoring a hypothetical $10,000 funding made on Inauguration Day 2025 throughout 12 main asset lessons, the outcomes reveal a substantial capital flight from speculative belongings into conventional, tangible protected havens. What does this sign? To many – uncertainty.

The Backside Line: From Inauguration Day to Now

Under you can see the present worth of a $10,000 funding made on January twentieth, 2025, throughout a variety of asset lessons (and subcategories).

It’s a Supercycle, Alright

Certainly, we noticed a supercycle, simply not the place many of the crypto business was anticipating it. Don’t get me flawed, BTC painted a number of all-time highs, altcoins (or at the least a few of them) had their second beneath the solar, however the 12 months has undoubtedly been rather a lot totally different from what many of the analysts anticipated it will be.

The rally didn’t come from historically risky and speculative belongings, however moderately from the precise reverse.

Essentially the most hanging development of the post-inauguration interval is, surely, the dominance of valuable and industrial metals. Whereas many of the consideration was targeted on inventory indices, silver delivered a staggering return of 134%. Thoughts you, a few of the numbers could be totally different on the time you might be studying this text as a result of, nicely, valuable metals are roughly appearing like sh*tcoins proper now.

However what does this imply?

Nicely, specialists speculate in regards to the parabolic value rises in valuable and industrial metals. A few of them justify the rise with fundamentals resembling rising international uncertainty across the conflict between Russia and Ukraine, the tensions within the Center East, the Trump-led coverage of nearly slamming each nation with tariffs, the demand for sure metals to supply graphic chips due to the booming AI sector, and far more. One report from the BBC lately defined that the provision for silver (as probably the most dominant performer within the chosen interval) is increasing due to:

- Its use in varied industries, resembling EV manufacturing and photo voltaic panels

- Fears of Trump imposing tariffs on it

- Incapacity to rapidly enhance provide

Bear in mind, most of those are pure assets and never a product, that means that there’s a finite provide of it. Though silver’s provide is estimated to be at the least ten instances that of gold, nearly all of its international output is a by-product of mines that primarily extract different metals, making it more durable to fulfill the rising demand.

Gold can be up by round 60%. By no means has the valuable steel seen such a formidable 12-month efficiency.

And whereas many specialists discover reasoning behind fundamentals, others are of the opinion that markets are pricing in rising inflation and uncertainty, treating the silver commerce as a beta to gold, which began to extend rather a lot sooner. In different phrases, some are already bracing for affect.

In any case, the “Trump Commerce” in 2025 turned out to be a commodities commerce moderately than a tech commerce.

The Shock Loser: Hypothesis Deflates

Donald Trump promised a whole lot of issues to crypto proponents in a bid to win them over, and to an extent, it labored. Many within the business favored him, and, in all equity, we’ve seen a whole lot of elementary progress, particularly when it comes to laws.

From a hawkish SEC that was legislating via enforcement, the US at present has an administration that’s actively engaged on sufficient payments. In July, the President’s Working Group on Digital Belongings printed a complete roadmap to strengthen the nation’s management within the digital asset discipline, calling for swift implementation of the GENIUS act, the modernization of AML laws, enactment of legal guidelines aimed toward market construction, and extra.

Each regulatory heavyweights, within the face of the CFTC and the SEC, have modified their stance, whereas the federal government can be an official “HODLer” due to the Strategic Bitcoin Reserve – one thing Trump signed an govt order for again in March.

And regardless of all the above, value motion has been nothing however disappointing over the previous few months, which finally led to the detrimental efficiency since Inauguration Day.

I learn a tweet saying that Bitcoin at $90K appears like we’re at $10K, and certainly, sentiment is close to all-time lows.

And right here’s why:

Crypto costs since Trump took workplace: $BTC: -18% $ETH: -10% $XRP: -42% $SOL: -52% $DOGE: -68% $ADA: -65% $LINK: -47% $AVAX: -68% $SUI: -71% $TON: -72% $ENA: -75% $PEPE: -78% $APT: -83% $TRUMP: -82%

Thankyou, MR President.

— Crypto Rover (@cryptorover) December 25, 2025

Whatever the causes, it’s evident that funds are flowing out of speculative belongings.

The actual alpha this 12 months was in metals. A portfolio allotted to a basket of Silver, Gold, Platinum, and Palladium would have greater than doubled in worth in 12 months.

The submit The $10,000 Trump Commerce: What Truly Made Cash Since Inauguration Day appeared first on CryptoPotato.