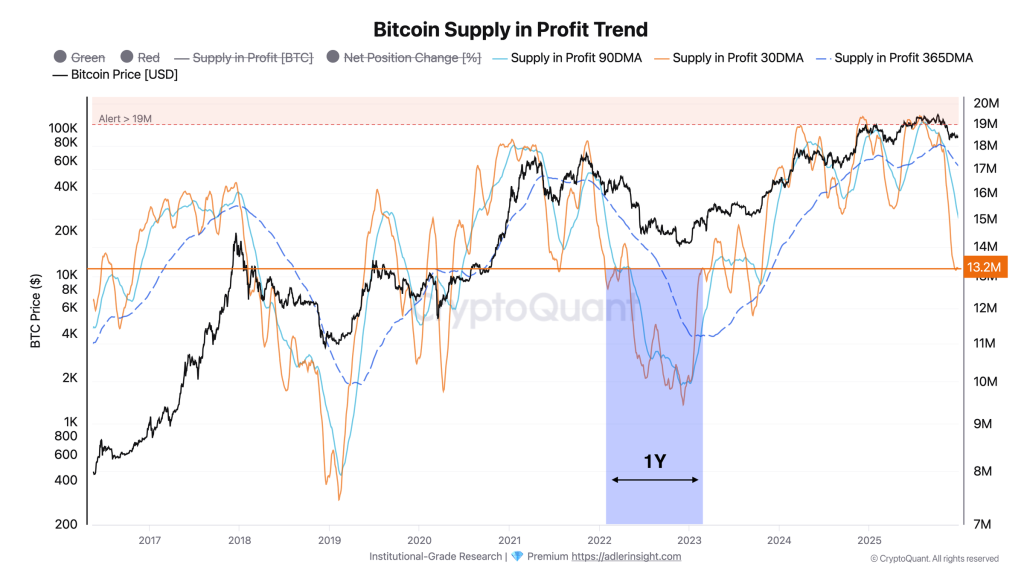

Bitcoin’s worth motion has pushed a carefully watched on-chain profitability gauge right into a configuration that, in 2022, preceded an prolonged drawdown and one analyst says a break beneath $70,000 would threat repeating that “year-long” reset.

In a Dec. 30 morning transient, Axel Adler Jr. argued that Bitcoin’s “Provide in Revenue” pattern is at an inflection level after BTC stabilized within the $87,000–$90,000 vary following the pullback from October highs. The metric, which tracks how a lot BTC is held above its acquisition worth, has fallen sharply from October peaks above 19 million BTC to roughly 13.2 million BTC, creating a large hole between short- and medium-term transferring averages.

A 2022-Like Setup Looms For Bitcoin

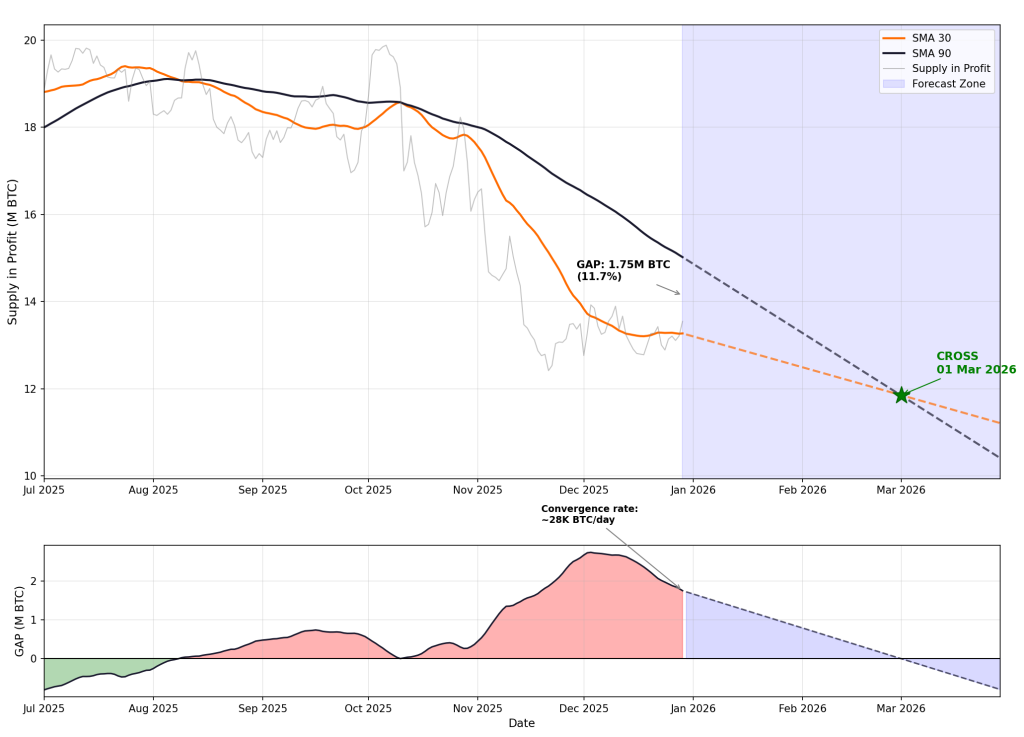

Adler’s core sign is the unfold between the 30-day and 90-day easy transferring averages of Provide in Revenue. After the correction from the all-time excessive, the 30-day common “dropped considerably beneath” the 90-day, forming a niche of about 1.75 million BTC.

Adler famous that “an identical configuration was noticed in 2022 earlier than an prolonged bearish interval,” however burdened an necessary distinction this time: the 365-day transferring common stays “at traditionally elevated ranges for now,” implying the longer-term revenue construction hasn’t absolutely rolled over.

Associated Studying

The near-term query is whether or not the 30-day pattern has bottomed. Adler flagged Dec. 18 as an area minimal for the 30-day common and stated it’s now “starting to show round,” with affirmation tied to a easy situation: Provide in Revenue should maintain above its 30-day common, which in observe requires BTC to maintain its footing at present ranges or increased.

Adler’s projection for a bullish restoration on this sign is unusually particular: he estimates the hole between the 30-day and 90-day averages is narrowing at roughly 28,000 BTC per day, primarily as a result of the 90-day common is being pulled down mechanically as excessive October values roll out of the window.

“Why is SMA 90 falling whereas worth stays secure?” Adler wrote within the transient’s FAQ. “It is a mechanical impact of the transferring common: values from early October are actually dropping out of the 90-day window, when Provide in Revenue was at peaks of 18–20M BTC with worth at $115–125K. Even with secure present Provide, this pulls the typical down.”

Associated Studying

That rollover impact, Adler stated, ought to persist by way of late January, offering a “tailwind” that might permit the 30-day line to reclaim the 90-day line even with out a dramatic surge in Provide in Revenue. If the present charges of change maintain, Adler initiatives a bullish cross — the place the 30-day common rises above the 90-day — in late February to early March.

The Invalidation: $70,000

The forecast, nonetheless, is explicitly price-sensitive. Adler estimated Provide in Revenue has “elasticity to cost” of 1.3x, which means a ten% BTC drawdown might translate into a few 13% drop within the provide held in revenue. In his mannequin, the market’s crucial fault line is the $70,000 zone.

“At what worth does the cross state of affairs get invalidated?” Adler wrote. “The crucial zone is beneath $70K. At that degree, Provide would fall to ~10M BTC, and SMA 30 would start declining quicker than SMA 90. The GAP would cease narrowing and shift to growth, suspending the bullish sign indefinitely.”

In that state of affairs, Adler stated the setup would extra carefully mirror 2022: the unfold expands quite than compresses, and the bullish cross will get pushed out, with restoration doubtlessly taking “as much as one yr.” Against this, he framed the constructive path as holding above $75,000–$80,000 by way of January, protecting Provide in Revenue supported and preserving the convergence tempo.

At press time, BTC traded at $88,102.

Featured picture created with DALL.E, chart from TradingView.com